Table of Contents

Mergers and Acquisitions (M&A): Types, Valuation, and Strategic Role

- CLFI Team

- 6 min read

Mergers and Acquisitions—commonly referred to as M&A—describe transactions where companies combine or one company purchases another. M&A activity is a central feature of corporate strategy, reshaping industries, creating synergies, and driving growth. Because these deals involve large sums and long-term consequences, understanding the types of M&A and how they are valued is critical for executives, investors, and boards alike.

Table of Contents

- What Are Mergers and Acquisitions?

- Types of M&A

- Why M&A Happens

- Valuation in M&A

- Worked Example: Valuation Using Multiples

- Limits and Risks of M&A

- Further Reading

What Are Mergers and Acquisitions?

A merger occurs when two companies agree to combine and form a single entity, usually to strengthen their market position. An acquisition happens when one company purchases another and assumes control. Although often grouped together, the two can differ in structure, strategy, and perception. For example, the merger of Essilor and Luxottica created a global eyewear leader, while Microsoft’s acquisition of LinkedIn was a purchase bringing the target under Microsoft’s full control.

Types of M&A

M&A transactions take different forms depending on strategic objectives. Each type has different implications for growth, control, and risk:

- Horizontal merger: Two companies operating in the same industry and often as direct competitors combine. This type of merger is typically pursued to increase market share, achieve economies of scale, and reduce competition. For example, airline consolidations allow carriers to share routes, reduce overlapping costs, and strengthen pricing power.

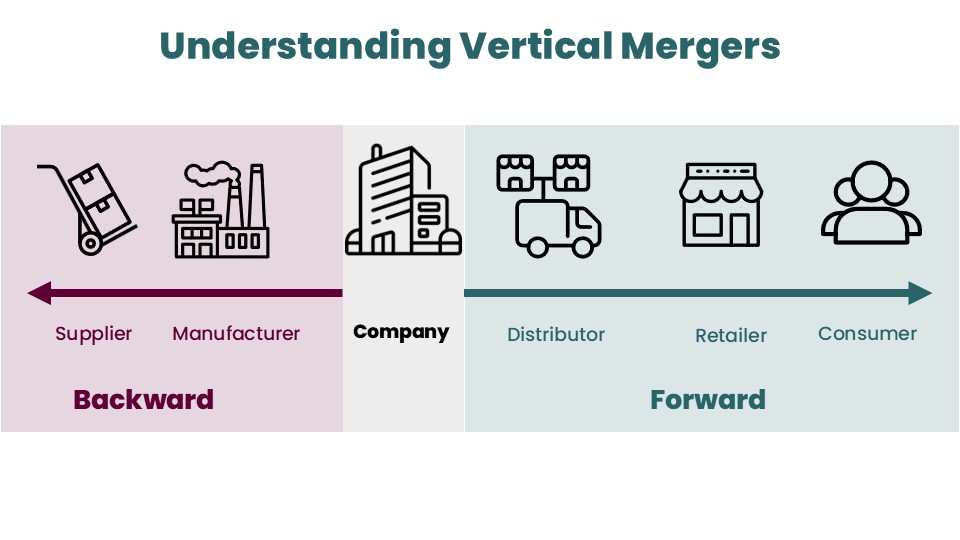

- Vertical merger: Companies at different stages of the supply chain join together. A vertical merger can be backward (a company acquires a supplier or manufacturer to secure critical inputs) or forward (a company acquires a distributor or retailer to reach customers more directly). The main objectives are efficiency, cost reduction, and tighter control over production and distribution.

M&A Course Module 1.3 Type of Mergers - Conglomerate merger: A transaction between companies in unrelated industries. The purpose is diversification, either to spread risk across sectors or to allocate surplus capital into new areas of growth. While it can create stability by reducing dependence on a single market, conglomerates often face challenges in managing diverse business units with little operational overlap.

- Acquisition of control: One company purchases a controlling stake—usually more than 50%—in another company. Unlike a merger of equals, control acquisitions allow the buyer to integrate operations, redirect strategy, or capture specific assets such as technology or brands. This route is common in cross-border deals where firms seek access to new markets without building from scratch.

- Leveraged buyout (LBO): An acquisition financed primarily with borrowed funds, where the target’s assets and cash flows are often used to secure and repay the debt. LBOs are a hallmark of private equity, as they allow investors to amplify returns through leverage. However, they also increase financial risk, making post-acquisition cash generation and operational improvements critical to success.

Programme Content Overview

The Executive Certificate in Corporate Finance, Valuation & Governance delivers a full business-school-standard curriculum through flexible, self-paced modules. It covers five integrated courses — Corporate Finance, Business Valuation, Corporate Governance, Private Equity, and Mergers & Acquisitions — each contributing a defined share of the overall learning experience, combining academic depth with practical application.

Chart: Percentage weighting of each core course within the CLFI Executive Certificate curriculum.

Grow expertise. Lead strategy.

Build a better future with the Executive Certificate in Corporate Finance, Valuation & Governance.

Why M&A Happens

The motivations behind M&A vary, but most transactions are driven by a combination of synergies, growth objectives, strategic repositioning, and financial opportunities. Understanding these drivers helps explain why some deals create lasting value while others struggle to deliver on expectations.

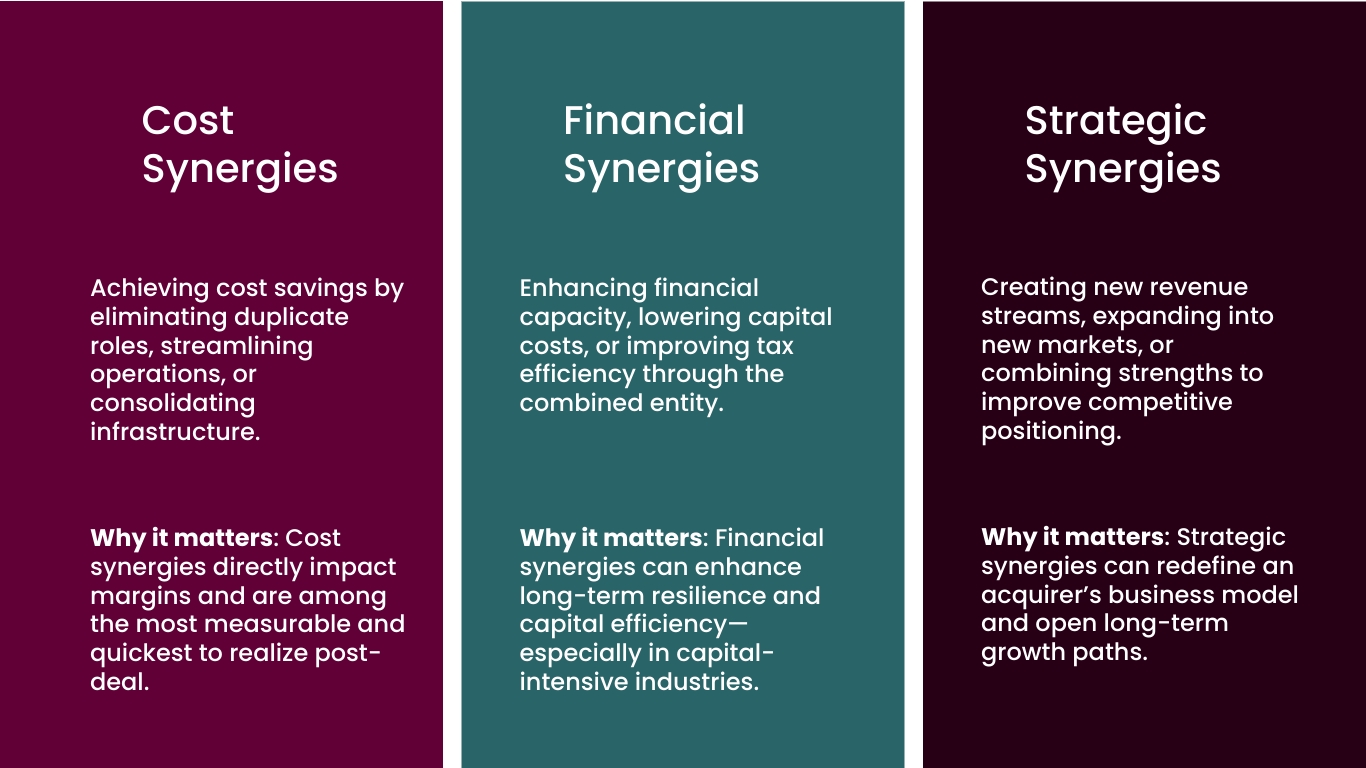

- Synergies: The most frequently cited reason for M&A, synergies capture the idea that the combined entity will be worth more than the sum of its parts. These are typically classified into three categories:

- Cost synergies: Achieved by eliminating duplicate functions, streamlining operations, or consolidating infrastructure. These directly improve profit margins and are often the quickest to realise after a deal.

- Financial synergies: Enhanced financial strength, such as lowering the cost of capital, increasing borrowing capacity, or achieving better tax efficiency. These synergies improve long-term resilience, especially in capital-intensive industries.

- Strategic synergies: Opportunities to generate new revenue streams, expand into new markets, or combine complementary strengths to improve competitive positioning. These are often the most transformative, shaping the long-term direction of the combined company.

M&A Course Module 1.4: Synergies in M&A - Growth: Acquiring another business can accelerate entry into new markets, product lines, or geographies, providing a faster route than organic expansion. For example, a consumer goods company may acquire a regional brand to gain immediate distribution and brand recognition.

- Strategic repositioning: M&A can reshape a company’s future by adding new capabilities, technologies, or intellectual property. This type of transaction often reflects a response to disruptive change or the need to realign with market trends, such as acquiring AI expertise in the tech sector.

- Financial motives: Some deals are pursued because of favourable financial conditions—such as undervalued targets, low interest rates, or tax advantages. In these cases, acquirers see an opportunity to unlock value through timing and capital structure benefits.

Valuation in M&A

Valuing companies in M&A transactions is one of the most challenging aspects of corporate finance. It goes beyond financial modelling and requires understanding both the fundamentals of the target’s performance and the strategic rationale for the deal. Analysts and executives rely on several core methods, each offering a different perspective on value:

- Discounted Cash Flow (DCF): Projects a company’s future free cash flows and discounts them back at the appropriate WACC. This method captures the intrinsic value of a business based on its ability to generate cash over time.

- Comparable company analysis: Benchmarks the target against similar publicly traded companies, using multiples such as EV/EBITDA or P/E. It provides a “market view” of value, rooted in how investors currently price comparable businesses.

- Precedent transactions: Examines valuations paid in recent M&A deals for comparable targets. This approach reflects real-world deal dynamics, including control premiums and sector-specific trends.

- Premium analysis: Focuses on the additional price buyers are typically willing to pay above market value to secure control, access synergies, or block competitors. Premiums vary across industries and deal contexts, making them a critical factor in negotiations.

Learn how to apply these valuation methods step by step, and develop the practical tools to navigate real M&A transactions, in our Executive Certificate in Corporate Finance, Valuation & Governance.

Limits and Risks of M&A

Despite their promise, M&A deals often fail to deliver anticipated benefits. Integration challenges, cultural clashes, overestimation of synergies, or excessive debt can undermine success. For this reason, valuation discipline, clear strategy, and post-merger integration planning are essential to maximise the chances of success.

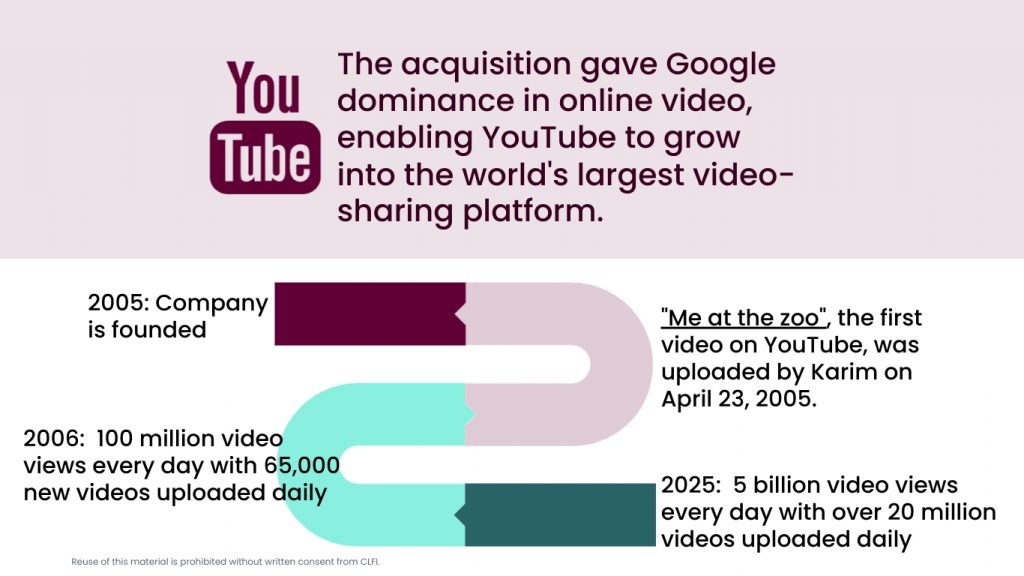

Google’s Acquisition of YouTube

In October 2006, Google announced it would acquire YouTube for $1.65 billion in an all-stock deal. At the time, YouTube was just 18 months old but already served 100 million video views per day with 65,000 daily uploads. Google recognised YouTube’s potential to dominate online video and integrated it as a subsidiary while preserving its brand identity. The deal became one of the most successful technology acquisitions in history.

In 2024 alone, YouTube generated $36.1 billion in advertising revenue. To put this in perspective, the platform now generates the equivalent of its original $1.65 billion purchase price every two weeks. For early investors and founders, the acquisition delivered extraordinary returns, demonstrating how strategic acquisitions can transform industries.