Table of Contents

Private Equity Deal Types Explained

- CLFI Team

- 7 min read

Private equity investment follows the economic life cycle of a company, and each stage requires different forms of capital, involvement, and expectations of risk and return. Although these deals are often grouped together under the term private equity or venture capital, in practice they represent a sequence of distinct interventions, each designed to solve a specific problem facing the business at that point in time. Understanding these stages is essential because investors, managers, and founders make decisions within very different conditions of uncertainty, governance, and operational maturity.

The below set of flashcards (click on each to expand) summarises the principal deal types across the early development, growth, maturity, and crisis phases of a company. Each card outlines the core concept, how the mechanism works, the type of company typically involved, the investor’s objective, and a simple analogy to help anchor the idea. Together they provide a concise reference framework for learners who want to build a structured understanding of how private equity supports firms from inception to recovery.

In practice, executives and founders encounter these deal types when raising capital, evaluating potential investors, or navigating strategic transitions. A clear grasp of the differences helps align expectations, negotiate effectively, and anticipate the demands associated with each form of financing.

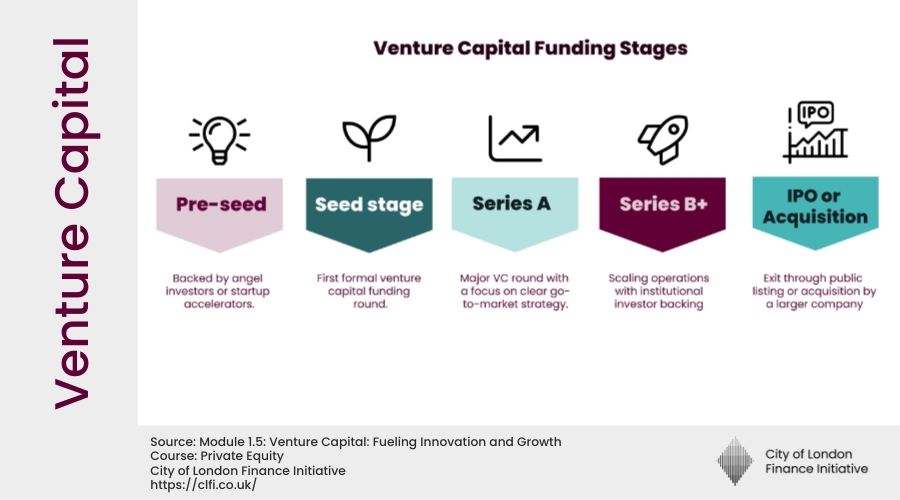

Seed Financing

Early-stage capital for transforming research and ideas into a potential venture.

Seed financing supports the creation of a business concept before a fully formed company exists. It bridges the gap between a scientific or technical idea and a potential commercial product.

Investors provide equity capital to fund research, prototypes, and proof-of-concept work. There is usually no revenue at this stage, and risk is very high because the product may never reach the market.

Research-led projects in biotech, hardware, engineering, and deep-tech fields, where technical potential is promising but the commercial and market outcomes are still uncertain.

Help convert a promising idea into a viable venture by:

- Shaping the business plan

- Protecting intellectual property

- Assembling an initial founding and advisory team

Seed financing is like watering a seed in the soil. Resources are committed long before there is any visible growth, and the outcome is still highly uncertain.

Start-Up Financing

Capital to turn a validated idea into an operating business with its first product and customers.

Start-up financing supports a newly formed company as it moves from a business idea to real operations. The goal is to build the first version of the product and start serving early customers.

Investors provide equity capital used to buy equipment, build inventory, hire key staff, and launch the initial go-to-market plan. Revenue is limited or just beginning, so the risk of commercial failure is still high.

Young ventures with a completed R&D phase, a clear business plan, an initial team, and a product ready to be introduced to the market, but without a proven customer base or stable cash flows.

Help the company move from plan to execution by:

- Stress-testing and refining the business plan assumptions

- Building a capable early management team

- Launching the first commercial version of the product or service

Start-up financing is like funding a new café that has a great recipe and a plan, but still needs a location, equipment, and staff before it can open its doors to customers.

Early Stage Financing

Capital for young firms that have launched, started selling, and now need support to grow their first customer base.

Early stage financing supports a “baby company” that has already launched its product and is beginning to generate sales, but still needs capital and guidance to turn early traction into a stable business.

Investors inject equity to fund working capital, strengthen operations, and refine the business model. The focus is on validating assumptions about pricing, customer behaviour, and market size while the firm is still fragile.

Companies with an active product, initial customers, and measurable sales, but without consistent profitability or fully developed internal processes.

Help management avoid early-stage mistakes and build a solid foundation by:

- Revising and strengthening the original business plan

- Supporting key strategic choices (pricing, market focus, hiring)

- Providing mentoring and advisory support on day-to-day decisions

Early stage financing is like helping a child who has learned to walk but still needs guidance to avoid falling, choose the right direction, and build confidence with each step.

Expansion Financing

Growth capital for companies that are already performing well and want to scale, enter new markets, or expand capacity.

Expansion financing supports a firm that has found product–market fit and now needs capital to grow faster, increase capacity, and strengthen its position in the market.

Investors provide equity or sometimes quasi-equity and debt to fund new plants, larger inventories, expanded sales teams, or acquisitions. The business model is known, so risk is mainly about execution speed and market choices.

Companies with strong revenue growth, a clear customer base, and opportunities to expand into new regions, channels, or product lines, but lacking the internal funds to do so quickly.

Enable disciplined, accelerated growth by:

- Financing capacity increases and new market entry

- Helping prioritise which markets, products, or segments to focus on

- Supporting management as they handle the operational risks of fast growth

Expansion financing is like giving a successful restaurant the funds to open several new branches, while also advising on where to locate them and how to maintain quality across all sites.

Replacement Financing

Capital used to change or reorganise ownership and governance in mature, stable companies.

Replacement financing focuses on governance, ownership, and strategic transitions rather than on funding growth. It helps mature firms handle events such as succession, shareholder exits, or restructuring of control.

Investors buy out existing shareholders, take significant stakes, or support transactions like IPOs, spin-offs, and family buyouts. The capital is used to reshape who owns and controls the business, not to expand its assets.

Profitable, mature businesses where the main challenges relate to family succession, shareholder conflicts, governance redesign, or preparation for listing on a stock exchange.

Guide and execute complex strategic transitions by:

- Designing and funding succession or ownership changes

- Improving governance structures and board composition

- Aligning the capital structure with long-term strategic objectives

Replacement financing is like helping a well-run family hotel transition from the founders to the next generation, buying out some relatives and putting in place clearer rules and leadership roles.

Vulture Financing

High-risk capital and control interventions for companies in severe financial distress or crisis.

Vulture financing targets firms in serious financial trouble, providing capital and tough restructuring to give the business a chance to survive instead of collapsing or entering formal insolvency.

Investors buy distressed debt or equity at deep discounts, often gaining strong control rights or board seats. They design and implement survival plans, including debt restructuring, asset sales, cost cuts, and management changes.

Companies facing declining revenues, liquidity shortages, covenant breaches, or a looming bankruptcy, where the underlying business may still be salvageable with decisive action.

Turn around a distressed firm and create value from recovery by:

- Stabilising cash flow and reducing unsustainable debt

- Repositioning the business or exiting non-core activities

- Strengthening governance and replacing ineffective leadership where needed

Vulture financing is like bringing in an emergency turnaround team to save a collapsing building — they may strip away unsafe sections, rebuild key structures, and take strict control to prevent total failure.

The Private Equity Valuation Toolkit

Most private equity valuations begin with a multiyear business plan that translates the company’s strategy into financial forecasts. Investors construct their own version of this plan, informed by management input and due diligence findings. They build base, downside, and upside scenarios and assess whether the company’s risks align with the fund’s mandate. These scenarios form the foundation for valuation techniques, which vary according to the target’s maturity.

Definition:

Enterprise Value (EV)

Enterprise value represents the economic value of the entire business, calculated as the value of its operations before considering the impact of its financing structure. Equity value is derived by subtracting net debt from EV.

Programme Content Overview

The Executive Certificate in Corporate Finance, Valuation & Governance delivers a full business-school-standard curriculum through flexible, self-paced modules. It covers five integrated courses — Corporate Finance, Business Valuation, Corporate Governance, Private Equity, and Mergers & Acquisitions — each contributing a defined share of the overall learning experience, combining academic depth with practical application.

Chart: Percentage weighting of each core course within the CLFI Executive Certificate curriculum.

Grow expertise. Lead strategy.

Build a better future with the Executive Certificate in Corporate Finance, Valuation & Governance.