Table of Contents

Online Corporate Finance Course with Private Equity, Venture Capital, and M&A.

- CLFI Team

- 6 min read

Why Corporate Finance Education Matters More Than Ever

Indeed, corporate finance sits at the centre of modern business leadership. Every major strategic decision — whether launching a new product, acquiring a competitor, or attracting investors — is grounded in financial reasoning. For executives, understanding how value is created, financed, and governed is not just a technical skill; it’s a strategic advantage.

As a result, today’s professionals are turning to both traditional classroom programmes and flexible, self-paced online corporate finance courses — designed for busy executives who want to connect finance with strategy, governance, and real investment decisions. At the City of London Finance Initiative (CLFI), the Executive Certificate in Corporate Finance, Valuation & Governance combines these dimensions into one cohesive executive education pathway.

Together, they form a practical and boardroom-relevant foundation for leaders seeking to strengthen their financial influence and governance insight.

In addition, our online offering adds the Private Equity course and Mergers & Acquisitions course, offering an integrated view of how capital, ownership, and strategy interact at the highest level of corporate decision-making. Participants gain practical exposure to valuation models, deal structures, and governance frameworks directly linked to real-world cases.

Whether you are seeking a comprehensive private equity course, or a course on mergers and acquisitions, this integrated certificate offers a unified pathway.

Inside Our Online Corporate Finance Course

Corporate Finance examines how organisations raise, allocate, and manage capital to achieve sustainable growth and profitability. In CLFI’s executive-level course, participants explore key areas such as capital structure, cost of capital (WACC), risk and return, capital budgeting, and free cash flow analysis. What distinguishes CLFI’s approach is the emphasis on applying these principles to real strategic decisions — from evaluating new projects or acquisitions and financing choices to assessing long-term value creation.

The course is taught by City practitioners with decades of experience in investment banking, valuation, and governance.

Our Venture Capital and Private Equity Course

Private markets now dominate global capital formation. The number of publicly listed companies has declined sharply over the last two decades, while private equity (PE) and venture capital (VC) have become primary engines of growth. Understanding how these investors operate — from fundraising and deal structuring to portfolio management and exit strategies — is now a must for finance and strategy professionals.

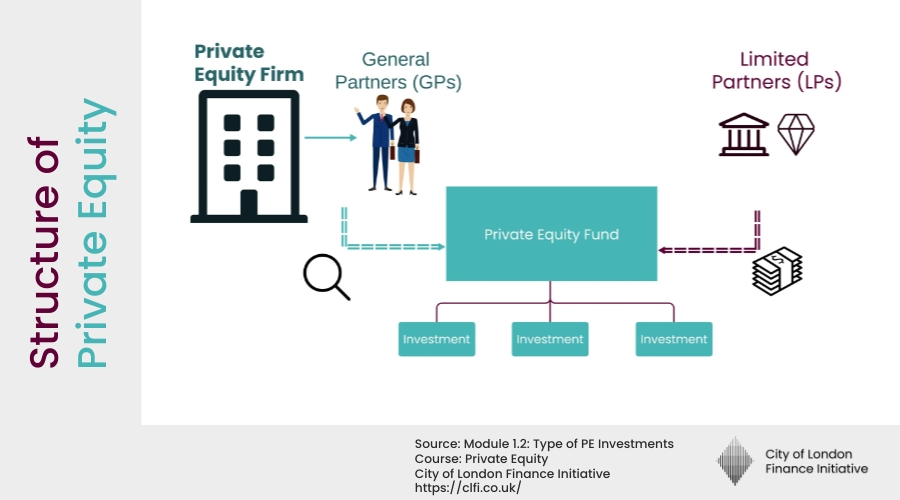

Within this context, CLFI’s Venture Capital and Private Equity course introduces participants to fund structures, capital commitment models, and profit distribution mechanisms. The programme explains how General Partners (GPs) and Limited Partners (LPs) interact, how value is created and shared through fees and carried interest, and how returns are realised across the investment lifecycle. For executives working in or with private equity–backed businesses, the course offers practical insight into investor objectives, governance alignment, and exit strategy dynamics.

Through case studies such as the Hilton Buyout by Blackstone learners see how private capital and strategic deals transforms corporate ownership and value creation. This perspective is crucial for professionals involved in fundraising, M&A, or operational leadership within investor-backed environments.

Programme Content Overview

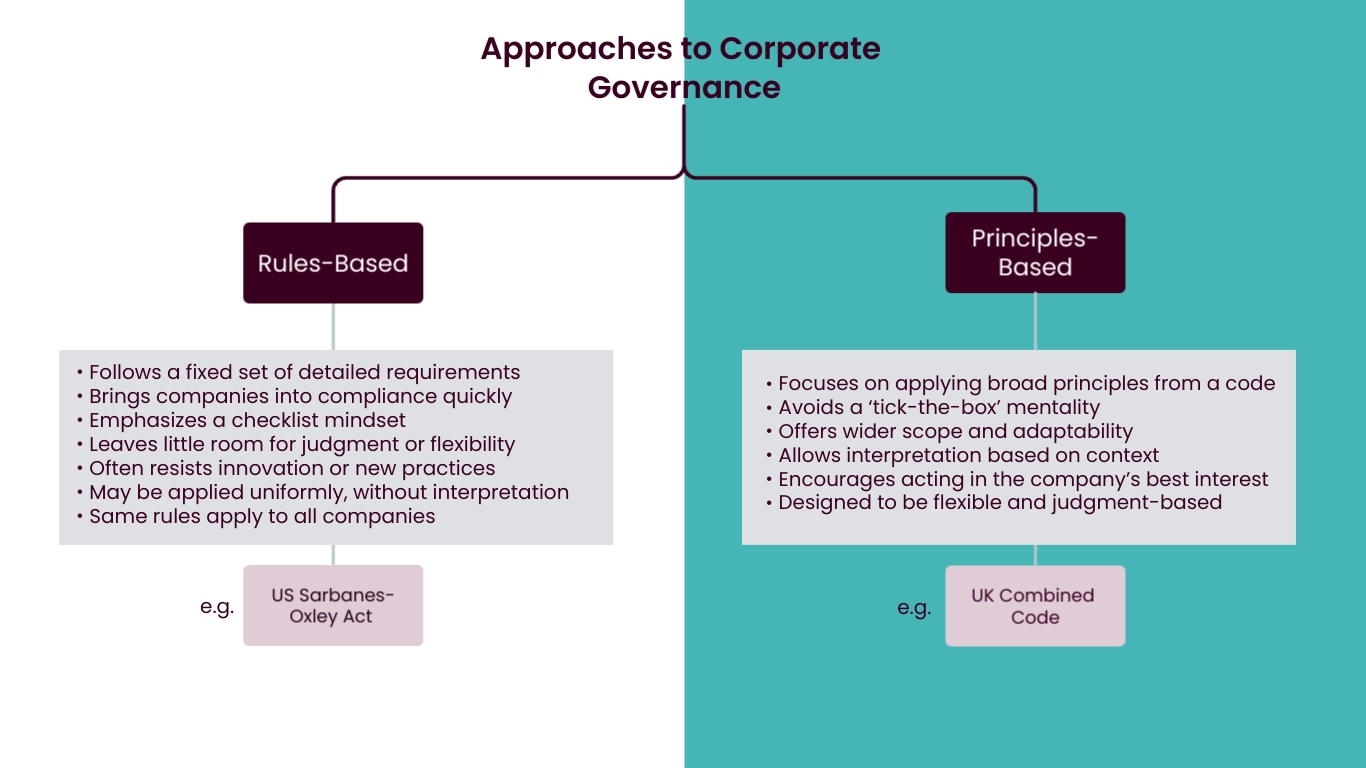

The Executive Certificate in Corporate Finance, Valuation & Governance delivers a full business-school-standard curriculum through flexible, self-paced modules. It covers five integrated courses — Corporate Finance, Business Valuation, Corporate Governance, Private Equity, and Mergers & Acquisitions — each contributing a defined share of the overall learning experience, combining academic depth with practical application.

Chart: Percentage weighting of each core course within the CLFI Executive Certificate curriculum.

Grow expertise. Lead strategy.

Build a better future with the Executive Certificate in Corporate Finance, Valuation & Governance.

Course on Mergers and Acquisitions (M&A)

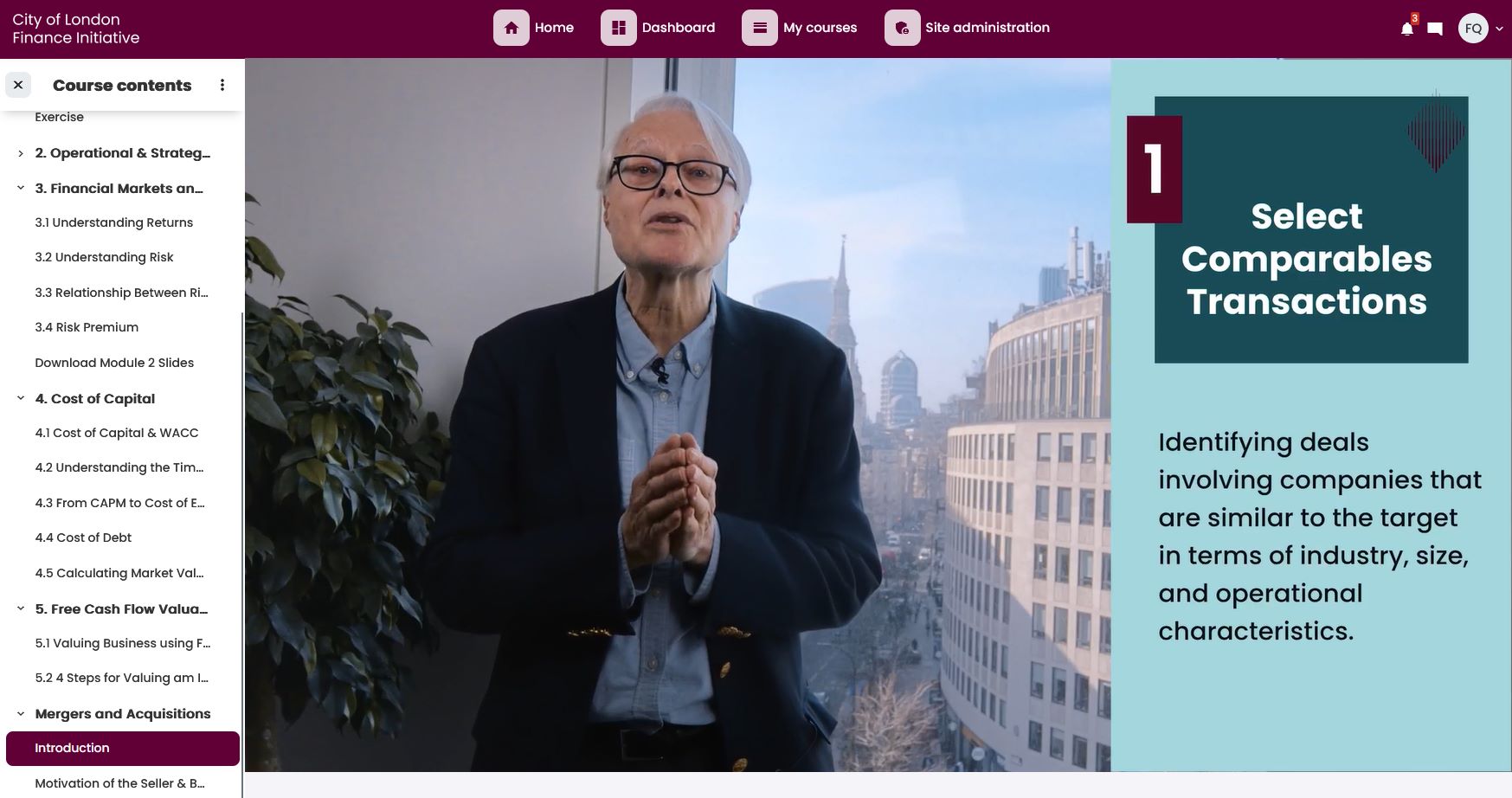

Indeed, Mergers and Acquisitions (M&A) represent one of the most complex and high-impact applications of corporate finance. Each deal requires careful analysis of valuation, financing structure, and post-merger integration. Understanding how M&A fits within the corporate finance framework is critical to evaluating growth opportunities and managing risk.

CLFI’s course on mergers and acquisitions — part of the Executive Certificate — examines the strategic rationale behind transactions — including synergy creation, buyer motivations, and seller objectives. Participants apply valuation techniques such as discounted cash flow (DCF), market multiples, and comparable transactions to analyse real-world deals.

The Importance of Executive Education Programs

The pace of change in global finance means that on-the-job experience alone is rarely enough to stay competitive. Executive education programs bridge the gap between theory and practice — giving professionals the frameworks, peer network, and strategic perspective to lead effectively.

We have designed our Executive Education Programmes for working professionals who want to deepen their financial understanding without stepping away from their careers. Delivered in flexible online, hybrid, and in-person formats in the heart ot the City of London, the short format courses combine academic rigour with applied relevance. Participants will gain the mechanics of valuation, corporate finance principles, and governance, connecting theory to practice through real-world case studies.

Online enrolment also includes exclusive access to CLFI’s partner AI research platform, allowing participants to research and analyse financial data, valuations, and transactions related to companies of interest.

Strategic Finance Upskilling for Leadership Teams

For L&D and HR leaders focused on strategic talent development, our executive education programs deliver essential financial acumen training for high-potential managers and senior operational executives. These highly practical, modular courses are specifically designed to go beyond basic accounting and spreadhsheets, focusing instead on connecting financial decisions to corporate strategy and long-term organizational goals.

We provide a structured pathway to upskill board members and senior leaders in areas such as corporate finance decision-making, business valuation, M&A analysis, and governance principles — enabling teams to strengthen strategic judgment, improve performance, and achieve measurable ROI from executive finance training.

Contact us to request a proposal for a custom corporate finance leadership development program tailored to your company’s strategic roadmap.