Table of Contents

Current Ratio and Quick Ratio Explained: Liquidity Analysis in Practice

- 5 min read

- Authored & Reviewed by: CLFI Team

Liquidity is a central concern in corporate finance because it determines a company’s ability to meet its short-term obligations as they fall due. Even profitable businesses can face financial distress if they are unable to convert assets into cash quickly enough to cover near-term liabilities. For boards, lenders, and investors, liquidity analysis provides an essential perspective on short-term financial resilience.

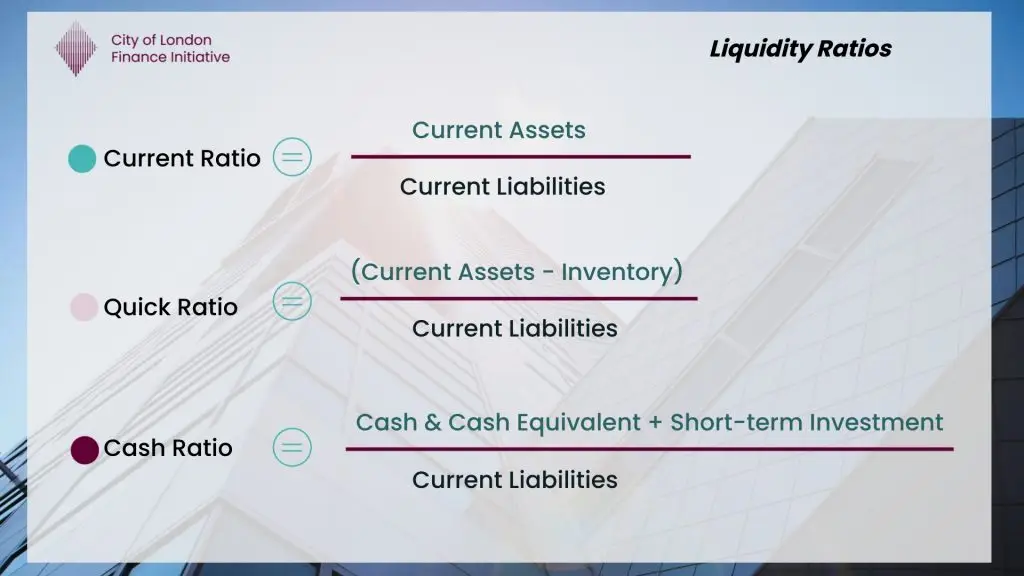

Liquidity ratios focus on solvency over the next operating cycle, rather than on long-term value creation. They complement profitability and cash flow analysis by highlighting whether a firm’s balance sheet structure can support ongoing operations, credit commitments, and unexpected shocks. Two of the most widely used measures are the Current Ratio and the Quick Ratio.

The Current Ratio

Definition:

Current Ratio

A liquidity ratio that measures a company’s ability to meet short-term liabilities using its current assets.

The current ratio compares current assets to current liabilities. Current assets typically include cash, receivables, inventory, and other assets expected to be realised within one year. Current liabilities represent obligations due within the same period, such as trade payables, short-term debt, and accrued expenses.

The formula is expressed simply as current assets divided by current liabilities. A ratio above 1 indicates that the company has more short-term assets than short-term obligations, suggesting a buffer against liquidity pressure. However, an excessively high ratio may also indicate inefficient use of capital, with cash or working capital tied up unnecessarily.

Current Ratio: Practical Example

Assessing a company's ability to meet short-term obligations using current assets and liabilities.

Consider a company with current assets of £500,000 and current liabilities of £250,000. The current ratio measures the firm's ability to cover short-term obligations with short-term resources.

Current Ratio: 2.0

This suggests that the firm has two pounds of short-term assets for every pound of short-term obligations. At face value, this indicates a comfortable liquidity position.

However, the quality and composition of those assets still matter. If a significant portion of current assets is tied up in inventory or slow-paying receivables, the firm's practical liquidity may be weaker than the ratio initially suggests. This is why analysts often examine the current ratio alongside more conservative measures such as the quick ratio.

The Quick Ratio

Definition:

Quick Ratio

A liquidity ratio that measures a company’s ability to meet short-term liabilities using its most liquid assets, excluding inventory.

While the current ratio provides a broad view of liquidity, it does not distinguish between assets that can be converted to cash quickly and those that cannot. The quick ratio addresses this limitation by excluding inventory from current assets.

Inventory is deducted because it may not be readily liquid. The speed and certainty with which inventory can be sold vary significantly by sector. Retail businesses may convert inventory rapidly, while manufacturers or capital-intensive firms may face longer cycles and greater pricing risk.

Quick Ratio: Practical Example

Measuring immediate liquidity by excluding less liquid current assets such as inventory.

Using the same company example, assume that £200,000 of the £500,000 in current assets consists of inventory. The quick ratio provides a more conservative view of liquidity by removing inventory and other less liquid assets.

Quick Ratio: 1.2

This result presents a more conservative view of liquidity. While the company still appears capable of meeting short-term obligations, the margin of safety is smaller once less liquid assets are excluded.

The comparison highlights why both ratios are used together rather than in isolation. The current ratio (2.0) shows overall short-term asset coverage, while the quick ratio (1.2) reveals the strength of the most liquid resources. Together, they provide a balanced view of liquidity health.

Liquidity Ratios: Purpose and Limitations

| Ratio | Purpose | Key Limitation | Typical Users |

|---|---|---|---|

| Current Ratio | Broad short-term liquidity | Includes less liquid assets | Boards, analysts |

| Quick Ratio | Immediate liquidity strength | May understate liquidity in inventory-heavy sectors | Lenders, credit committees |

Limitations and Practical Use

Liquidity ratios are static snapshots based on balance sheet figures at a single point in time. They do not capture the timing of cash inflows and outflows within the operating cycle, nor do they reflect seasonal patterns or short-term financing arrangements. Differences in working capital structures across industries also limit direct comparability.

Stakeholders use the current ratio and quick ratio together to assess short-term financial resilience. They are commonly applied in credit analysis, covenant monitoring, and early warning assessments, where the objective is not to predict profitability but to evaluate a firm’s capacity to withstand short-term stress without disrupting operations.

Programme Content Overview

The Executive Certificate in Corporate Finance, Valuation & Governance delivers a full business-school-standard curriculum through flexible, self-paced modules. It covers five integrated courses — Corporate Finance, Business Valuation, Corporate Governance, Private Equity, and Mergers & Acquisitions — each contributing a defined share of the overall learning experience, combining academic depth with practical application.

Chart: Percentage weighting of each core course within the CLFI Executive Certificate curriculum.

Grow expertise. Lead strategy.

Build a better future with the Executive Certificate in Corporate Finance, Valuation & Governance.

Current Ratio and Quick Ratio — Comparisons & Common Questions (FAQ)

Explore key comparisons such as current ratio vs quick ratio, what liquidity strength means in practice, and how inventory, receivables, and timing affect interpretation.

Current ratio vs quick ratio — what is the real difference?

The current ratio compares all current assets to current liabilities, treating cash, receivables, and inventory as available to meet short-term obligations. The quick ratio is more conservative because it excludes inventory, focusing on assets that can typically be converted into cash with greater certainty within the operating cycle.

What is a “good” current ratio or quick ratio?

There is no universal benchmark. Liquidity needs vary by sector, operating model, and access to short-term financing. Ratios above 1.0 generally indicate coverage of near-term obligations, but interpretation depends on asset quality. A high current ratio can still coincide with liquidity pressure if working capital is tied up in slow-moving inventory or overdue receivables.

Why is inventory excluded in the quick ratio?

Inventory is excluded because it is often the least liquid current asset. Its conversion into cash can be uncertain and sensitive to pricing risk, obsolescence, or demand conditions. The quick ratio removes inventory to provide a clearer view of the firm’s immediate liquidity buffer, especially under short-term stress.

Can a company show strong ratios but still face liquidity stress?

Yes. Liquidity ratios are balance sheet snapshots taken at a single point in time. They do not capture the timing of cash inflows and outflows within the operating cycle. A firm with long customer payment terms or uneven cash collection may report healthy ratios while still experiencing short-term cash strain.

How do lenders and boards use liquidity ratios in practice?

Lenders and boards use the current ratio and quick ratio as screening and monitoring tools rather than decision rules. They are commonly reviewed in credit analysis, covenant discussions, and early-warning assessments, alongside cash flow forecasts, receivables ageing, and access to committed facilities.

How to interpret liquidity ratios when seasonality matters

- Across multiple reporting dates rather than a single year-end snapshot

- In conjunction with the composition of current assets

- Against the firm’s operating and cash conversion cycle

Join the Executive Certificate to deepen your understanding of working capital, liquidity risk, and balance sheet analysis in practice.