Table of Contents

What Is Goodwill in Accounting and M&A?

- CLFI Team

- 4 min read

Goodwill is a central concept in accounting and in mergers and acquisitions. It arises when a buyer pays more than the fair value of the identifiable net assets of a business. This difference reflects the advantages the buyer expects to gain, such as brand strength, customer relationships, talent, or proprietary technology. As a result, goodwill represents the portion of value that does not sit in physical or easily measurable assets and that often supports long-term performance.

What Goodwill Represents

When one company acquires another, the buyer identifies and measures all assets and liabilities at fair value. These include tangible assets such as equipment and intangible assets such as patents. If the purchase price is higher than the value of these net assets, the difference becomes goodwill. This amount reflects the benefits the buyer expects to receive in the future. These benefits may arise from synergies, loyal customers, market share, brand reputation, or strong management teams.

Definition

Goodwill

Goodwill is the premium a buyer pays above the fair value of a company’s identifiable net assets in an acquisition. It reflects advantages such as brand strength, customer loyalty, talent, or synergies the buyer expects to gain.

How Goodwill Appears in Accounting

Goodwill is recorded as an intangible asset on the balance sheet. It does not depreciate or amortise under modern accounting rules. Instead, companies review goodwill each year through an impairment test. If the acquired business underperforms, the goodwill value may fall and the company recognises an impairment loss in the income statement.

Goodwill arises only through acquisitions. Internal activities, such as developing a brand or improving customer loyalty, do not create goodwill on the balance sheet. This rule exists because internally generated goodwill cannot be measured reliably.

Why Goodwill Matters in M&A

In M&A deals, goodwill signals the value a buyer sees beyond the assets recorded on paper. A high level of goodwill may indicate strong expectations for future performance. It may also show the potential for cost savings, revenue synergies, or strategic advantages. Because of this, goodwill often becomes a key point in purchase price discussions.

Difference Between Goodwill and Other Assets

| Aspect | Goodwill | Other Assets |

|---|---|---|

| Nature | Intangible asset created only through acquisitions. | Includes tangible and intangible assets identifiable separately. |

| Measurement | Purchase price minus identifiable net assets. | Measured individually at fair value. |

| Expense treatment | Not amortised; tested annually for impairment. | Depreciated or amortised over useful life. |

| Relation to synergies | Captures synergies and future expectations. | Does not reflect synergy value. |

Example: Calculating Goodwill in an Acquisition

To understand goodwill clearly, let us walk through a simple acquisition example. First, the buyer pays a price for the target company. Then we compare that price to the fair value of the target’s identifiable net assets. The difference between the two becomes goodwill.

Goodwill Calculation — Step-by-Step

How purchase price and net assets create goodwill in an acquisition.

A buyer acquires a company for £12 million. The fair value of the identifiable assets is £10 million. The fair value of the liabilities is £4 million.

Compare purchase price to net assets

Interpret the goodwill amount

Interpretation. The goodwill created in this example highlights that buyers often pay for value that does not appear on the balance sheet. This premium reflects expectations of future earnings, stronger competitive positioning, or operational improvements. As a result, goodwill becomes a practical link between how an acquisition is valued and how the combined business is expected to perform over time.

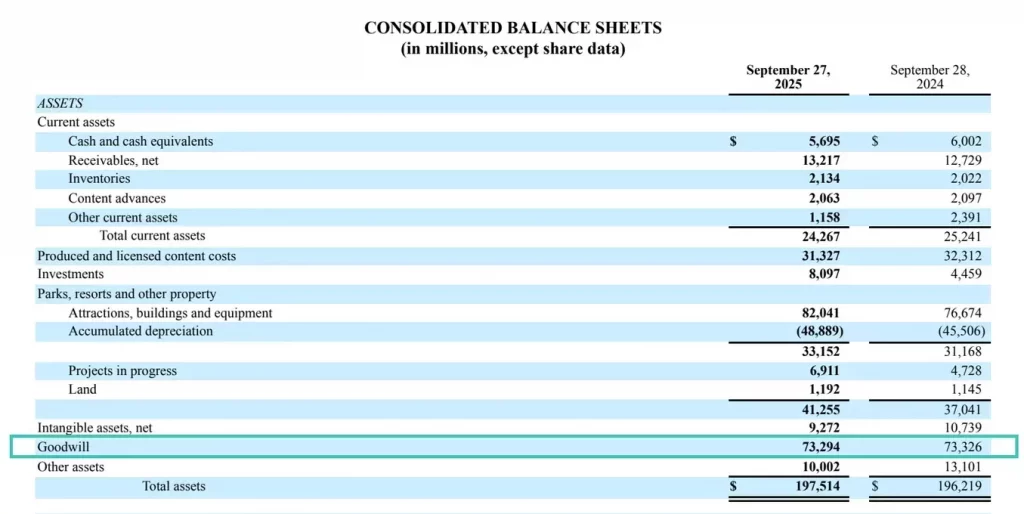

Example in Practice: Disney’s Goodwill from the Fubo Acquisition

When Disney acquired Fubo, it estimated the fair value of Fubo at $1.3 billion, based on the closing share price of $3.69 on 29 October 2025. This value will be allocated to the tangible assets, identifiable intangible assets, and assumed liabilities, all measured at fair value. The remaining amount — the excess over these identifiable net assets — is recorded as goodwill.

An important point is that goodwill only arises through M&A activity. A company cannot choose to record goodwill or brand value internally. Instead, goodwill acts as the “bridge” between the price paid for a business — usually based on earnings multiples or discounted cash flows — and the fair value of the assets and liabilities acquired. In most transactions, the price paid exceeds the value of net assets, which is why goodwill becomes the natural plug that captures expected future performance and synergies.

Disney’s acquisition strategy has focused on securing high-value content and intellectual property to strengthen its creative portfolio and broaden its global reach. This includes transactions such as Pixar, Marvel, and Lucasfilm, which brought world-leading franchises into the group. As reflected in recent filings, these activities have contributed to a goodwill balance of approximately $73 billion.

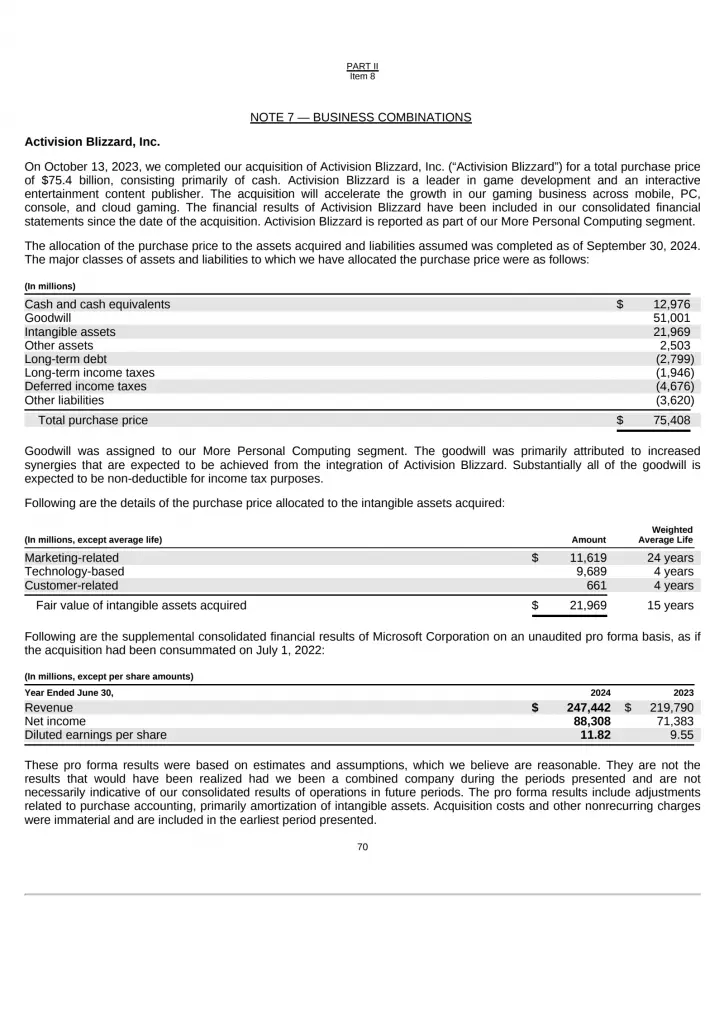

Example in Practice: Microsoft’s Goodwill from the Activision Blizzard Acquisition

Microsoft completed its acquisition of Activision Blizzard on 13 October 2023 for a purchase price of $75.4 billion, primarily paid in cash. In its FY2025 Annual Report, Microsoft disclosed the final purchase price allocation. The transaction generated $51.0 billion of goodwill, assigned to the More Personal Computing segment. This goodwill reflects the expected benefits of integrating Activision Blizzard’s gaming capabilities, user base, and technology. Nearly all of this goodwill is non-deductible for tax purposes.

The identifiable intangible assets acquired were valued at $21.97 billion with an average useful life of approximately fifteen years. These assets included marketing-related intangibles of $11.62 billion, technology-based intangibles of $9.69 billion, and customer-related intangibles of $0.66 billion. Other acquired assets totalled $2.50 billion, while Microsoft assumed around $13 billion in debt and tax liabilities. The final allocation reconciled to a total purchase consideration of $75.41 billion.

Microsoft has consolidated Activision Blizzard’s results since the acquisition date. The deal significantly expanded the Gaming division within the More Personal Computing segment and contributed almost $22 billion in new intangible assets. Goodwill increased from $67.9 billion to more than $119 billion following the transaction. Microsoft reported no goodwill or intangible asset impairments in FY2024 or FY2025, indicating that performance expectations remain aligned with the valuation assumptions used during the acquisition.

In Practice

In practice, goodwill helps explain why an acquisition price can exceed the fair value of a target’s identifiable assets. Buyers usually pay this premium because they expect benefits that extend beyond the figures shown in financial statements. These benefits may include operational efficiencies, cross-selling opportunities, expansion into new markets, or access to specialised talent and intellectual property.

Goodwill also shapes key performance measures. A high goodwill balance increases total assets and influences ratios such as return on assets (ROA). When goodwill becomes impaired, the resulting loss reduces reported profit immediately. Because of this direct impact on performance, goodwill reviews are closely linked to strategy, forecasting, and the ongoing evaluation of acquisition success.

Within the broader Accounting Series, goodwill connects asset valuation with M&A activity, risk assessment, and long-term value creation. It forms the basis for understanding impairment testing, purchase price allocation (PPA), and valuation multiples. These concepts become increasingly important as readers move into advanced areas such as enterprise valuation and deal structuring.

Definition

Balance Sheet

A financial statement showing what a business owns and owes at a specific point in time, summarising assets, liabilities, and equity. For a step-by-step guide to interpreting it, read How to Read a Balance Sheet – Finance for Non-Finance Managers .

Programme Content Overview

The Executive Certificate in Corporate Finance, Valuation & Governance delivers a full business-school-standard curriculum through flexible, self-paced modules. It covers five integrated courses — Corporate Finance, Business Valuation, Corporate Governance, Private Equity, and Mergers & Acquisitions — each contributing a defined share of the overall learning experience, combining academic depth with practical application.

Chart: Percentage weighting of each core course within the CLFI Executive Certificate curriculum.

Grow expertise. Lead strategy.

Build a better future with the Executive Certificate in Corporate Finance, Valuation & Governance.

Accounting Series

Bridging business decisions and accounting fundamentals