Table of Contents

How to Become a Finance Director: Skills, Experience, and Qualifications for Strategic Leadership

- CLFI Team

- 7 min. read

Introduction

Becoming a Finance Director is less about a title change and more about a shift in scope. The role moves beyond reporting accuracy to directing financial strategy, shaping resource allocation, and communicating a clear plan for value creation. If you have mastered controllership, built reliable forecasts, and partnered with the business on performance, you already hold important parts of the foundation. The next step is learning how to connect numbers with direction, to lead people through change, and to engage executives and investors with clarity.

Table of Contents

- What a Finance Director Does

- The Pathway from Manager to Director

- Skills and Experience that Accelerate the Transition

- Salary Progression Tiers

- Finance Director vs CFO

- Qualifications and Learning Routes

- Explore Further from CLFI Insight

What a Finance Director Does

A Finance Director sets direction for the finance function while acting as a partner to the CEO and operating leaders. The task is to turn operational reality into a financial plan that is credible, fundable, and aligned with strategy. This involves ownership of forecasting quality, capital allocation, working capital discipline, and the governance processes that protect the organisation. It also involves communication, since the Finance Director must explain assumptions, risks, and trade-offs in language that guides action across sales, product, and operations.

Definition:

Finance Director

The senior executive who leads financial planning, reporting integrity, and capital allocation for a business unit or group, and who supports the board and executive team by translating strategy into a resourced financial plan with clear risks and controls.

The Pathway from Manager to Director

Careers rarely progress in a straight line. Most leaders move through controllership, FP&A, and commercial finance before stepping into a Director post. The turning point is the moment you stop producing numbers for others and start shaping decisions yourself. That shift usually follows deliberate rotations across three environments. First, control roles that build credibility with auditors, regulators, and lenders. Second, commercial roles that build fluency with revenue drivers, unit economics, and pricing. Third, project or investment roles that expose you to capital strategy, investor communication, or M&A execution.

Your goal is breadth with accountability. Lead monthly performance reviews, then lead a budgeting cycle that embeds driver-based forecasting. Manage a cash working group with procurement and sales, then manage a refinancing process with the CFO and banking partners. Join due diligence as a workstream lead, then own integration reporting for the first ninety days. Each step builds the judgement and calm execution that boards expect from a Finance Director.

Skills and Experience that Accelerate the Transition

Across global finance roles, five domains consistently predict readiness for the Finance Director level. These represent the bridge between technical expertise and strategic leadership, the areas that enable finance professionals to move from interpreting results to shaping the direction of the business.

Together, they form the practical foundation for senior financial decision-making and boardroom contribution.

Core Domains for Finance Director Readiness

Understanding capital structure, funding options, and investment appraisal is essential. Finance Directors must evaluate projects through NPV, IRR, and sensitivity analysis, not as compliance exercises, but as strategic tools for prioritising growth and managing risk. This domain connects financial theory with the practical decisions that allocate capital.

Being able to value a company, business unit, or strategic initiative underpins both fundraising and acquisition readiness. Whether through discounted cash flow (DCF), comparable multiples, or transaction benchmarks, valuation fluency allows a Finance Director to negotiate confidently and articulate value creation to stakeholders.

Boards expect Finance Directors to understand oversight frameworks, director duties, and committee structures. Familiarity with audit, risk, and remuneration principles ensures that financial leadership also safeguards transparency, ethics, and accountability, qualities central to long-term value creation.

In many mid-market and high-growth environments, Finance Directors work alongside investors. Exposure to private equity or venture capital teaches the discipline of covenant management, investor reporting, and cash control. It also develops commercial judgement in balancing short-term funding needs with sustainable performance.

Experience in M&A brings together all prior domains—finance, valuation, and governance—into a single decision cycle. Leading due diligence, assessing synergies, and overseeing post-deal integration broaden a Finance Director's perspective on growth, control, and culture. It is one of the most direct ways to build credibility with CEOs and boards.

Experience Pathways: From Controller to CFO

Progression to the CFO role is rarely linear. Most journeys start within audit, assurance, or management accounting, gradually expanding toward commercial finance and group leadership. What differentiates those who reach the top in finance career is not only technical mastery but the deliberate accumulation of strategic and cross-functional experience. Rotating between control-focused and outward-facing roles builds the dual credibility every board expects — confidence with auditors and fluency when shaping plans alongside sales, product, and operations leaders.

Analysis of senior CFO job profiles across the UK and continental Europe shows five recurring domains of expertise that drive this transition: corporate finance, business valuation, corporate governance, private equity and venture capital exposure, and mergers and acquisitions. Together, these form the backbone of modern finance leadership. They reflect how the CFO's remit has expanded beyond compliance and reporting into capital allocation, strategic investment, and stakeholder engagement. Each domain represents both a skillset and a career milestone that directly influences earning potential and board readiness.

For a full breakdown of the competencies and salary ranges associated with these stages — from Finance Manager through Group Financial Controller to CFO — read our latest article on Skills that Drive the Transition: From Finance Manager to CFO . It details how advancing from operational finance to board-level influence requires mastering the science of financial analysis alongside the art of leadership, communication, and governance.

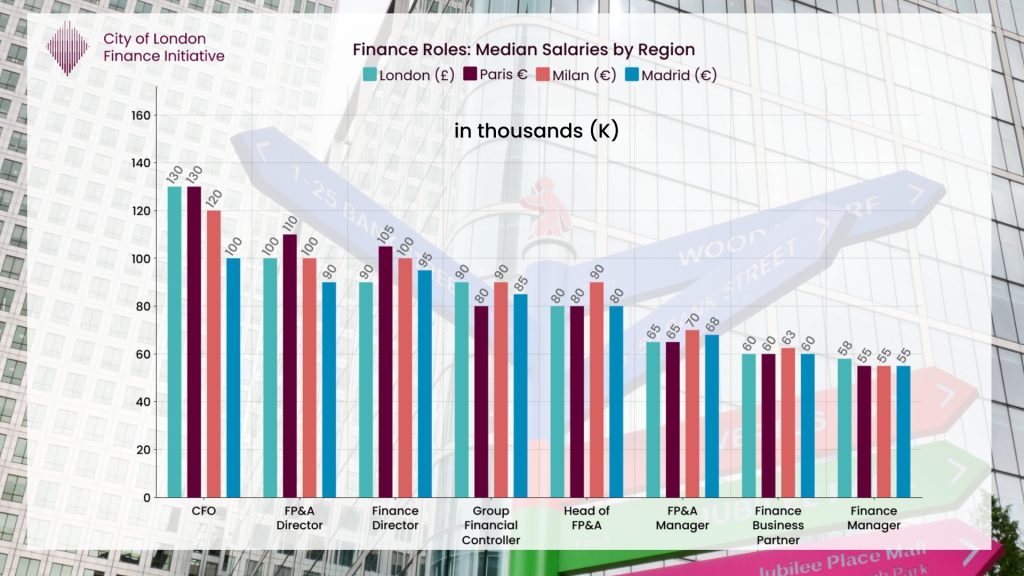

Salary Progression Tiers

Compensation reflects scope and impact. As responsibilities expand from accurate reporting to directing investment and shaping growth, pay typically moves up through clear tiers. Managers sit in the first tier, Finance Business Partners and FP&A leaders in the middle tier, and Finance Directors alongside Group Controllers in the upper tier, with CFOs above. Bonuses and long-term incentives increase with board exposure and decision authority. The key point is that salary follows influence. When you take ownership of the financial plan and can clearly explain the reasoning behind it, your influence and professional value increase.

Finance Director vs CFO

The titles often overlap, yet scope differs by organisation. A Finance Director typically leads the finance function of a business unit or the whole company in mid-market settings. A Chief Financial Officer carries group-wide accountability for capital markets communication, enterprise risk, and board relationships, particularly in listed or multi-entity groups. Many executives serve as Finance Director before stepping into a Group FD or CFO role. The capability set is largely shared, although the CFO spends more time on funding strategy, investor dialogue, and enterprise governance.

Qualifications and Learning Routes

There is no single credential that guarantees a Director post, yet certain routes provide strong foundations. Professional accountancy bodies build technical assurance and ethical standards that boards value. Each qualification brings distinct strengths to financial leadership:

Not every path starts with a multi-year charter journey. ACCA, for example, requires 13 exams, a mandatory Ethics and Professional Skills Module (EPSM), and Post Qualification Experience before becoming a full member and officially using the ACCA letters after your name. Executives who want immediate strategic lift can use targeted executive education to bridge from strong operational finance to board-level fluency.

The Executive Certificate in Corporate Finance, Valuation & Governance is designed for this purpose. Participants practise forecasting, DCF valuation, cost of capital, and governance frameworks using live case work, which translates directly into the conversations Finance Directors lead with CEOs and boards.

Definition:

Corporate Governance

It is the framework that defines how a company is directed, controlled, and held accountable. It clarifies where decisions are made, how authority is exercised, and the standards of conduct expected from those in leadership.

Progress also depends on how you learn. If a chartered route suits your context, pursue it with purpose. If you need strategic acceleration first, use executive certificates to acquire valuation, governance, and corporate finance fluency while you deliver in role. Either way, combine technical assurance with clear communication. When numbers, narrative, and governance align, you will be ready to lead the finance function and to support the board with confidence.

For L&D leaders, tiers for teams and HR seats enable structured development across departments without removing staff from the business for extended periods, supporting a culture where sound financial judgement is shared rather than concentrated.

Programme Content Overview

The Executive Certificate in Corporate Finance, Valuation & Governance delivers a full business-school-standard curriculum through flexible, self-paced modules. It covers five integrated courses — Corporate Finance, Business Valuation, Corporate Governance, Private Equity, and Mergers & Acquisitions — each contributing a defined share of the overall learning experience, combining academic depth with practical application.

Chart: Percentage weighting of each core course within the CLFI Executive Certificate curriculum.

Grow expertise. Lead strategy.

Build a better future with the Executive Certificate in Corporate Finance, Valuation & Governance.