Hybrid

Flexible learning that combines online modules with an

immersive in-person experience in London.

Programme Overview

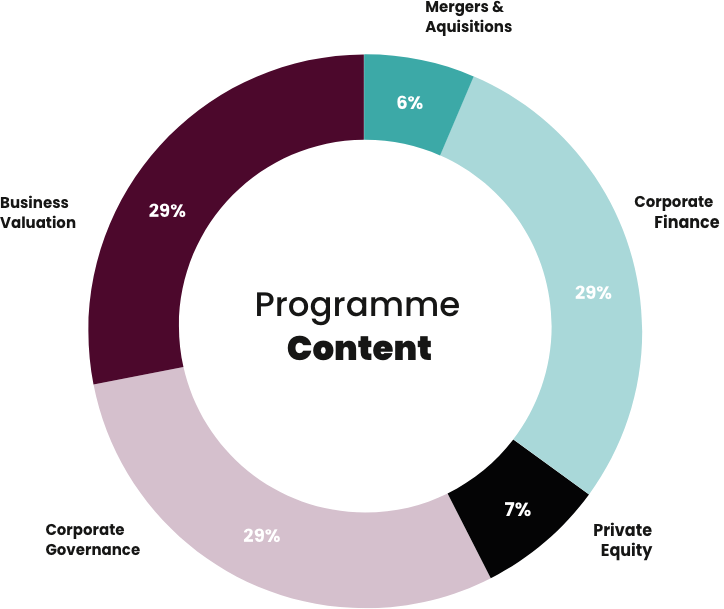

This hybrid executive programme combines flexible online modules with an immersive in-person masterclass held in the heart of the City of London. Designed specifically for ambitious finance professionals, corporate executives, and business leaders, the programme offers expert-led sessions focused on Corporate Finance, Governance, Business Valuation—culminating in a dynamic, interactive experience that maximises impact and convenience.

A blend of online flexibility with 2 days in London for maximum impact

Real-World

Case Studies

Gain the tools to evaluate business valuations and assess investment opportunities with precision.

Strategic Courses

Advance your expertise in finance, valuation, governance, and M&A to drive high-level business decisions.

Executive

Certification

Earn your Executive Certificate in Finance, Governance & Valuation, and CPD accreditation.

Programme Overview

Strategic Decision-Making

Master the skills to make confident, high-impact decisions in complex M&A and corporate finance scenarios.

Risk and Capital Management

Develop expertise in risk management and capital structure optimisation to achieve sustainable growth.

Operational and Financial Expertise

Enhance your ability to drive operational efficiency and ensure long-term business success.

Advanced Valuation Techniques

Gain the tools to evaluate business valuations and assess investment opportunities with precision.

Integration and Synergy Realisation

Learn to navigate integration challenges and unlock value through synergies in transformative deals.

Practical Insights

Apply real-world case studies to overcome challenges with actionable, results-focused solutions.

Courses

Corporate Governance

Corporate Finance

Business Valuation

Corporate governance defines how organisations are directed and controlled. This programme explores corporate governance principles and frameworks, including the UK Corporate Governance Code and the US Sarbanes-Oxley Act.

With directors playing a key role in company oversight, ensuring decisions serve the best interests of shareholders and other stakeholders, participants will examine board structure and directors' responsibilities, including the separation of CEO and Chairman roles.

Explore the importance of audit, remuneration, and nomination committees, board induction, and performance assessment, while addressing critical challenges such as the agency problem and its resolution. Through practical tools and case studies, participants will strengthen their ability to enhance board effectiveness and apply governance principles in real-world contexts.

This course delves into the principles of corporate finance, equipping participants with the tools to navigate financial decision-making, ensuring effective capital allocation and strategic planning.

The programme covers the three fundamental financial decisions—investment, financing, and dividend policy—expanding into risk and return analysis, including diversification, historical market returns, and the risk premium. It also examines free cash flow forecasting, capital structure optimisation and its cost (WACC), working capital management, and risk mitigation strategies.

Through real-world case studies and practical applications, participants will develop the skills to support strategic investment decisions, using NPV analysis to assess whether a project creates value for the company and its shareholders.

Mastering business valuation is essential for professionals involved in investment decisions, mergers and acquisitions, and project finance. This course provides participants with the framework to assess a company’s or project’s value with confidence.

The programme explores core valuation methodologies, including discounted cash flow (DCF) analysis, relative valuation using market multiples, and precedent transaction analysis. Emphasis is placed on net present value (NPV), alongside alternative techniques such as internal rate of return (IRR) and the payback period. It also covers key components that influence valuation outcomes, including working capital and terminal value assumptions.

Through case studies and practical applications, participants will refine their ability to perform sound business valuations and make informed financial decisions that support long-term value creation.

Key Detailes

Executive Programmes for Ambitious Professionals

High-quality and impactful learning experiences to advance careers and meet executive demand

Programme Structure

– 2 Days Online: Flexible, high-quality e-learning modules available anytime.

– 2 Day in-Person: Interactive session in London, featuring a lecture, discussion session and networking.

Focused Curriculum

Applied and practical content to enhance participants profiles, meeting the strategic needs of global executive roles.

Accessible

Real value for money for corporates and employees.

Expert Lecturers

Courses delivered by seasoned professionals and academics with proven track records in the UK.

Is this the right programme for you?

You are a business owner, entrepreneur, or senior professional seeking to strengthen your financial decision-making.

You want to contribute more effectively to board-level decisions around valuation, governance, and stakeholder value creation.

You want to get involved in fundraising, acquisitions, or strategic investments and want practical tools to navigate them.

You value learning from both academic experts and experienced practitioners with real-world insight.

You’re looking for flexible, high-impact training that fits your schedule and delivers immediate value.

Agenda

2-Day

In-presence

Spring

2025

City

Of London

Online

16 hours equivalent

Self-paced modules, available anytime. Covering in-depth content in corporate finance, valuation, and governance to prepare you for the in-person sessions.

THU

08:30 – 16:30

Expert-led sessions on Corporate Finance and Business Valuation, with case studies exploring their application in real-world business scenarios.

FRI

08:30 – 16:30

Sessions led by City-experienced professionals on Private Equity and Mergers & Acquisitions, offering insights and practical perspectives from real-world dealmaking.

Course Leaders

Delivered by professors, lecturers, and industry experts.

Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do.

Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do.

Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do.

Programme Impact

The programme offers a dynamic and immersive learning experience, blending interactive sessions, in-person engagements in London, hands-on exercises, practical examples, case studies, and reflective activities to ensure active participation and impactful outcomes.

What you will learn

Participate in engaging sessions led by experienced academics and industry practitioners, blending theory with real-world application. You’ll develop strategic decision-making skills for high-stakes scenarios, master advanced valuation techniques to assess investment opportunities with precision, and refine your expertise in risk management and capital structure optimisation.

How you will learn

The programme combines flexible online modules with immersive in-person sessions:

Online: Self-paced modules covering comprehensive content in corporate finance, valuation, and governance.

In-Person: Two days of expert-led sessions focusing on real-world applications and case studies.

What is the application process

You can apply directly through our online application form, by downloading the brochure, or by contacting us via email. Once we receive your expression of interest, we’ll send a short questionnaire to better understand your objectives. Following an internal review to ensure the programme is the right fit, eligible candidates will be invited to complete their enrolment.

Duration and Location

The programme includes the equivalent of three days of online content, delivered through self-paced modules that you can complete flexibly. This is followed by two in-person days held in the City of London, providing an opportunity for live sessions, case discussions, and peer interaction.

What are the entry requirements

Applicants should have a university-level qualification or recent experience in a financial or operational role. A one-page CV is required as part of the application. Proficiency in English is essential. Non-UK nationals may require a visa to attend the in-person sessions in London.

Upcoming

Programmes

Finance, Private Equity and M&A

Gain in-depth knowledge of Mergers & Acquisitions, Corporate Finance principles, and Business Valuation techniques. Build the skills to excel in Private Equity, whether negotiating deals or entering the field.

| Duration | 2 days |

|---|---|

| Next | Summer 2025 |

| Location | City of London |

| Format | In-presence |

| Fees | Contact us |

Finance, Private Equity and M&A

Gain in-depth knowledge of Mergers & Acquisitions, Corporate Finance principles, and Business Valuation techniques. Build the skills to excel in Private Equity, whether negotiating deals or entering the field.

| Duration | 2 days |

|---|---|

| Period | Autumn 2025 |

| Location | City of London |

| Format | Hybrid |

| Fees | Contact us |

A Learning

experience

in the heart

of London

Get your certificate

Fees

On enquiry

What’s included

– Course materials

– Lunch

– Networking event

What’s not included

– Accommodation

– Travel

Programme

| Format | In-presence |

|---|---|

| Location | City of London |

| Duration | 3 days |

| Schedule | Wed – Thu – Fri |

| Period | 23-25 April |

Contact Us

We’re here to help you take the next step in your executive education journey. Whether you have questions about our programmes, need guidance on enrolment, or want to explore customised training options, our team is ready to assist.

Email: hybrid@clfi.co.uk

Location: 36-38 Cornhill

City of London, London EC3V 3NG

We look forward to welcoming you to one of our programmes and helping you achieve your professional goals.

Alternatively, fill out our contact form on this page, and we’ll get back to you promptly.