Full Online

Business Valuation & Governance – Anytime, Anywhere.

Programme Overview

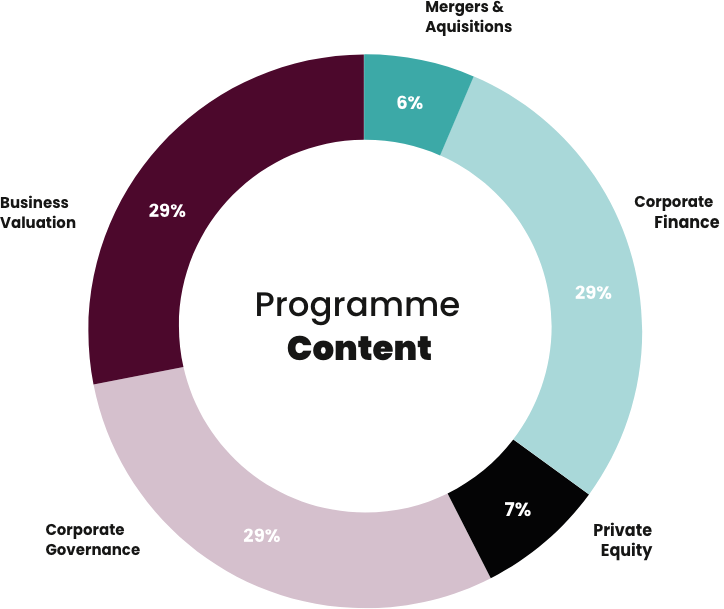

A fully online, self-paced programme bringing London’s executive finance experience directly to you—delivered by expert lecturers from the heart of the City. Designed specifically for finance professionals, corporate executives, and business leaders seeking advanced knowledge in Corporate Finance, Corporate Governance, and Business Valuation, the programme also includes exclusive access to specialised modules in Private Equity and M&A.

100%

Online

Access for 4 Months – Learn at your own pace

Real-World

Case Studies

Gain the tools to evaluate business valuations and assess investment opportunities with precision.

Exclusive Insights into Private Equity & M&A

Enhance your ability to drive operational efficiency and ensure long-term business success.

Executive

Certification

Earn your Executive Certificate in Finance, Governance & Valuation, and CPD accreditation.

Courses

Corporate Governance

Corporate Finance

Business Valuation

This course explores corporate governance principles and frameworks, including the UK Corporate Governance Code and the US Sarbanes-Oxley Act.

With directors playing a key role in company oversight, ensuring decisions serve the best interests of shareholders and other stakeholders, participants will examine board structure and directors' responsibilities, including the separation of CEO and Chairman roles.

They will also explore the role of key committees, board induction, and performance assessment, while addressing challenges such as the agency problem and its resolution.

Gain the strategic financial insight needed to navigate key corporate decisions, from capital allocation to long-term planning.

This course covers the three fundamental financial decisions—investment, financing, and dividend policy—expanding into risk and return analysis, including diversification, historical market returns, and the risk premium. It also examines free cash flow forecasting, capital structure optimisation and its cost (WACC), working capital management, and risk mitigation strategies.

Through real-world case studies and practical applications, participants will develop the skills to support strategic investment decisions, using NPV analysis to assess whether a project creates value for the company and its shareholders.

Mastering business valuation is essential for professionals involved in investment decisions, mergers and acquisitions, and project finance. This course provides participants with the framework to assess a company’s or project’s value with confidence.

The course explores core valuation methodologies, including discounted cash flow (DCF) analysis, relative valuation using market multiples, and precedent transaction analysis. Emphasis is placed on net present value (NPV), alongside alternative techniques such as internal rate of return (IRR) and the payback period. It also covers key components that influence valuation outcomes, including working capital and terminal value assumptions.

Courses

Corporate Governance

Empowering ambitious executives with the tools to lead with integrity and accountability, this course delves into the principles and evolution of corporate governance. Participants will gain a comprehensive understanding of key frameworks, structures, and practices that drive transparency and ensure effective oversight.

The program explores directors’ roles and responsibilities, including remuneration strategies, induction processes, and performance evaluation, while addressing critical challenges such as the agency problem and its resolution.

Business leaders will gain insights into major governance models, including the UK Corporate Governance Code, the US Sarbanes-Oxley Act, and frameworks from Australasia, BRICS, and the EU.

With practical tools, case studies, and expert insights, participants will refine their ability to enhance board effectiveness. Engaging discussions and real-world applications ensure executives leave equipped to foster governance excellence in today’s complex and dynamic business landscape.

Corporate Finance

Empowering ambitious executives with the tools to lead with integrity and accountability, this course delves into the principles and evolution of corporate governance. Participants will gain a comprehensive understanding of key frameworks, structures, and practices that drive transparency and ensure effective oversight.

The program explores directors’ roles and responsibilities, including remuneration strategies, induction processes, and performance evaluation, while addressing critical challenges such as the agency problem and its resolution.

Business leaders will gain insights into major governance models, including the UK Corporate Governance Code, the US Sarbanes-Oxley Act, and frameworks from Australasia, BRICS, and the EU.

With practical tools, case studies, and expert insights, participants will refine their ability to enhance board effectiveness. Engaging discussions and real-world applications ensure executives leave equipped to foster governance excellence in today’s complex and dynamic business landscape.

Business Valuation

Empowering ambitious executives with the tools to lead with integrity and accountability, this course delves into the principles and evolution of corporate governance. Participants will gain a comprehensive understanding of key frameworks, structures, and practices that drive transparency and ensure effective oversight.

The program explores directors’ roles and responsibilities, including remuneration strategies, induction processes, and performance evaluation, while addressing critical challenges such as the agency problem and its resolution.

Business leaders will gain insights into major governance models, including the UK Corporate Governance Code, the US Sarbanes-Oxley Act, and frameworks from Australasia, BRICS, and the EU.

With practical tools, case studies, and expert insights, participants will refine their ability to enhance board effectiveness. Engaging discussions and real-world applications ensure executives leave equipped to foster governance excellence in today’s complex and dynamic business landscape.

Exclusive Private Equity & M&A Extension

Elevate your expertise in Private Equity and M&A through high-impact insights that seamlessly blend advanced corporate finance principles with real-world investment practices

Private Equity Fund Structures

Understand the typical lifecycle and frameworks that underpin private equity funds.

Operations of PE Firms

Explore how these firms source deals, manage portfolios, and create value for investors.

Investment Decision-Making

Discover how crucial decisions are shaped to drive business growth and strategic acquisitions.

M&A Strategies & Synergies

Gain insight into the buyer and seller rationale behind mergers and acquisitions, and learn how synergies unlock new opportunities.

Key Detailes

Executive Programmes for Ambitious Professionals

High-quality and impactful learning experiences to advance careers and meet executive demand

3 Days Equivalent (Online): Self-paced modules providing a structured, rigorous learning experience.

Focused Curriculum

Applied and practical content to enhance participants profiles, meeting the strategic needs of global executive roles.

Accessible

Real value for money for corporates and employees.

Expert Lecturers

Courses delivered by seasoned professionals and academics with deep experience across corporate finance, investment practice, and executive education.

Is this the right programme for you?

- You are a business owner, entrepreneur, or senior professional seeking to strengthen your financial decision-making.

- You want to contribute more effectively to board-level decisions around valuation, governance, and stakeholder value creation.

- You want to get involved in fundraising, acquisitions, or strategic investments and want practical tools to navigate them.

- You value learning from both academic experts and experienced practitioners with real-world insight.

- You’re looking for flexible, high-impact training that fits your schedule and delivers immediate value.

A programme designed to balance the critical expertise required for strategic growth and leadership progression.

Master the strategic expertise that shapes boardroom decisions — bring insight to the table with governance frameworks, corporate finance principles, and M&A strategies.

Real World

Case Studies

Tools to become a real practitioner

Access professionally designed financial models used by leading finance practitioners.

Lectures

Experts in the field.

Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do.

Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do.

Title

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do.

Programme Impact

The programme offers a dynamic and immersive learning experience, blending interactive sessions, in-person engagements in London, hands-on exercises, practical examples, case studies, and reflective activities to ensure active participation and impactful outcomes.

What you will learn

You’ll build strategic decision-making skills, master advanced valuation methods to evaluate companies and investments, and strengthen your capabilities in governance, capital structure, and risk management—all grounded in real-world case studies. Gain exclusive insights into Private Equity and M&A to broaden your perspective on the industry.

How you will learn

Self-Paced: Core modules in corporate finance, valuation, and governance—designed for flexible, independent learning.

Exclusive Modules: Gain additional insights into Private Equity and M&A, delivered through real-world case studies and practitioner-led content.

What is the application process

You can apply directly through our online form, by downloading the brochure, or by contacting us via email. After submitting your interest, you’ll receive a short questionnaire to help us understand your goals. Once reviewed and accepted, eligible candidates will be invited to complete payment and will receive onboarding details to access our online learning platform.

Duration and Location

The programme includes the equivalent of 16 hours content, delivered entirely online through flexible, self-paced modules. You can complete the course at your own pace, from anywhere in the world.

What are the entry requirements

Applicants should have a university-level qualification or recent experience in a financial or operational role. Proficiency in English is essential. A stable internet connection and access to a computer or laptop are required to complete the online learning modules effectively.

Get your certificate

Contact us for a quote

What’s included

– Course materials

– Financial models

– 4 months access

What’s not included

– In-presence masterclass

Programme

| Format | Full Online |

|---|---|

| Location | City of London |

| Duration | 3 days equivalent |

| Schedule | Open 24/7 |

| Period | 2025/2026 |

Contact Us

We’re here to help you take the next step in your executive education journey. Whether you have questions about our programmes, need guidance on enrolment, or want to explore customised training options, our team is ready to assist.

Email: online@clfi.co.uk

Location: 36-38 Cornhill

City of London, London EC3V 3NG

We look forward to welcoming you to one of our programmes and helping you achieve your professional goals.

Alternatively, fill out our contact form on this page, and we’ll get back to you promptly.