Table of Contents

Breaking Into Private Equity: The Career Zones and How to Reach Them

- 8 min read

Context & Shift

Private equity has moved from a specialist corner of finance to a central force in the global economy. It now shapes employment, corporate ownership, and executive careers across almost every major industry. As more companies stay private for longer, choosing concentrated private capital instead of public listings, the need for structured learning, including a dedicated

private equity course, has grown alongside this expansion.

For job seekers and mid-career professionals, getting into private equity can mean very different paths. Some aim to work directly inside investment firms, others join operating teams that funds deploy into portfolio companies, and many more seek strategic roles in private equity backed environments that reward agility, analytical skill, and financial judgement. Understanding where you fit in this ecosystem, and how a focused private equity course can support that journey, is the first step in positioning your skills effectively.

Grow expertise. Lead strategy.

Build a better future with the Executive Certificate in Corporate Finance, Valuation & Governance.

The Three Career Zones in Private Equity

When mapping the private equity job landscape, three broad zones emerge. Each represents a different level of access, expectation, and career potential, and each calls for a different learning pathway, from introductory online private equity course options to more advanced, executive level study – typically taught in top-tier business schools.

1. The “No Zone” – Outside the Market Perimeter

This group includes professionals whose current experience sits outside the functional requirements of private markets. They may have general finance, accounting, or operations exposure but lack familiarity with investment appraisal, corporate finance, or governance principles that underpin private equity work. Transitioning from this zone usually requires structured learning, particularly in valuation, financial modelling, and deal mechanics, to build a credible entry point through a focused private equity course.

2. The “Mid Zone” – The High Potential Majority

Most professionals sit in this segment. They have meaningful experience in finance, operations, or strategic management, often in corporates, advisory, or consulting roles, and they already understand business drivers, value creation, and performance measurement. They may not yet have direct deal experience, but they have a solid analytical and commercial foundation. This group represents the strongest pool of realistic entrants into private equity, venture capital, and private equity backed companies, especially when they complement experience with a well structured private equity course.

At this level, the target is twofold: to develop specialist knowledge aligned with private market dynamics, and to show that financial insight can be translated into operational value. Many mid zone professionals successfully move into roles such as analyst, portfolio operator, or finance leader within private equity backed companies, positions that combine hands on execution with strategic impact. In a market where operational improvement is valued as highly as deal making, these hybrid roles have become the true growth engine of private equity talent.

Foundation Stage

The “No Zone” – Outside the Market Perimeter

Strong general experience, but limited exposure to valuation, modelling, or deal mechanics for private markets.

- What it means: You currently sit outside core private markets requirements such as investment appraisal, corporate finance, and governance fundamentals.

- Typical profiles: General finance, accounting, or operations roles without transaction exposure or structured training in valuation or deal analysis.

- Next step: Build a credible entry point through structured learning in valuation (DCF and multiples), financial modelling, capital structure, and governance, for example through an online executive finance certificate that fits around full time work.

High Potential Majority

The “Mid Zone” – The High Potential Majority

Experienced in finance, operations, or strategy, with a strong commercial and analytical base that can be directed toward private equity and venture capital.

- What it means: You understand business drivers, value creation, and performance measurement, but may not yet have direct deal or fund experience.

- Target roles: Analyst, portfolio operator, FP&A or finance lead in private equity backed companies, hybrid roles that blend execution, value creation, and strategic input to investors.

- Next step: Align your skills with private market dynamics and demonstrate that you can turn financial insight into operational value, for example by completing a structured private equity course in London or a flexible private equity course online that covers fund structures, valuation, and governance.

3. The “Max Zone” – The Established Inner Circle

This is the smallest and most exclusive segment, made up of individuals who already hold roles within private equity firms or elite advisory houses. They often combine strong academic credentials with well developed networks and operate close to the centre of capital allocation and fund management. While aspirational, this group is not the main focus of our learning pathway. The CLFI approach prioritises professionals in the Mid Zone and supports them in reaching the competence and confidence to work credibly with funds, boards, and portfolio leadership on merit.

Established Inner Circle

The “Max Zone” – The Established Inner Circle

Professionals already operating at the core of capital allocation and fund management.

- What it means: Roles inside private equity firms or top tier advisory practices, usually supported by strong academic pedigree, deal experience, and established networks.

- Reality check: This route is aspirational and relatively narrow, often associated with top business schools or highly selective career paths.

- Perspective: Our focus is on enabling Mid Zone talent to work alongside this inner circle, building a profile that can collaborate credibly with funds, investment committees, and portfolio company leadership.

Positioning for the Mid Zone: Building Relevant Skills

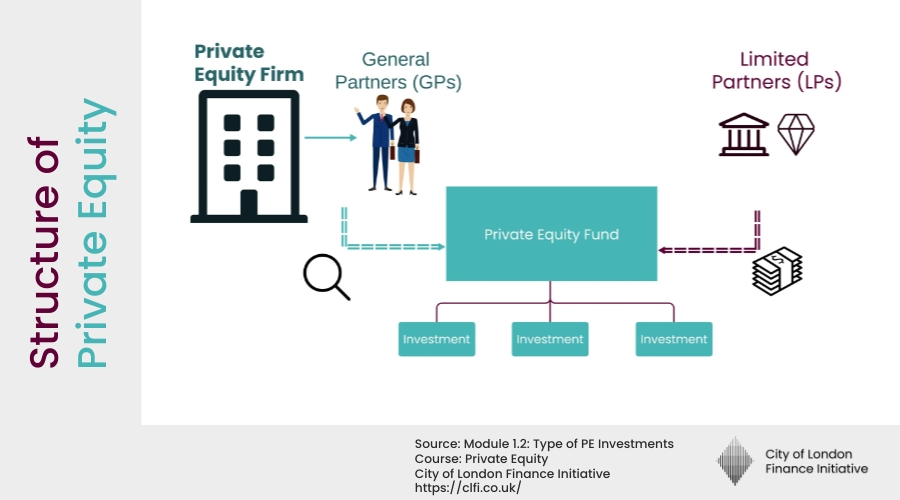

For Mid Zone professionals, the priority is to gain structured exposure to how private equity works, the mechanics, the mindset, and the operating model. This includes understanding fund structures, fee mechanisms, investment horizons, and the relationship between investors (limited partners) and fund managers (general partners). Equally important is learning how private equity firms create value after an acquisition, through financial discipline, governance improvements, and operational transformation in their portfolio companies.

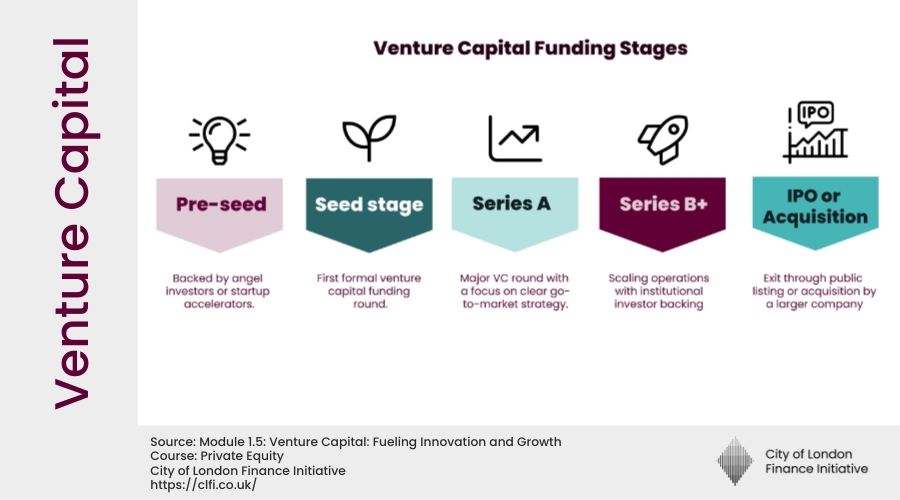

The Executive Certificate in Corporate Finance, Valuation & Governance from CLFI includes two integrated courses, Private Equity and Mergers & Acquisitions, that connect theory with practice. Taken together, they explain how private equity and venture capital firms structure deals, evaluate targets, and work with portfolio companies to achieve long term returns. For professionals looking for an online private equity course that remains anchored in London’s financial context, this programme provides a coherent toolkit for working in or around private equity backed organisations.

Becoming effective in this environment also requires an understanding of the operational side of private equity. Portfolio operators, sometimes called operating partners or business operators, work within the companies that funds acquire. They implement change, drive performance, and align management teams with the investment thesis agreed at deal stage. For professionals in finance, strategy, and operations, this has become an attractive and increasingly visible career path, and a well structured private equity course online can help bridge the gap between traditional corporate roles and these operator positions.

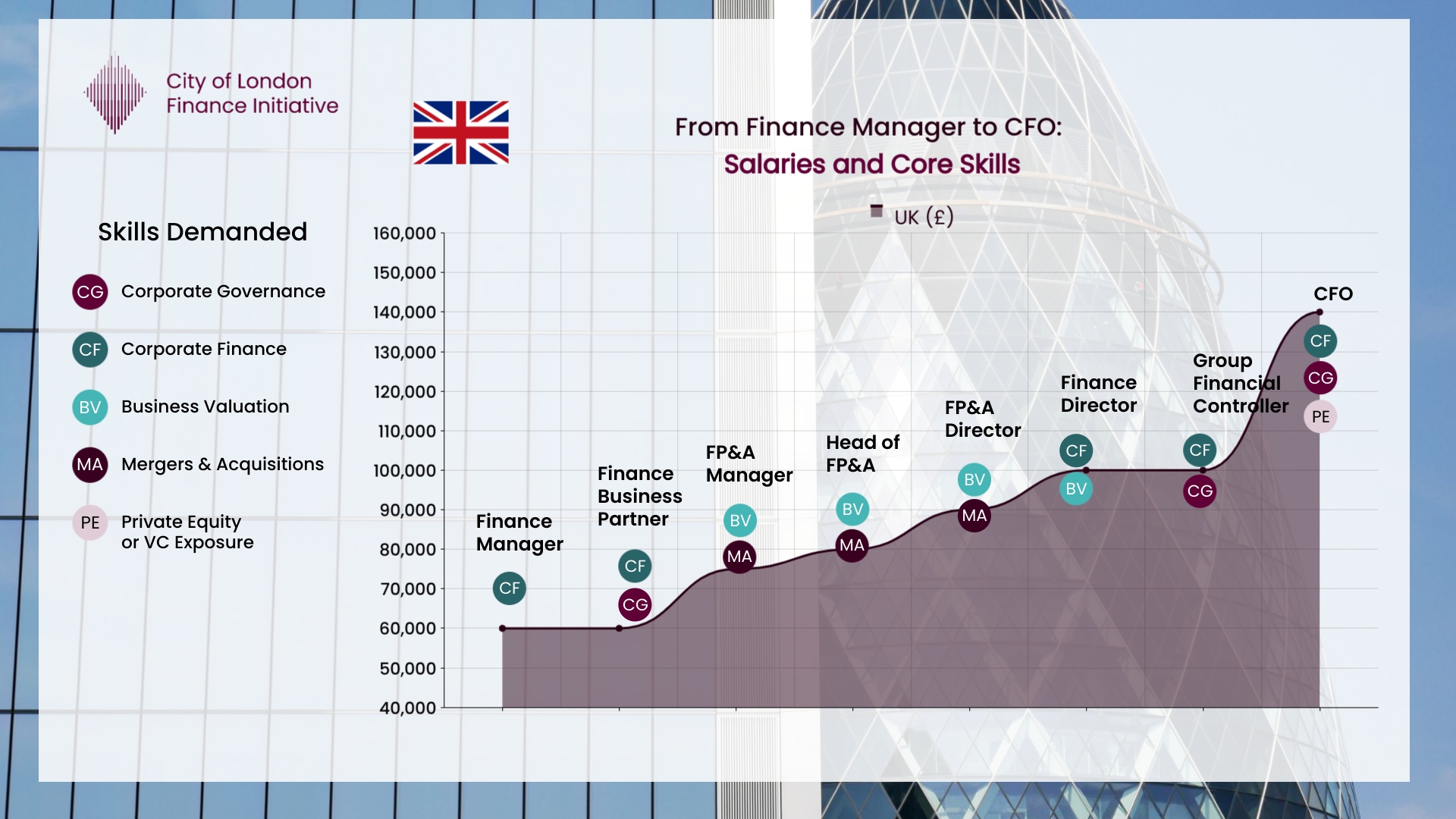

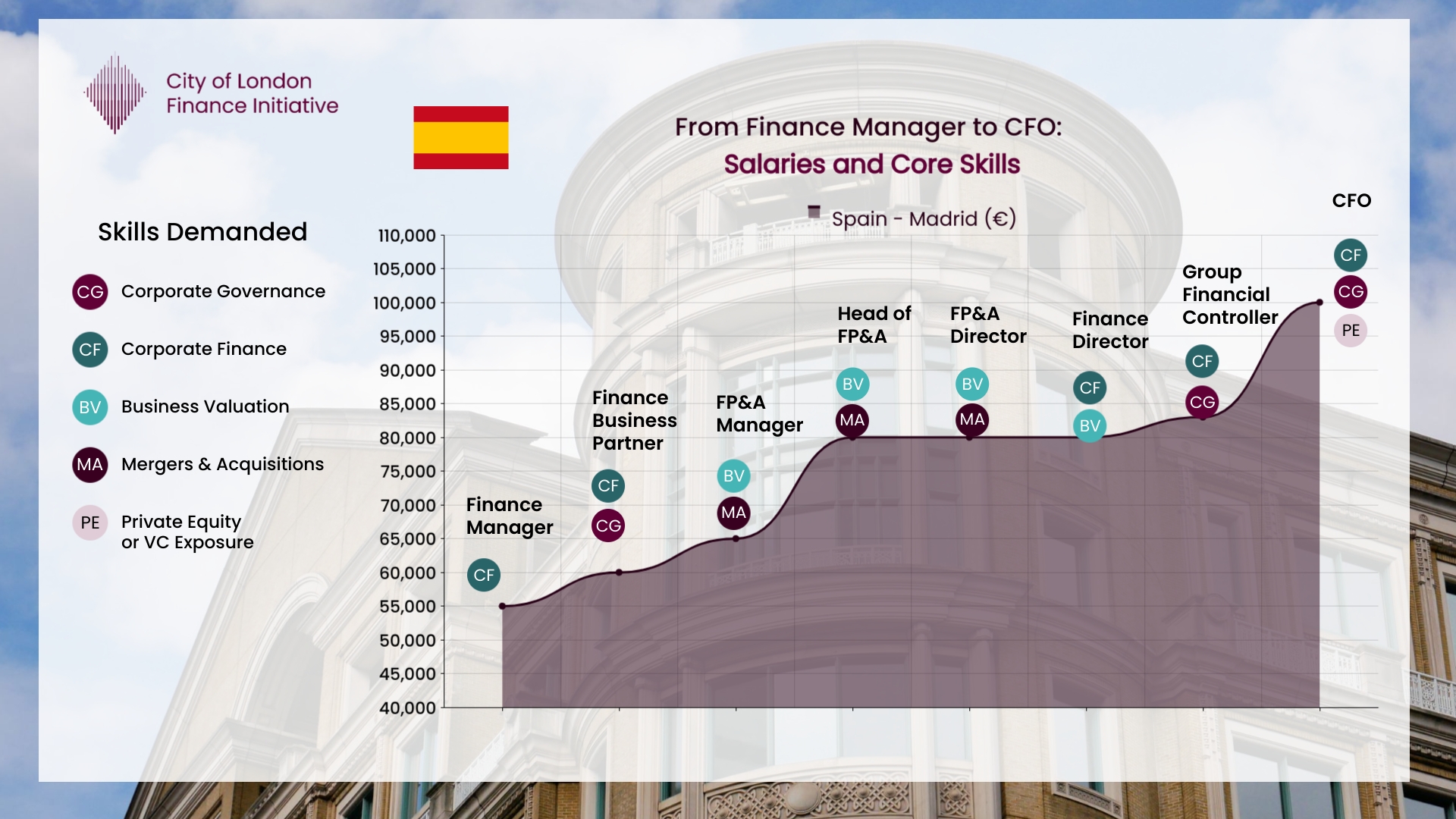

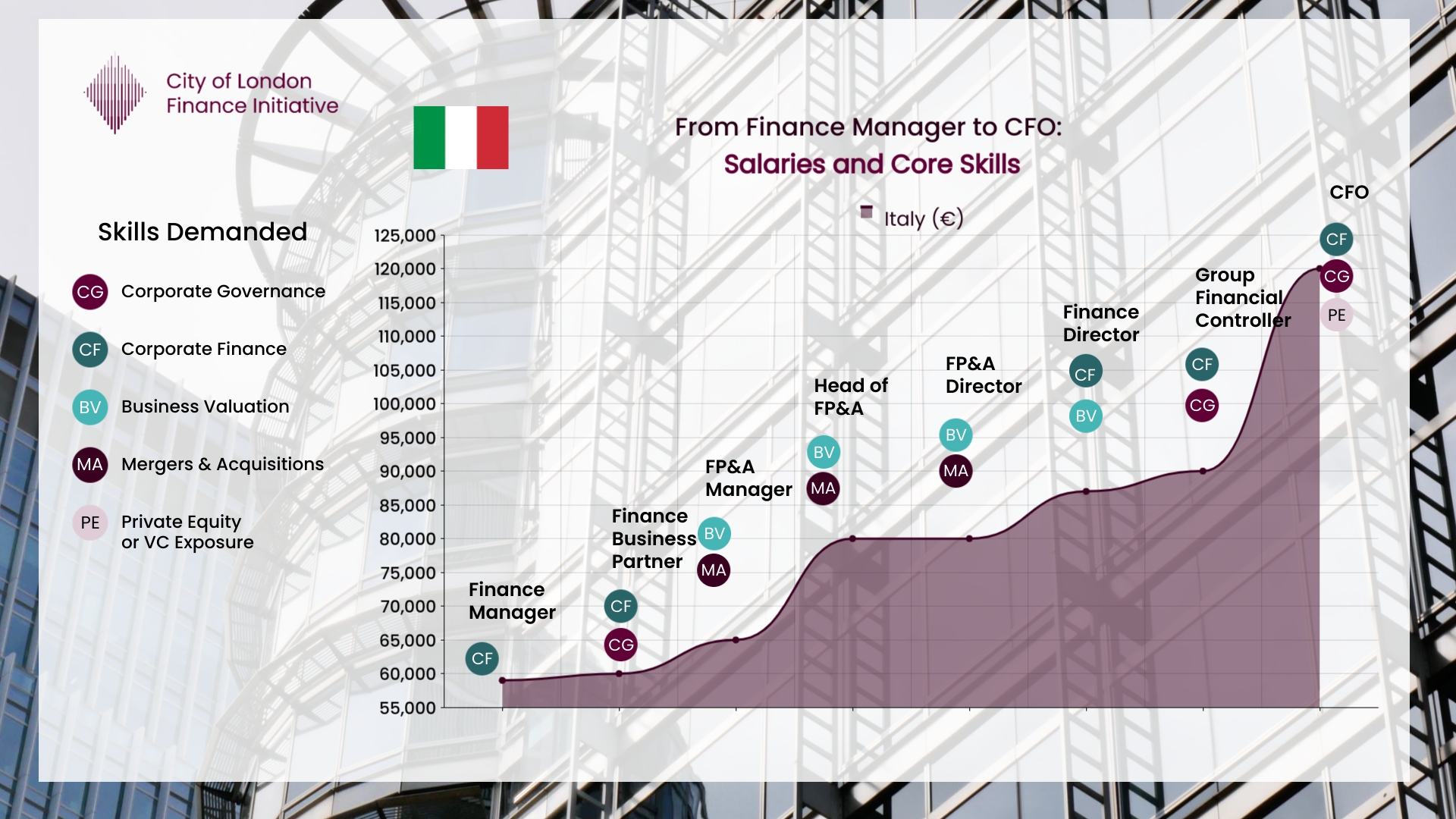

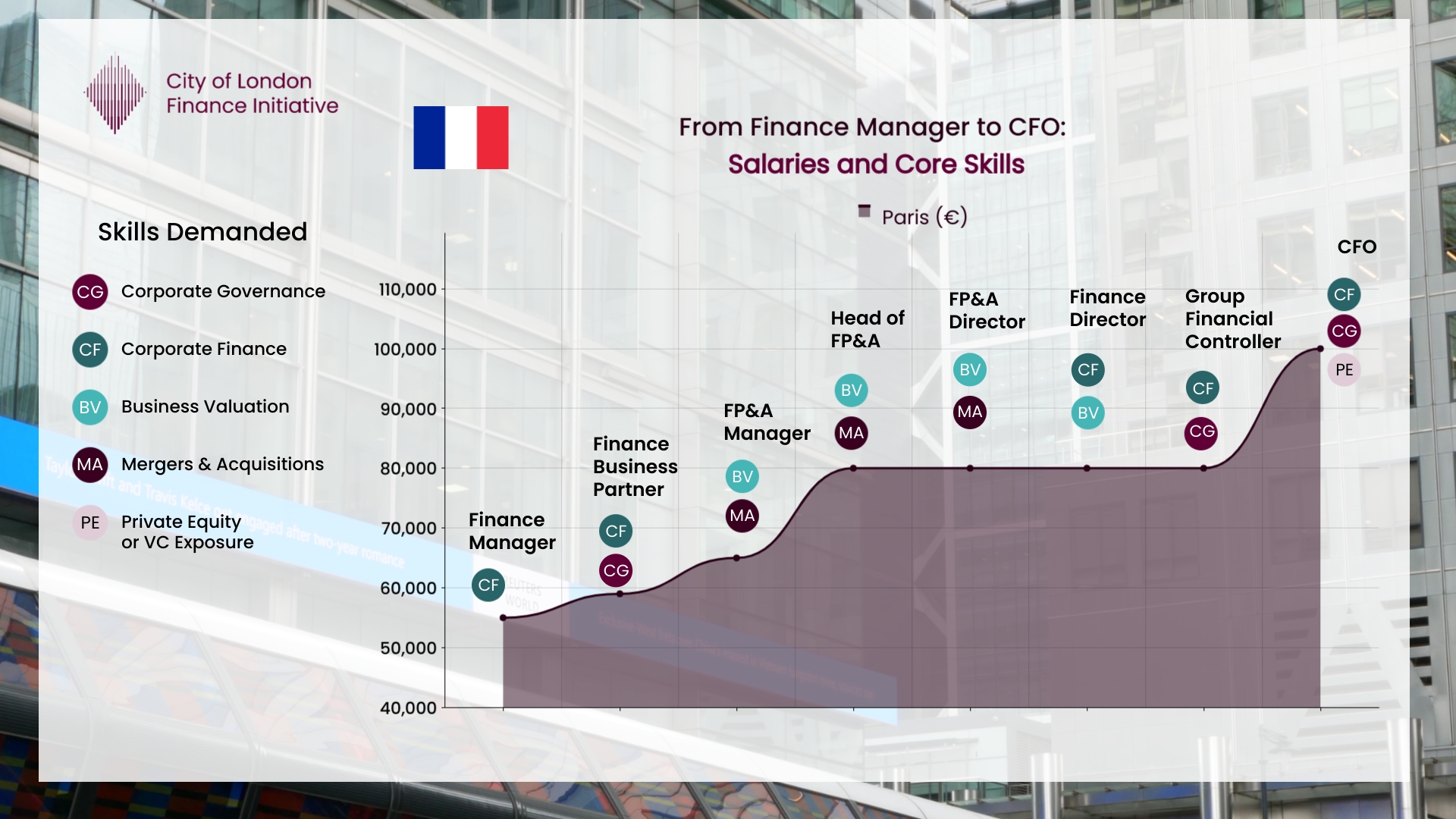

Private Equity Backed Companies: Roles and Salaries

Private equity backed companies are among the most dynamic employers in the current market. Their focus on performance and growth often translates into higher compensation structures than those offered by traditional corporates. Roles in these environments, whether in finance, FP&A, or operations, carry clear expectations around measurable results and accountability to investors.

Data from European salary benchmarks indicates that

finance professionals in private equity backed businesses earn, on average, 10–20 percent more

than peers in comparable non PE environments. The premium reflects both the pace and the expectations of these organisations. While listed companies often work within quarterly reporting cycles, private equity backed firms operate within defined investment horizons, typically five to seven years, so value creation over that period directly influences investor outcomes and exit options.

Over the past decade, these dynamics have evolved further. Many private equity funds are now holding assets for longer periods, a shift that may reflect strategic patience or uncertainty around traditional exit routes. At the same time,

the number of public listings has continued to decline

as private capital becomes an increasingly important engine of value creation.

Today, private market valuations are reaching levels once associated only with the largest listed corporations. In 2025, estimates placed OpenAI near $500 billion, SpaceX around $400 billion, Anthropic near $200 billion, and Stripe around $70 billion, all while remaining privately held. These examples show how some of the most influential companies of the decade are choosing to grow under private ownership, reshaping where finance and strategy professionals find opportunity.

A Changing Market Landscape

The global investment landscape has shifted. Many of the companies setting the pace in innovation and growth are remaining private, supported by deep pools of institutional, sovereign, and specialist capital. Public offerings, once viewed as the natural end point for corporate growth, are no longer the default objective. Instead, leading firms often choose to stay private to preserve control, agility, and strategic confidentiality. Understanding private equity, venture capital, and governance frameworks is now a core requirement for professionals aiming to operate near the top of the financial and strategic hierarchy.

Looking Forward: Skills That Bridge Public and Private Markets

Professionals who become fluent in how private equity operates, including its investment logic, valuation methods, and governance standards, gain a meaningful career advantage. These skills enable movement between public and private market roles and support informed dialogue with investors, boards, and ownership groups. In a period where private markets account for a growing share of capital formation, the ability to “speak private equity” is becoming a differentiator for executives in finance, strategy, and operations.

You can develop these skills in the

Executive Certificate in Corporate Finance, Valuation & Governance, a programme that includes exclusive courses on

Private Equity and Mergers & Acquisitions. Delivered as an

online private equity course with London based faculty and case studies, it is designed for professionals working with or within private capital backed organisations who want a structured pathway rather than ad hoc exposure.

References:

- CLFI Executive Programme in Corporate Finance, Valuation & Governance, 2025.

- PitchBook Data, Inc., Global Private Capital Market Overview, 2025.

- Michael Page, European Salary Guide 2025.

Grow expertise. Lead strategy.

Build a better future with the Executive Certificate in Corporate Finance, Valuation & Governance.