Table of Contents

What is Private Equity: The Role of General Partners (GPs) and Limited Partners (LPs) Explained

- CLFI Team

- 5 min read

In private equity, General Partners (GPs) play a central role as the active fund managers responsible for sourcing deals, managing investments, and driving value creation. We will introduce and define the roles, responsibilities, and dynamics of GPs and LPs, providing insights into how they collaborate to achieve investment objectives and how their alignment shapes fund success.

The roles of General Partners and Limited Partners, and the way their responsibilities and incentives are structured within private equity funds, are examined in the Private Equity Course Modules.

Table of Contents

- Definition of GPs and LPs in Private Equity

- Roles and Responsibilities

- Incentive Alignment

- Investment Structure

- Fundraising and Capital Commitments

- Advisory Boards and Fund Governance

Definition of GPs and LPs in Private Equity

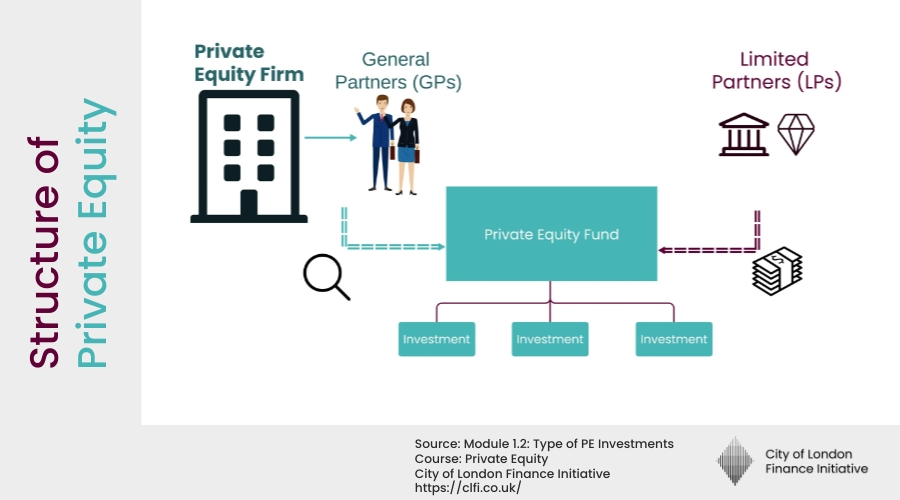

General Partners (GPs) are the entities or individuals responsible for managing a private equity fund. In practice, a GP in private equity typically refers to the fund management team or firm that takes responsibility for the fund’s investment strategy, execution, and reporting. They make investment decisions, oversee the fund’s portfolio, and are accountable for its performance.

Limited Partners (LPs), by contrast, are the investors who provide the capital but have limited day-to-day involvement. LPs typically include institutional investors such as pension funds, endowments, sovereign wealth funds, and family offices. An LP in private equity (a private equity limited partner) commits capital to the fund, evaluates the GP’s strategy and track record, and monitors performance via reporting and governance forums.This GP-LP structure is fundamental to private equity. It allows GPs to leverage their expertise in investment management and strategic control, while LPs gain exposure to potentially high-return investments without the operational burden. For a broader overview of private equity’s structure and function, see What Is Private Equity?.

Roles and Responsibilities of GPs and LPs in Private Equity

The responsibilities of GPs and LPs are distinct but closely interconnected:

- General Partners (GPs): GPs source, evaluate, and execute investments. They conduct due diligence, structure deals, and manage portfolio companies post-acquisition. GPs also lead fundraising, reporting, and compliance. The GP’s role in private equity is both operational and strategic—acting as the fund’s decision-maker and steward of investor capital.

- Limited Partners (LPs): LPs contribute the majority of capital and may sit on advisory committees, but they do not manage the fund. They receive periodic performance updates and review decisions affecting the partnership. Major LPs like California Public Employees’ Retirement System (CalPERS) or Ontario Teachers’ Pension Plan often invest across multiple funds, giving them market influence. Typical responsibilities for LPs in private equity include portfolio monitoring, meeting capital calls, voting on certain partnership matters, and participating in LPACs where appointed.

The partnership agreement formalises this division of responsibilities, detailing rights, reporting requirements, and profit distribution terms. For an understanding of how fees and incentives factor into this relationship, see How Are Private Equity Fees Structured?.

Grow expertise. Lead strategy.

Build a better future with the Executive Certificate in Corporate Finance, Valuation & Governance.

Incentive Alignment Between GPs and LPs in Private Equity

A core feature of GP-LP relationships in private equity is the alignment of interests through co-investment and performance-based incentives. GPs are typically required to co-invest their own capital into the fund — a concept often referred to as having “skin in the game.” This ensures that GPs are exposed to both the upside and downside of fund performance.

In addition to this, GPs receive carried interest — usually around 20% of the fund’s profits — only after a certain minimum return (the hurdle rate) is achieved for LPs. This profit-sharing model incentivises GPs to pursue strong risk-adjusted performance while maintaining alignment with the capital providers’ objectives.

Private Equity Fund Structure: The GP–LP Model

Private equity funds are typically structured as limited partnerships. In this model, GPs serve as the managing partners while LPs act as passive contributors. The fund is governed by a Limited Partnership Agreement (LPA), which outlines capital commitments, management fees, the fund’s life cycle (usually 10 years), and distribution rules.

This structure provides legal protections for LPs, while granting operational flexibility to GPs. It also allows the fund to operate with a long-term, closed-end model suited to illiquid investments. This format is one of the key reasons private equity has remained attractive to institutional investors seeking diversification and return potential. For a private equity limited partner, the LPA codifies rights on reporting, conflicts, and distributions, helping standardise governance across vintages.

Fundraising and Capital Commitments

Fundraising is a critical phase where GPs pitch the fund’s investment strategy, track record, and team credentials to prospective LPs. During fundraising, the GP in private equity markets the fund’s strategy to institutional investors, presenting track record, investment focus, and governance standards. Once LPs commit capital, they do not transfer the full amount upfront. Instead, they agree to contribute funds incrementally through capital calls as the GP identifies and closes investments.

LPs must manage their liquidity to ensure they can meet capital calls, which may occur over several years. This process helps GPs avoid cash drag and optimise capital efficiency. The pace and size of these calls also reflect market dynamics and investment pipeline health.

Advisory Boards and Fund Governance

Many private equity funds establish Limited Partner Advisory Committees (LPACs), composed of representatives from major LPs. These committees review conflict-of-interest disclosures, approve extensions to investment periods, and act as a sounding board for strategic matters. While LPACs do not have binding authority on most decisions, they serve as a key governance safeguard.

Strong GP–LP governance is a hallmark of institutional-grade funds. LPACs enhance transparency, manage reputational risk, and foster trust between parties — a defining feature of a well-managed GP–LP relationship in private equity.

Further Reading

Common Questions About GPs and LPs in Private Equity

1. What is a GP in private equity?

A General Partner (GP) is the fund manager who sources deals, carries out due diligence, executes investments, and oversees the fund’s portfolio. The GP runs the fund’s day-to-day operations and investment strategy, usually investing some of its own money and earning a share of profits (carried interest) when the fund performs well.

2. What is an LP in private equity?

A Limited Partner (LP) is an investor who commits capital to a private equity fund but doesn’t manage it directly. LPs can be pension funds, endowments, sovereign wealth funds, or family offices. They provide funding, review reports, and join advisory committees but leave investment decisions to the GP.

3. What does a private equity limited partner do?

LPs assess and invest in private equity funds managed by GPs. They make capital contributions when called, monitor fund performance, and review key governance matters. Many LPs reinvest in future funds if returns meet expectations.

4. How do GPs and LPs work together?

Their relationship is governed by the Limited Partnership Agreement (LPA). The GP manages the fund, and the LPs provide capital and oversight. Alignment of interests comes through co-investment, transparent reporting, and performance-based profit sharing.

5. What is an LPAC and why is it important?

The Limited Partner Advisory Committee (LPAC) is a small group of major LPs that reviews conflicts of interest, approves key changes such as fund extensions, and offers guidance. While it doesn’t make investment decisions, it strengthens trust and governance between GPs and LPs.