Table of Contents

Who’s Paying What? M&A Deal Multiples by Buyer Type and Sector

- 10 min read

- Authored & Reviewed by: Farhan Qamar

At a time when capital deployment is under increasing pressure — shaped by the decline in publicly available targets, Private Equity not able to make the exits and a growing pile of undeployed corporate cash — the price paid for control, and who is willing to pay it, has become a focal point for both sellers and acquirers. M&A participants across sectors are navigating a more selective environment, defined less by the availability of cheap financing — as in the post-Great Financial Crisis of 2008 and COVID years — and more by strategic clarity and capital discipline.

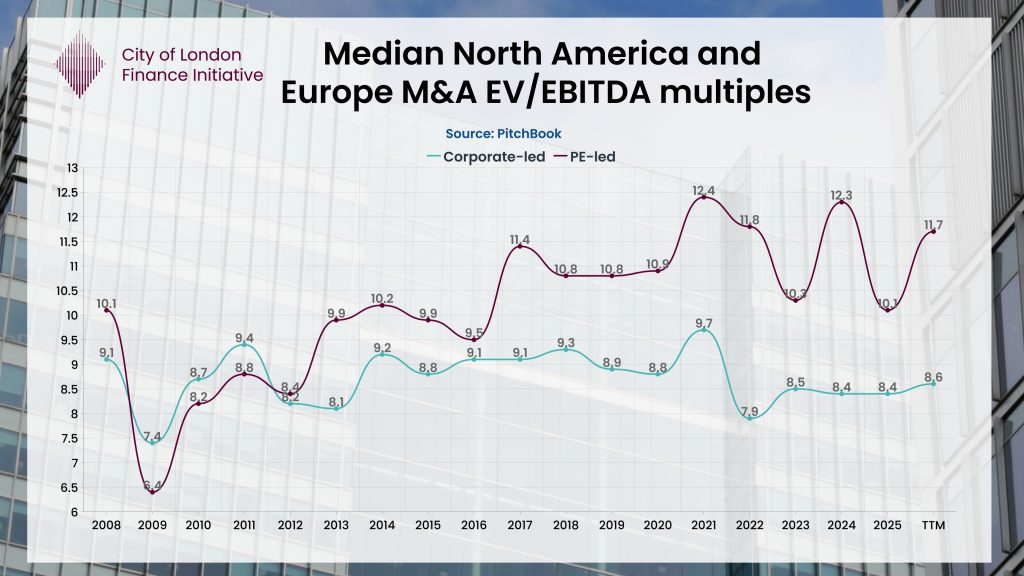

Against this backdrop, a clear pricing distinction has emerged. Private equity buyers are consistently paying higher valuations than their corporate counterparts across most regions and sectors. These elevated EV/EBITDA multiples reflect a structural premium that persists even in an environment shaped by higher base rates and tougher exit conditions. As of June 2025, the global median M&A EV/EBITDA multiple 2025 across all transactions stands at 9.3x.

Historically, corporate buyers were able to justify higher EV/EBITDA multiples than private equity firms. Their advantage came from the ability to extract operational synergies (through cost savings, cross-selling, and post-deal integration) which gave them greater headroom to pay more for strategic acquisitions.

However this dynamic has shifted. Over the past ten years, as observed in the chart above, private equity has closed that gap and have increasingly matched or exceeded corporate buyers on valuation. Several structural shifts explain this change: an extended period of ultra-low interest rates made leveraged buyouts more attractive; dry powder reached historic levels; and many private equity firms evolved into diversified conglomerates with the ability to generate synergies across large portfolios. The resulting competition has elevated deal pricing — and as of 2025, data confirms that this structural premium remains intact, with private equity continuing to pay higher median multiples across most sectors and regions.

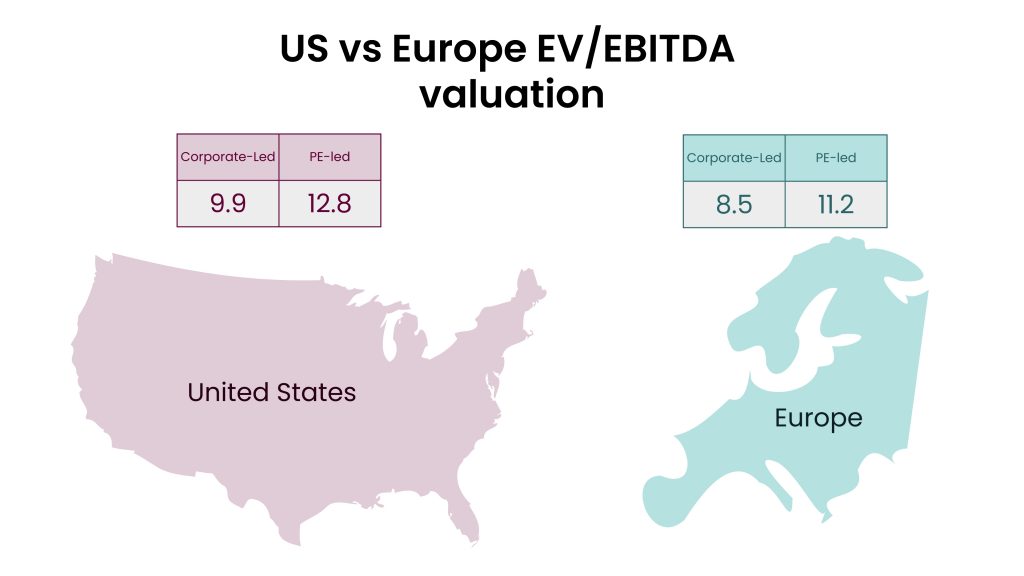

In the United States, M&A transactions completed over the trailing 12 months show a clear valuation premium for private equity buyers. The median EV/EBITDA multiple reached 12.8x for private equity-led deals, compared with 9.9x for those led by corporate acquirers.

A similar pattern is observed in Europe. There, private equity buyers paid a median EV/EBITDA multiple of 11.2x over the same period, while corporate acquirers averaged 8.5x. These figures reaffirm the persistent valuation premium that private equity sponsors continue to pay, even amid tighter financing conditions and more cautious exit markets.

These valuation differences are interpreted using relative valuation techniques in M&A analysis, including EV/EBITDA multiples and precedent transactions, as covered in the Business Valuation Executive Course.

PE-led transactions continue to pay materially higher EV/EBITDA multiples in 2025, particularly in industries such as software, healthcare services, and IT infrastructure. In contrast, corporate-led deals have shown more moderate pricing, even as their overall deal activity has increased. This gap in M&A multiples is not only about headline valuations, it reflects fundamentally different incentives: For instance, corporates often pursue strategic fit and cost synergies, while private equity remains driven by capital deployment timelines and exit outcomes.

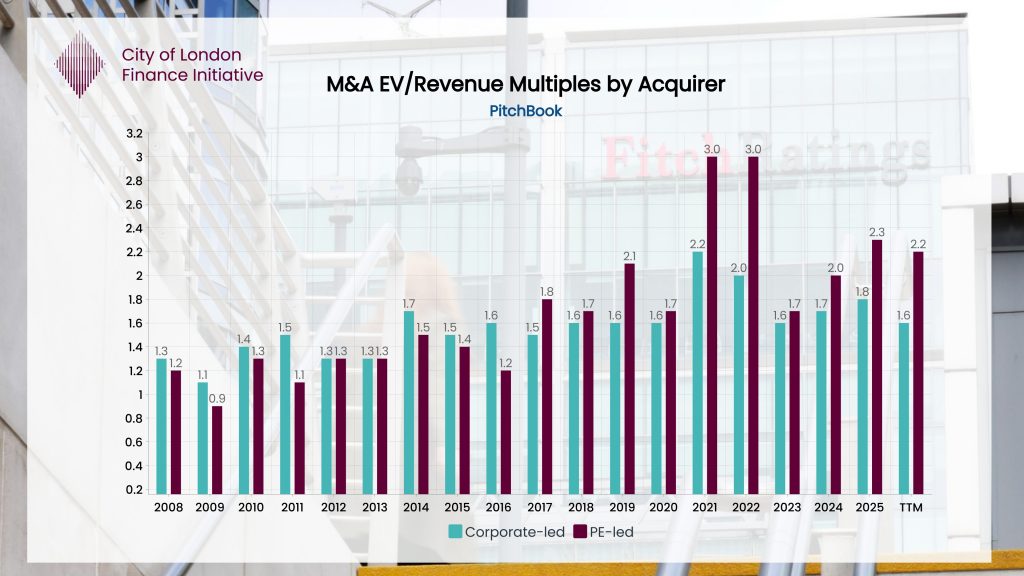

Although EV/EBITDA multiples remain the primary benchmark in M&A, many buyers also look at EV/revenue multiples in high-growth or asset-light industries where EBITDA is less relevant.

Over the past 12 months, private equity buyers in the U.S. have paid a median EV/revenue multiple of 2.2x, compared with 1.6x for corporate acquirers.

Source: PitchBook, Q2 2025 Global M&A Report

This pricing environment is more than a numbers game — it has become central to strategic decision-making. Boards considering exits, founders evaluating offers, and investors preparing new bids must now navigate a recalibrated M&A landscape. Today, deal premiums are shaped less by market exuberance and more by the fundamentals of buyer type, capital cost, and long-term intent. As global M&A resets from the valuation spikes of 2021, these pricing distinctions are proving durable rather than cyclical.

Valuation by Sector

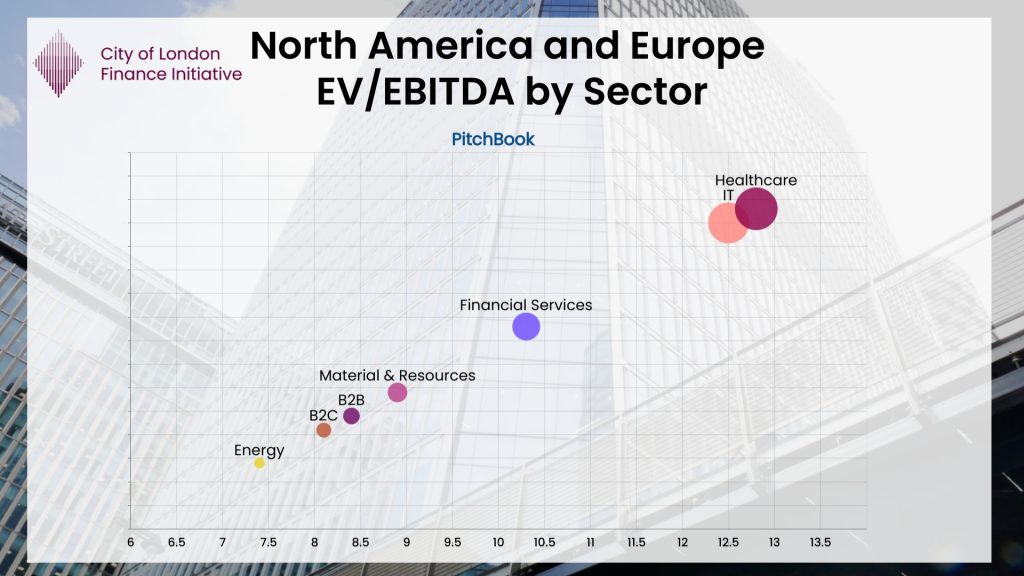

Valuation levels in M&A continue to vary sharply by sector. Across North America and Europe, IT and Healthcare trade at the highest median EV/EBITDA multiples, at 12.5x and 12.8x respectively — reflecting their scalable business models, recurring revenue streams, and strong investor demand for growth and resilience. Financial Services follows with a median multiple of 10.3x, while the B2B and B2C sectors are slightly lower, in the 8.1x–8.4x range. The lowest M&A valuation multiples by sector are seen in the Energy sector at 7.4x, followed by Materials & Resources at 8.9x — both impacted by asset intensity and exposure to commodity cycles.

| Sector | Median EV/EBITDA (2025) | Valuation Drivers |

|---|---|---|

| IT | 13.2x | Recurring revenue, scalability, low capex |

| Healthcare | 12.3x | Biopharma platforms, medtech, ageing demographics |

| Financial Services | 8.7x | Fintech premiums offset by legacy banking drag |

| Materials & Resources | 8.9x | Commodity-linked volatility, capex intensity |

| B2B Services | 8.1x | Contract depth, margin visibility varies |

| B2C | 8.1x | Consumer cyclicality, pricing power dispersion |

| Energy | 7.9x | Oil price swings, transition risk, high capex |

Source: PitchBook, Q2 2025 Global M&A Report. Median sector-level EV/EBITDA, North America and Europe.

Price Is a Data Point. Value Is a Decision.

Learn more through the Executive Certificate in Corporate Finance, Valuation & Governance – a structured programme integrating governance, finance, valuation, and strategy.

Private equity is facing a structural shift. With more than half of portfolio companies now held for over four years, and sponsors increasingly turning to continuation vehicles, traditional exit timelines have notably lengthened.

This raises a fundamental question: Is private equity entering a period of structural strain, not due to a lack of capital, but because its business model is under pressure? After all, the private equity model was never designed as a buy-and-hold strategy — it’s built around exits as transitional forms of ownership.

But what happens when exit routes stall, valuations remain high, and hold periods extend well beyond what funds were originally structured to support? These are no longer hypothetical scenarios. They now define the evolving risks and operational realities of capital deployment in today’s market.

Dominance and Deal Type Differences

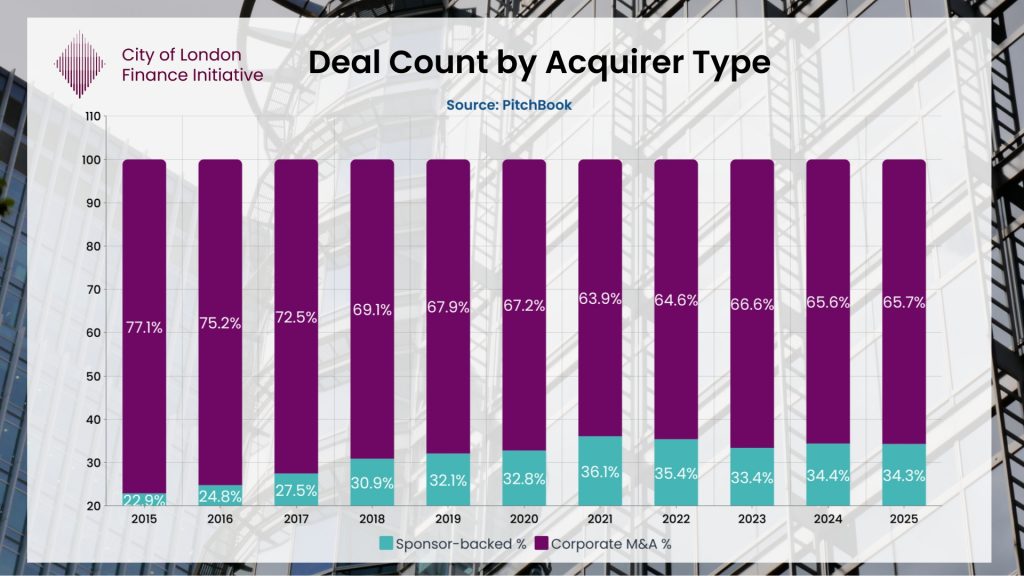

Although corporate buyers continue to lead in deal volume, private equity is increasingly dominating in terms of deal value. In the first half of 2025, sponsor-led acquisitions made up just over 34% of global M&A transactions — a slight increase from 2024 — yet they accounted for 42.4% of total deal value. This reflects a well-established pattern: PE sponsors tend to deploy larger sums into fewer, more targeted deals.

The pricing gap between buyer types mirrors this approach. As of Q2 2025, private equity buyers paid an average M&A EV/EBITDA multiple of 10.1x, compared to 8.6x for corporate acquirers.

Private equity firms typically underwrite acquisitions to meet internal rate of return (IRR) targets within a 4–7 year investment horizon. This structure allows them to justify paying higher entry multiples — particularly when they identify margin expansion levers, cost optimisation opportunities, or consolidation pathways to grow the asset.

For corporate acquirers, by contrast, the investment rationale is grounded in earnings increase, balance sheet discipline, and integration risk. These factors shape board-level decision-making and often cap how far valuations can stretch, even in cases of strong strategic alignment.

Another key factor behind this divergence is funding certainty. General partners with committed capital at Private Equity — even as dry powder ages — face deployment pressure. Corporate dealmaking, on the other hand, is more discretionary and often tied to annual cycles or long-term plans. This creates an urgency asymmetry that helps explain why private equity continues to outbid in many competitive processes.

Looking Ahead: What the Multiples Reveal

The ongoing private equity premium in deal valuations isn’t just about competition — it reflects how today’s market works. Private equity firms often need to invest within fixed timeframes, which gives them a different approach to risk. When capital must be deployed, there’s more willingness to pay higher prices, even if the exit options are unclear.

For corporate buyers, the situation is different. Their decisions are shaped by shareholders, credit conditions, and balance sheet limits — not fund deadlines. That’s why corporate valuations tend to stay more grounded, even when there’s a strong strategic case for a deal. In many ways, this gap between private equity and corporate buyers isn’t about who has the better strategy, but who is under more pressure to act.

What the data shows is that valuation multiples now reflect more than just sector fundamentals — they also depend on who the buyer is and how they’re funded. For sellers and boards considering offers, this matters. Understanding the difference between private equity and corporate logic can be just as important as the headline price. The gap between those bids isn’t only about today’s value — it shows how capital, strategy, and timing are shaping the future of M&A.

Explore Further from CLFI Insight

References:

- PitchBook, Q2 2025 Global M&A Report. Read more

- The critical role of exit readiness in today’s private equity landscape.