Table of Contents

Net Present Value (NPV) Explained for Investment Decisions

- 5 min read

- Authored & Reviewed by: CLFI Team

Investment decisions require a method that can distinguish between projects that merely return cash and those that genuinely create economic value. Net Present Value, commonly referred to as NPV, is designed precisely for this purpose. It translates future cash flows into today’s terms and compares them directly with the capital invested, allowing decision-makers to assess whether an investment increases or reduces value.

Unlike simpler appraisal tools, NPV embeds the time value of money into the decision process. This makes it central to modern corporate finance, particularly in environments where capital is scarce and opportunity cost matters. For boards and executives, NPV provides a disciplined framework for comparing projects with different risk profiles, timings, and cash flow patterns.

The principles underpinning investment appraisal, including the use of Net Present Value and the time value of money, are examined in the Corporate Finance Executive Course.

Table of Contents

What Is Net Present Value

Definition:

Net Present Value (NPV)

The difference between the present value of expected future cash inflows and the initial investment required to undertake a project.

Net Present Value measures value creation in absolute monetary terms. A positive NPV indicates that an investment is expected to generate returns above the cost of capital, while a negative NPV signals value destruction. This framing aligns investment appraisal with shareholder value and long-term capital efficiency.

The strength of NPV lies in its conceptual clarity. By expressing all future cash flows in today’s money, it allows projects with different lifespans and timing profiles to be compared on a consistent basis. At the same time, NPV is sensitive to assumptions about discount rates and cash flow forecasts, which introduces estimation risk that must be managed carefully.

How NPV Works

The logic of NPV rests on the time value of money, the principle that a pound received today is worth more than a pound received in the future. This is because money available today can be invested, earns returns, and provides flexibility that delayed cash flows do not.

NPV applies this principle by discounting future cash inflows back to their present value using a rate that reflects the project’s risk and the firm’s opportunity cost of capital. Cash flows that arrive later are discounted more heavily, reducing their contribution to value relative to earlier inflows.

This approach ensures that both timing and risk are embedded in the decision process. As a result, NPV favours projects that generate cash earlier and compensates appropriately for uncertainty, while penalising investments that delay returns or expose the firm to excessive risk.

How NPV Is Calculated

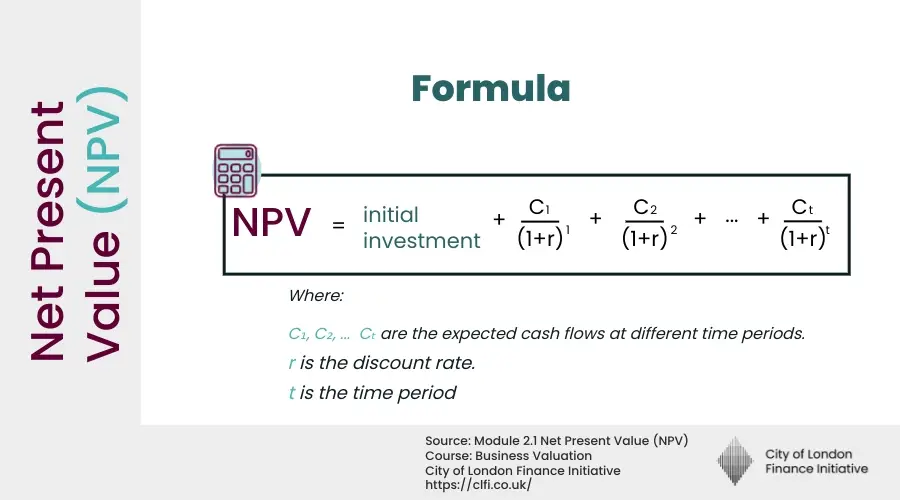

Net Present Value is calculated by discounting each expected cash flow to its present value and subtracting the initial investment. While the mathematical expression can appear technical, the intuition is straightforward: compare what you give up today with what you expect to receive, adjusted for time and risk.

The decision rules are clear. If NPV is greater than zero, the project is expected to create value and should be accepted. If NPV equals zero, the project is expected to break even relative to the cost of capital. If NPV is negative, the project is expected to destroy value and should be rejected.

Although NPV provides a strong theoretical foundation, its accuracy depends on the quality of inputs. Forecasting errors or inappropriate discount rates can materially affect outcomes, which is why NPV should be supported by sensitivity analysis and scenario testing in practice.

Applied Example

Calculating Net Present Value (NPV)

How to evaluate whether an investment creates value by discounting future cash flows to present terms.

A company is evaluating a £1,000,000 investment in new technology. The project is expected to generate annual cash inflows of £300,000 over the next five years. Management needs to determine whether this investment creates value for the firm.

Using Net Present Value (NPV), each future cash inflow is discounted back to its present value using the firm's cost of capital (discount rate). If the total present value of discounted inflows exceeds the initial investment, the project adds value. The discount rate reflects the time value of money and the risk associated with future cash flows.

The discount rate of 10% represents the firm's cost of capital — the minimum return required to compensate investors for the risk and opportunity cost of tying up capital in this project.

Understand the NPV formula

Where t = year, r = discount rate, and each cash flow is divided by (1 + r)t to find its present value.

Calculate the discount factor for each year

The discount factor shows how much £1 received in a future year is worth today:

| Year | Calculation | Discount Factor |

|---|---|---|

| 1 | 1 ÷ (1.10)1 | 0.9091 |

| 2 | 1 ÷ (1.10)2 | 0.8264 |

| 3 | 1 ÷ (1.10)3 | 0.7513 |

| 4 | 1 ÷ (1.10)4 | 0.6830 |

| 5 | 1 ÷ (1.10)5 | 0.6209 |

Notice that discount factors decrease over time — money received further in the future is worth less today.

Discount each year's cash flow to present value

| Year | Cash Flow | Discount Factor | Present Value |

|---|---|---|---|

| 0 | (£1,000,000) | 1.0000 | (£1,000,000) |

| 1 | £300,000 | 0.9091 | £272,730 |

| 2 | £300,000 | 0.8264 | £247,920 |

| 3 | £300,000 | 0.7513 | £225,390 |

| 4 | £300,000 | 0.6830 | £204,900 |

| 5 | £300,000 | 0.6209 | £186,270 |

| Total Present Value of Cash Flows | £1,137,210 | ||

Calculate the Net Present Value

Interpret the result

The NPV is £137,210 (positive).

A positive NPV means the project creates value for the firm. The present value of expected cash inflows (£1,137,210) exceeds the initial investment (£1,000,000) by £137,210. This indicates that the project returns more than the firm's cost of capital and should be accepted.

If NPV were negative, the project would destroy value and should be rejected. If NPV equals zero, the project exactly meets the required return but adds no additional value.

Learning takeaway

Net Present Value (NPV) is the gold standard for investment appraisal because it accounts for the time value of money and focuses on value creation rather than accounting profit. Unlike payback period, NPV considers all cash flows throughout the project's life and adjusts for risk through the discount rate. A positive NPV signals that an investment will increase shareholder wealth.

Programme Content Overview

The Executive Certificate in Corporate Finance, Valuation & Governance delivers a full business-school-standard curriculum through flexible, self-paced modules. It covers five integrated courses — Corporate Finance, Business Valuation, Corporate Governance, Private Equity, and Mergers & Acquisitions — each contributing a defined share of the overall learning experience, combining academic depth with practical application.

Chart: Percentage weighting of each core course within the CLFI Executive Certificate curriculum.

Capital Is a Resource. Allocation Is a Strategy.

Learn more through the Executive Certificate in Corporate Finance, Valuation & Governance – a structured programme integrating governance, finance, valuation, and strategy.

NPV in Corporate Finance Practice

In corporate finance practice, Net Present Value is widely regarded as the most reliable decision rule for evaluating capital investments. It is particularly effective when organisations must choose between mutually exclusive projects or allocate limited capital across competing opportunities, because it measures value creation in absolute monetary terms rather than relative percentages.

Where NPV Creates Decision Exposure

Understanding how Net Present Value is calculated is not the same as understanding how it should be challenged in real investment decisions. In practice, many professionals are involved in evaluating, recommending, or approving projects based on NPV outputs they did not produce themselves.

At this point, the exposure does not lie in the mechanics of the formula, but in the assumptions behind it. Cash flow forecasts, discount rates, project timing, and downside scenarios can materially change the perceived value of an investment. Relying on headline NPV figures without interrogating these inputs can lead to weak capital allocation decisions.

Effective use of NPV therefore depends less on calculation and more on judgement. This includes understanding how NPV interacts with capital constraints, competing priorities, and alternative uses of funds, as well as recognising when other decision criteria should also be considered.