Table of Contents

Capital Expenditure (CAPEX) Explained: Meaning, Examples, and Modern Use

- 5 min read

- Authored & Reviewed by: CLFI Team

Understanding capital expenditure is essential for interpreting how organisations invest for growth, efficiency, and long-term competitiveness. In finance, CAPEX refers to spending on assets that deliver benefits over multiple periods, shaping both a firm’s balance sheet and its future operating capacity. This makes CAPEX decisions central to strategy, valuation, and governance.

As business models evolve, the nature of capital expenditure has expanded beyond factories and machinery to include software platforms, cloud infrastructure, and artificial intelligence capabilities.

Table of Contents

What Is CAPEX in Finance

Definition:

Capital Expenditure (CAPEX)

Spending on assets that are expected to generate economic benefits over more than one accounting period.

When asking what is CAPEX in finance, the defining feature is duration. Capital expenditure creates or enhances assets that support operations over time, rather than being consumed immediately. These assets appear on the balance sheet and are expensed gradually through depreciation or amortisation.

CAPEX decisions typically involve large cash outlays and long-term commitment, which is why they attract board-level scrutiny. While capital investment can drive growth and competitive advantage, it also increases fixed costs and execution risk if demand or technology shifts.

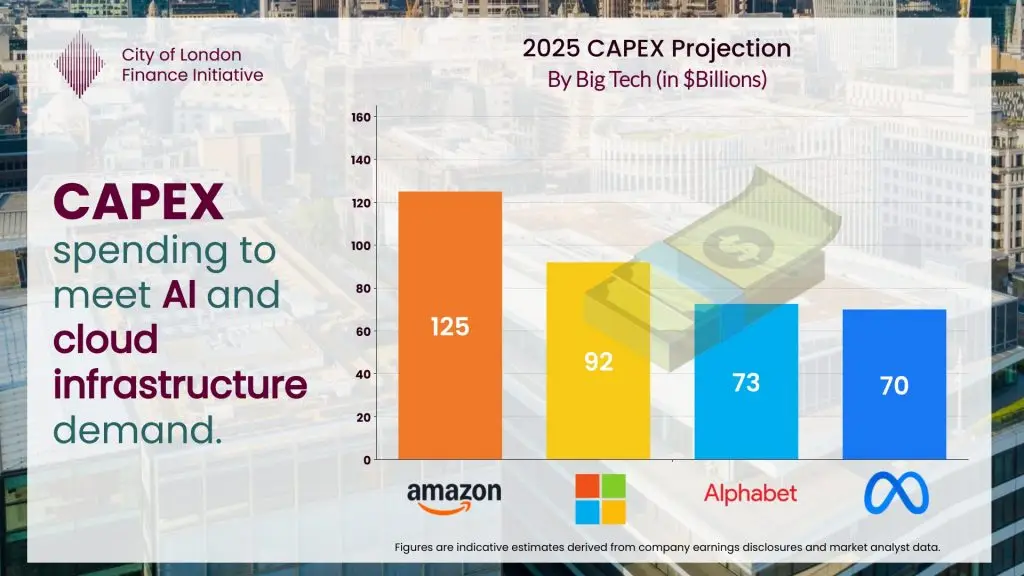

This pattern is evident in recent AI-related infrastructure investment across the value chain, from semiconductor manufacturers such as NVIDIA and AMD to model developers such as OpenAI. Across these actors, multi-billion-dollar commitments are being directed toward data centres, specialised computing hardware, and dedicated energy capacity, reflecting long-term investment in productive infrastructure rather than short-term operating spend. As AI workloads scale, planned expenditure to meet projected computing and energy requirements over the coming years is increasingly classified as capital investment. In accounting terms, these outlays are therefore recognised as capital expenditure and recorded as CAPEX on the balance sheet, rather than treated as recurring operating costs.

See the CLFI analysis on the AI economy and energy demand.

Definition:

Capex financing methods

The ways a company funds large, long-term investment in productive assets such as data centres, equipment, and long-duration technology infrastructure. Common methods include operating cash flow, new borrowing (bonds and bank loans), lease structures (including long-term data-centre leases), and equity issuance. The choice affects leverage, interest burden, credit ratings, and the resilience of free cash flow during build-out periods.

Oracle 2025 AI infrastructure expansion illustrates how large-scale capital expenditure is financed and justified in practice. Citing exceptionally strong demand from AI model developers, including OpenAI, Oracle raised its capital expenditure forecast by more than 40 per cent to approximately $50bn for its next financial year, with quarterly spending reaching $12bn, well above market expectations. To fund this build-out, largely focused on data centres and specialised compute capacity, the company relied heavily on external financing, increasing long-term debt and lease obligations to over $116bn, up more than 40 per cent year on year, and issuing $18bn in bonds with plans for further debt financing. Management’s rationale was that this upfront investment in capacity will convert into long-term infrastructure revenues, with Oracle indicating that AI-related contracts could generate up to $300bn in revenue between 2027 and 2032. Although, credit agencies and equity analysts raised concerns that the scale and pace of investment may reflect elevated market expectations, with returns dependent on sustained AI demand and customers’ ability to honour long-term commitments.

OPEX vs CAPEX Meaning

A common question in finance is what is OPEX and CAPEX, and how they differ. Operating expenditure relates to costs incurred in the normal course of business that are consumed within the period, such as rent, utilities, and routine maintenance. These costs are expensed immediately through the income statement.

By contrast, capital expenditure is capitalised and spread over time, reflecting the longer economic life of the asset. The distinction between OPEX or CAPEX affects reported profits, cash flow timing, tax treatment, and performance metrics, which explains why classification decisions matter to management and investors.

While the conceptual difference is clear, practical classification can be complex. Judgement is often required to determine whether spending enhances an asset’s future economic benefits or simply maintains existing capacity, a distinction that carries both financial and governance implications.

Definition:

Operating Expenditure (OPEX)

Operating expenditure refers to the recurring costs incurred in the normal course of business that are consumed within the accounting period and do not create long-term assets, such as rent, utilities, staff costs, and routine maintenance required to sustain ongoing operations.

Traditional CAPEX Examples

In traditional industries, capital expenditure typically includes investments in property, plant, and equipment. Examples include building a new manufacturing facility, purchasing heavy machinery, upgrading production lines, or acquiring long-lived transport assets. These investments expand or improve productive capacity over many years.

Textbook finance treats such expenditures as classic CAPEX because their benefits extend well beyond the current period and can be measured with reasonable certainty. However, even in these cases, long asset lives expose firms to technological obsolescence and demand risk, reinforcing the need for disciplined appraisal.

The Accounting Treatment of CAPEX

From an accounting perspective, capital expenditure is not recognised as an immediate expense. Instead, CAPEX is recorded as an asset on the balance sheet, reflecting the fact that the expenditure is expected to generate economic benefits over multiple accounting periods. This treatment distinguishes CAPEX from operating expenditure, which is expensed directly through the income statement.

Once recognised as an asset, the cost of capital expenditure is allocated systematically over its useful life. Tangible assets such as machinery, buildings, or data centre infrastructure are expensed through depreciation, while intangible assets such as capitalised software development costs are expensed through amortisation. This process matches the cost of the asset to the periods in which it contributes to revenue generation.

The choice of depreciation or amortisation method, as well as the estimated useful life of the asset, has a direct impact on reported profitability and key performance metrics. While these accounting charges do not affect cash flow, they influence earnings, asset values, and return measures, making them an important consideration for investors, lenders, and boards.

Is Software CAPEX or OPEX

A frequent modern question is whether software is CAPEX or OPEX. The answer depends on the nature of the expenditure. Internally developed software that creates identifiable future economic benefits may qualify as capital expenditure and be amortised over its useful life.

By contrast, subscription-based software, cloud services, and routine updates are generally treated as operating expenditure, as they do not create a separately identifiable asset controlled by the firm. This distinction has become increasingly important as businesses shift toward software-driven operating models.

CAPEX in AI and Modern Technology

In the AI and technology sectors, capital expenditure increasingly includes data centres, specialised chips, networking infrastructure, and internally developed platforms that support machine learning at scale. These investments resemble traditional CAPEX in economic substance, even if they differ in physical form.

Programme Content Overview

The Executive Certificate in Corporate Finance, Valuation & Governance delivers a full business-school-standard curriculum through flexible, self-paced modules. It covers five integrated courses — Corporate Finance, Business Valuation, Corporate Governance, Private Equity, and Mergers & Acquisitions — each contributing a defined share of the overall learning experience, combining academic depth with practical application.

Chart: Percentage weighting of each core course within the CLFI Executive Certificate curriculum.

Grow expertise. Lead strategy.

Build a better future with the Executive Certificate in Corporate Finance, Valuation & Governance.

CAPEX in Corporate Finance Practice

In corporate finance practice, capital expenditure decisions shape long-term cost structures and strategic flexibility. While CAPEX can enable scale, efficiency, and technological leadership, it also commits capital that may be difficult to redeploy if conditions change.

Executives and boards evaluate CAPEX proposals using investment appraisal techniques such as Net Present Value and scenario analysis, while also considering balance sheet capacity and operational risk. The growing overlap between physical assets, software, and AI infrastructure has made these judgements more complex, increasing the importance of clear financial classification and governance oversight.