Table of Contents

From Finance Manager to CFO: The Skills that Redefine the Modern Finance Career Path

- 8 min read

Introduction

Reaching the Chief Financial Officer level remains one of the most visible milestones in a finance career. Yet the path from Finance Manager to CFO is rarely linear. What was once an upward move through accounting and reporting roles has evolved into a broader journey—one that requires fluency in strategy, valuation, governance, and commercial leadership. In today’s finance functions, technical skill is essential but no longer sufficient. The modern CFO operates at the intersection of finance, strategy, and business transformation.

Over the past decade, the expectations of finance leaders have shifted dramatically. Digitalisation, private capital growth, and cross-border competition have expanded the CFO’s remit from stewarding financial statements to shaping corporate direction. Whether in listed companies, venture-backed scale-ups, or private equity portfolio firms, employers increasingly seek leaders who can connect operational performance with shareholder value. This structural change is redefining both career trajectories and the learning pathways professionals choose along the way.

The Career Path: From Finance Manager to CFO

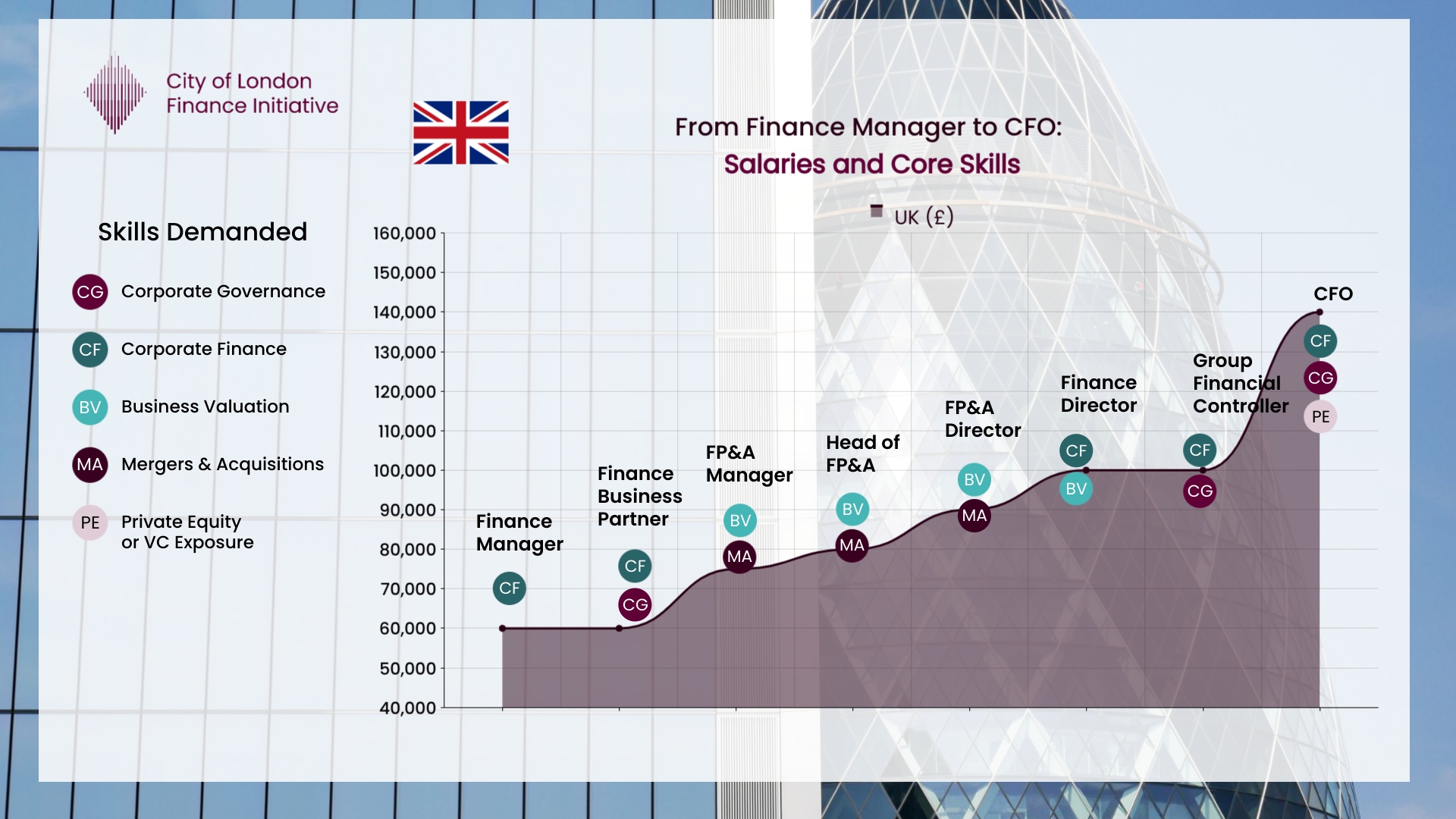

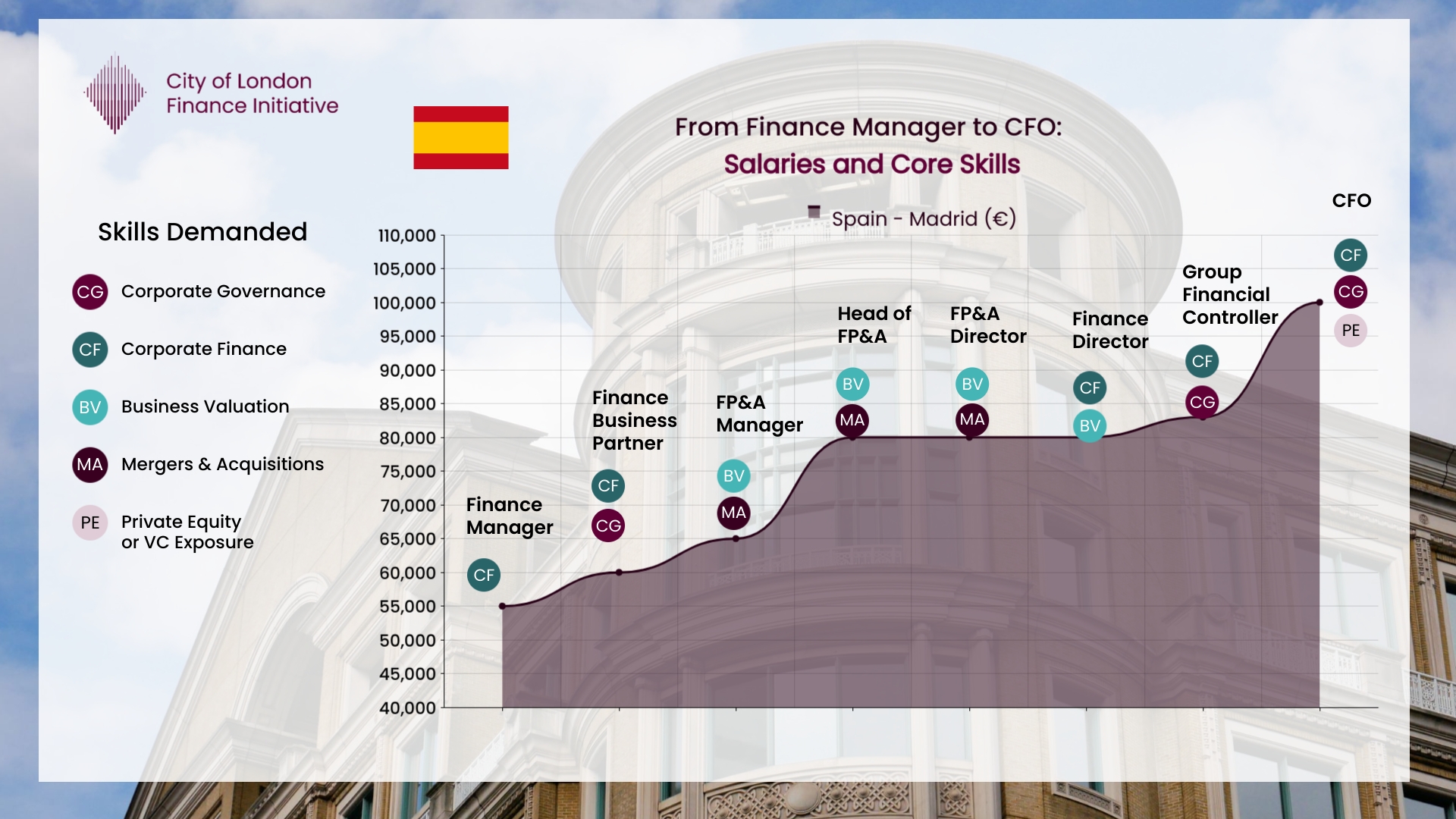

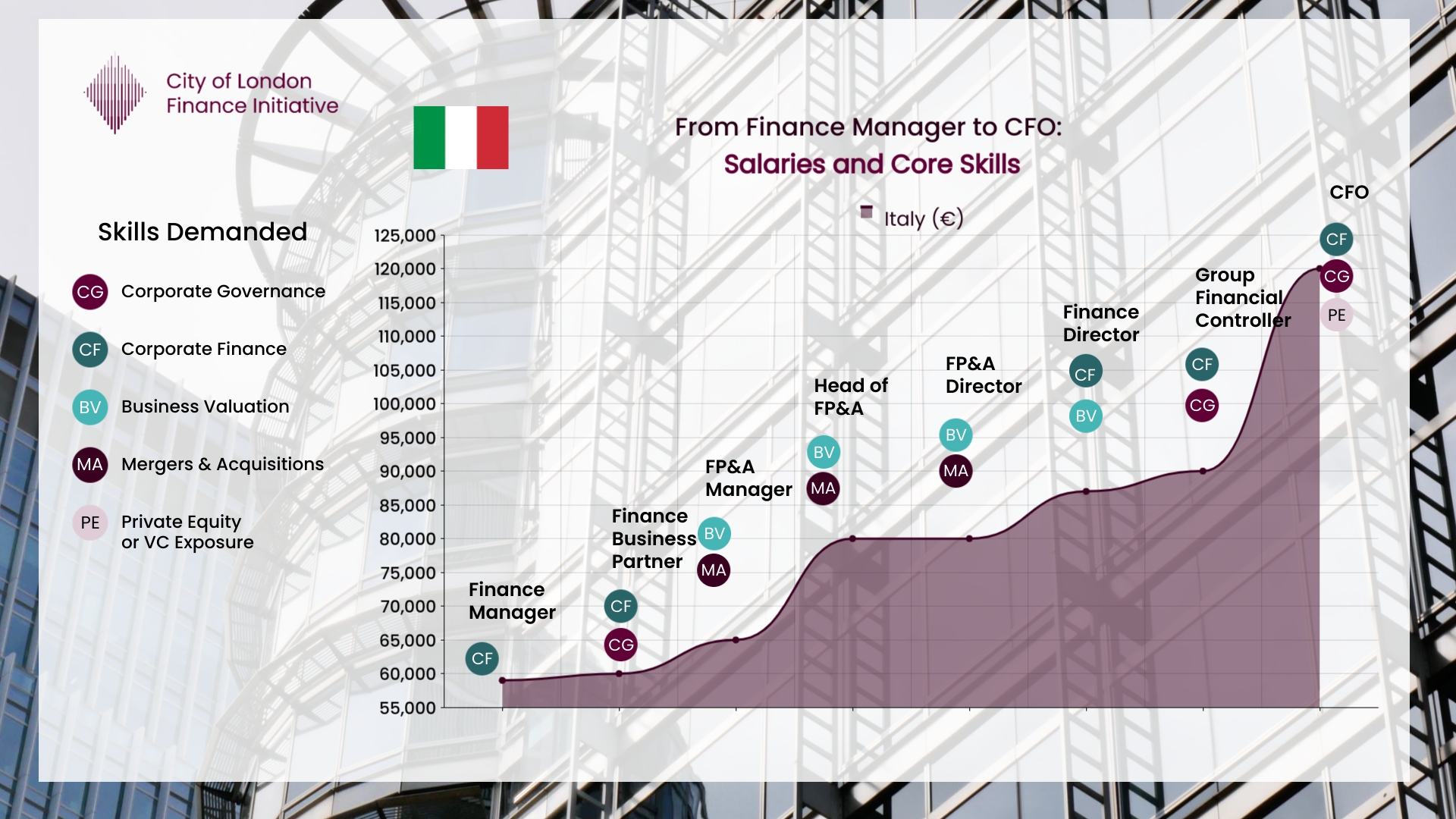

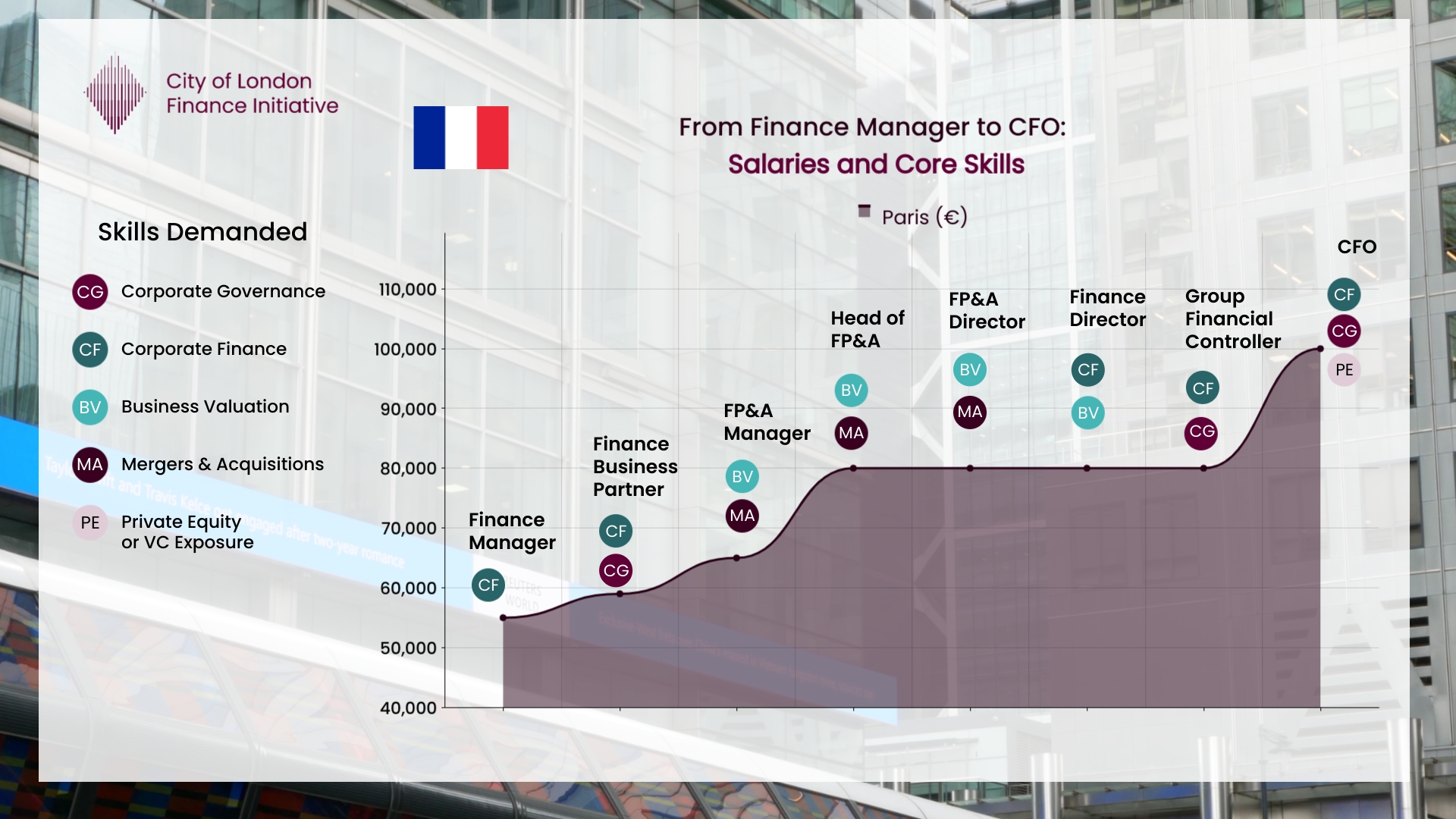

Most professionals begin their senior finance journey in controllership, management reporting, or FP&A. The Finance Manager role typically consolidates technical oversight— accounting & financial reporting, forecasting, and compliance—while introducing the first layers of strategic exposure. Progression to Finance Director or Head of FP&A demands a shift toward business partnering. This implies aligning financial data with operational decisions, managing cross-functional teams, and guiding capital allocation. These middle-senior positions often mark the transition from pure analysis to influence in decision-making.

At the upper end of the ladder, the Group Controller or CFO role brings together three dimensions of leadership: strategic foresight, governance responsibility, and stakeholder communication.

The CFO becomes both an internal advisor to the CEO and a public face to investors, boards, and lenders.

Working at a PE or VC-Backed Company or Startup

In many private equity or venture capital-backed companies, the VP Finance role often represents the highest level of financial and operational leadership before a formal finance department is fully established. At this stage, a deep understanding of how private equity operates and how governance frameworks function becomes essential. The VP Finance acts as the bridge between investors and founders—ensuring transparency, financial discipline, and accountability while supporting growth objectives and capital efficiency.

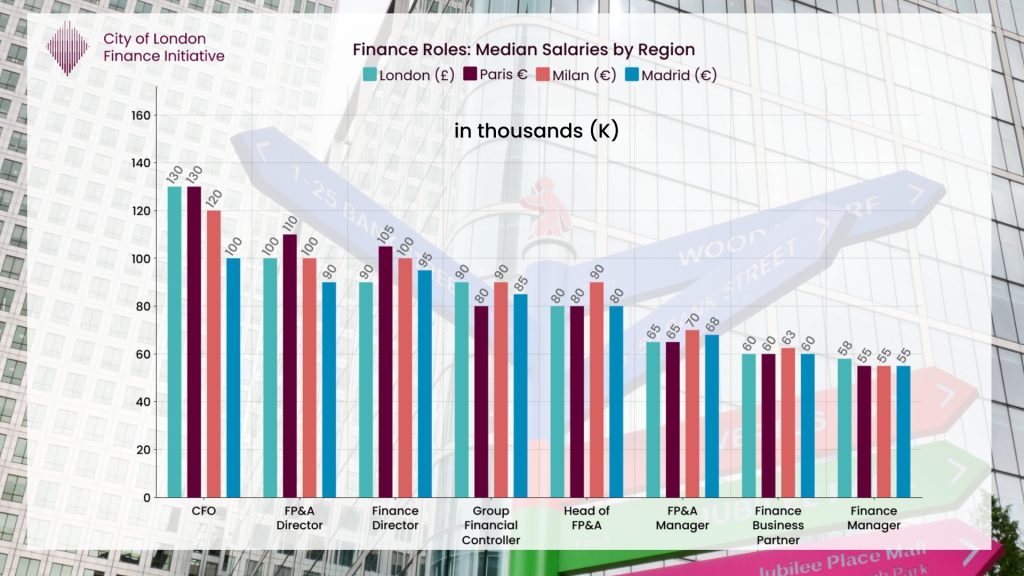

In the most competitive markets—London, Paris, Milan, and Madrid—median compensation reflects this blend of accountability and strategic scope. Salaries typically rise from the mid-50k range at Finance Manager level to above £120k or €120k at the CFO level, with bonuses frequently adding 15–25 percent. The salary gap signals more than seniority; it represents the premium on business judgement and boardroom literacy.

Each step on the salary ladder is associated with a distinct skill profile.

Skills that Drive the Transition

Advancing from Finance Manager to CFO requires mastery of both the science and the art of finance leadership. Analysis of senior-level job descriptions across the UK and continental Europe reveals five recurring domains of expertise that consistently appear in high-earning roles:

- Corporate Finance: Understanding capital structure, cost of capital, and investment appraisal is now fundamental. CFOs are expected to evaluate projects through NPV, IRR, and scenario analysis, integrating these insights into strategy rather than treating them as compliance exercises.

- Business Valuation: The ability to value companies, divisions, and strategic options underpins decision-making in M&A and fundraising. Whether through discounted cash flow, comparables, or transaction multiples, valuation fluency signals boardroom readiness.

- Corporate Governance: Boards demand finance leaders who understand oversight frameworks, director duties, and audit committee dynamics. Governance knowledge is increasingly vital as CFOs become custodians of transparency and ethical decision-making.

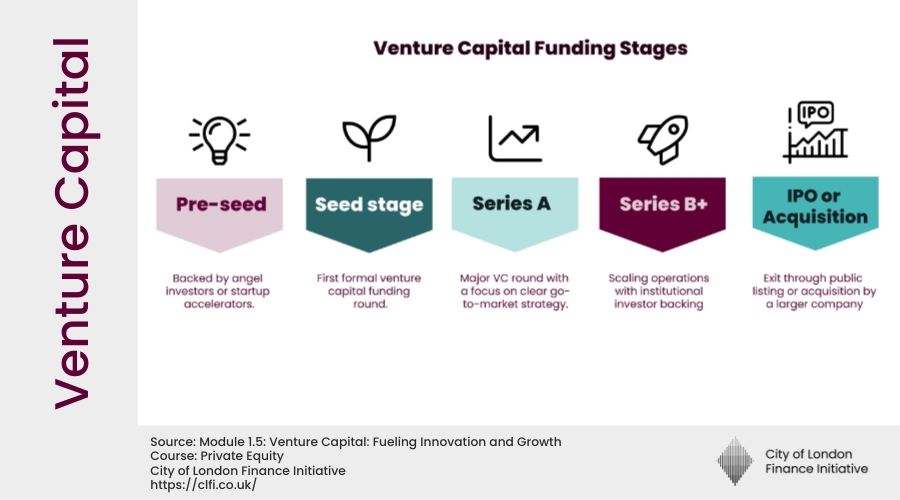

- Private Equity and Venture Capital Exposure: Many modern CFOs operate within PE-backed or VC-backed structures. Familiarity with investor reporting, capital calls, and exit strategies differentiates candidates capable of engaging private capital stakeholders.

- Mergers and Acquisitions: Strategic growth through acquisitions is common across Europe’s mid-market. Experience managing due diligence, synergy assessment, and post-deal integration enhances a finance leader’s credibility.

Developing these skills systematically is what transforms financial managers into strategic partners. As many executives acknowledge, finance today is no longer just about slicing and dicing excels to present a P&L — which nowadays, thanks to advanced tools and business intelligence these are almost automated — it is more about direction and understanding of market dynamics.

Valuefinex, provider of fractional CFO services in the UK and Europe said, «our fractional CFOs support private equity-backed and Series A+ companies, where the role typically requires senior finance leaders to prioritise in the short-term, the streamlining of the processes, enhancing information flow, and reducing back-office manual and repetitive workload. The goal is to redirect those hours toward greater involvement in the commercial and strategic aspects of finance in the mid and long-term.»

This convergence creates both opportunity and pressure. The route to CFO can accelerate for those who deliberately acquire cross-functional exposure—leading system implementations, managing investor relations, or contributing to board committees. Conversely, remaining confined to traditional and routine financial control may limit career mobility.Strategic literacy—understanding how to interpret valuation drivers, evaluate capital structure decisions, and communicate governance implications—is increasingly recognised as a key differentiator for leadership succession. Finance professionals who can connect analytical insight with strategic context stand out as future CFOs.

The Two Clear Paths to the CFO Role

Many finance professionals aspire to reach the CFO level but often find themselves constrained by traditional, reporting-driven roles. The challenge is not competence, it is exposure. Without deliberate development of strategic, commercial, and governance-related skills, progression can plateau.

In active markets such as London, where private equity and venture-backed companies represent an important share of hiring, two main routes have emerged for professionals aiming to accelerate their trajectory.

- The first is to acquire the five core strategic competencies—corporate finance, business valuation, corporate governance, private equity or venture capital exposure, and M&A—through focused executive programmes designed to build decision-level capability.

- The second is to pursue a more entrepreneurial route by taking on fractional CFO or interim finance leadership roles, a fast-growing segment driven by high-growth and PE-backed companies seeking experienced guidance on finance and governance matters.

Fractional CFO roles, in particular, are reshaping how senior finance expertise is deployed. These positions place leaders at the centre of dynamic, scaling businesses where every process improvement and strategic decision can multiply enterprise value. Companies in this space are not merely looking for financial reporting or complex Excel workbooks —they seek experienced finance leaders who can bring structure, discipline, and foresight to fast-growing teams.

The role often involves setting standards that allow the organisation to scale efficiently while maintaining control over risk, governance, and cash flow visibility.

Equally important is the ability to act as a genuine business partner to the founding team and executive leadership—working cross-functionally to align operations, finance, and strategy toward the next valuation milestone or growth target.

Startup funding rarely happens all at once, instead it progresses through distinct stages as the business matures. Each funding round introduces new investors, ideally higher valuations, and increasingly formal expectations around governance and reporting. At each stage, the CFO plays a pivotal role in bridging investor confidence with operational reality, ensuring the company remains both growth-oriented and well-controlled.

At CLFI, we deliver the first online executive programme in Corporate Finance, Valuation & Governance, with exclusive modules on Private Equity and Mergers & Acquisitions—topics traditionally reserved for top-tier business schools and often accessible only through employer sponsorship. Today, as brand prestige becomes less decisive than demonstrable competence, accessible and high-quality executive education provides a direct bridge to boardroom readiness.

Programme Content Overview

The Executive Certificate in Corporate Finance, Valuation & Governance delivers a full business-school-standard curriculum through flexible, self-paced modules. It covers five integrated courses — Corporate Finance, Business Valuation, Corporate Governance, Private Equity, and Mergers & Acquisitions — each contributing a defined share of the overall learning experience, combining academic depth with practical application.

Chart: Percentage weighting of each core course within the CLFI Executive Certificate curriculum.

Grow expertise. Lead strategy.

Build a better future with the Executive Certificate in Corporate Finance, Valuation & Governance.

Knowledge and applied experience now outweigh labels. In a world where AI and technology-driven capital expenditure define the post-pandemic investment cycle, financial leaders must adapt faster than ever. The recent valuation of OpenAI at nearly half a trillion dollars—while the company remains private—illustrates how value creation has shifted decisively toward private markets. For finance professionals, this is the momentum they can take advantage of to level-up their next career move.

Career growth in finance will continue to depend on adaptability—learning new frameworks, adopting technology, and maintaining credibility in front of investors and boards. Structured executive education provides one of the few ways to accelerate that journey without waiting for promotion cycles. For professionals aiming to bridge from finance to strategy roles, targeted learning in valuation, governance, and corporate finance remains one of the most direct investments in future boardroom success.

Explore Further from CLFI Insight

References:

- CLFI consolidated finance salary database, 2025.

- Michael Page, Finance Salary Reports 2025.

- OpenAI wraps $6.6 billion share sale at $500 billion valuation

- What Is Venture Capital? Funding Innovation and High-Growth Companies

- CFOConnect finance-insights: Fractional CFO: Bridging the gap with in-depth financial expertise for business growth

- Valuefinex Fractional CFO Rate Survey 2025