Table of Contents

Corporate Finance Career Path: Build Strategic Expertise for the Boardroom

- 8 min read

The Role of Corporate Finance in Modern Leadership

Corporate finance isn’t just about numbers; it’s about direction. Every capital decision — from an acquisition to a divestment — signals a company’s priorities and long-term intent. Corporate finance is the backbone of strategic decision-making. It defines how organisations allocate capital, evaluate investments, and create long-term value. Every major corporate move — from launching a new product line to executing a merger — ultimately passes through a financial lens. For senior leaders, understanding these dynamics is no longer optional; it’s central to effective leadership.

In practice, corporate finance shapes how companies balance growth and risk. It determines how funding and/or equity are structured, how returns are measured, and how value is created for shareholders and stakeholders alike. Whether deciding on an acquisition, evaluating a capital project, or managing investor expectations, finance fluency drives clarity and confidence in leadership decisions. And that’s why professionals across strategy, operations, investing in focused learning to strengthen their financial expertise — to speak the language of the boardroom.

Why Learn Corporate Finance? The Career Impact

For many professionals, studying corporate finance is not just about technical mastery — it’s about strategic readiness. The ability to understand how financial decisions influence value creation has become a defining attribute of modern executives. From board contributors and consultants to business owners and entrepreneurs, finance literacy strengthens decision-making authority and promotion readiness.

For accounting professionals, learning corporate finance provides the progress from excel and ERP driven role to a more strategic one. For those in FP&A or operations, it sharpens investment analysis and business case evaluation. And for executives aspiring to the boardroom, it builds the confidence to engage credibly with CFOs, investors, and advisors. In today’s competitive market, developing corporate finance skills is not just career enhancement — it’s leadership preparation.

Key Learning Areas in Corporate Finance

A well-designed corporate finance course brings together valuation, governance, and investment disciplines into one coherent framework. At CLFI, these topics form the foundation of the Executive Certificate in Corporate Finance, Valuation & Governance, structured around four interconnected modules:

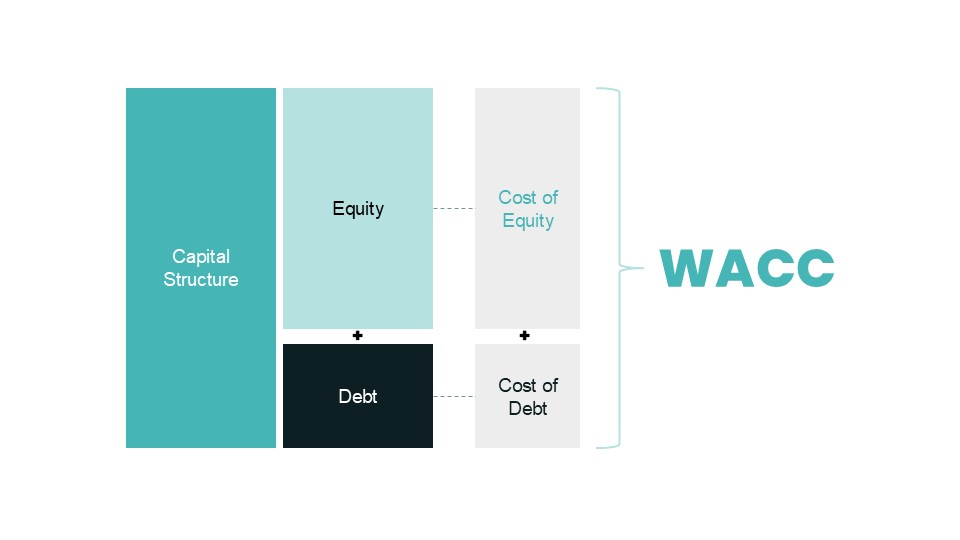

- Corporate Finance: Capital structure, cost of capital (WACC), and the balance between risk and return. Participants learn how companies fund growth, assess financing options, and make capital budgeting decisions that align with long-term strategy.

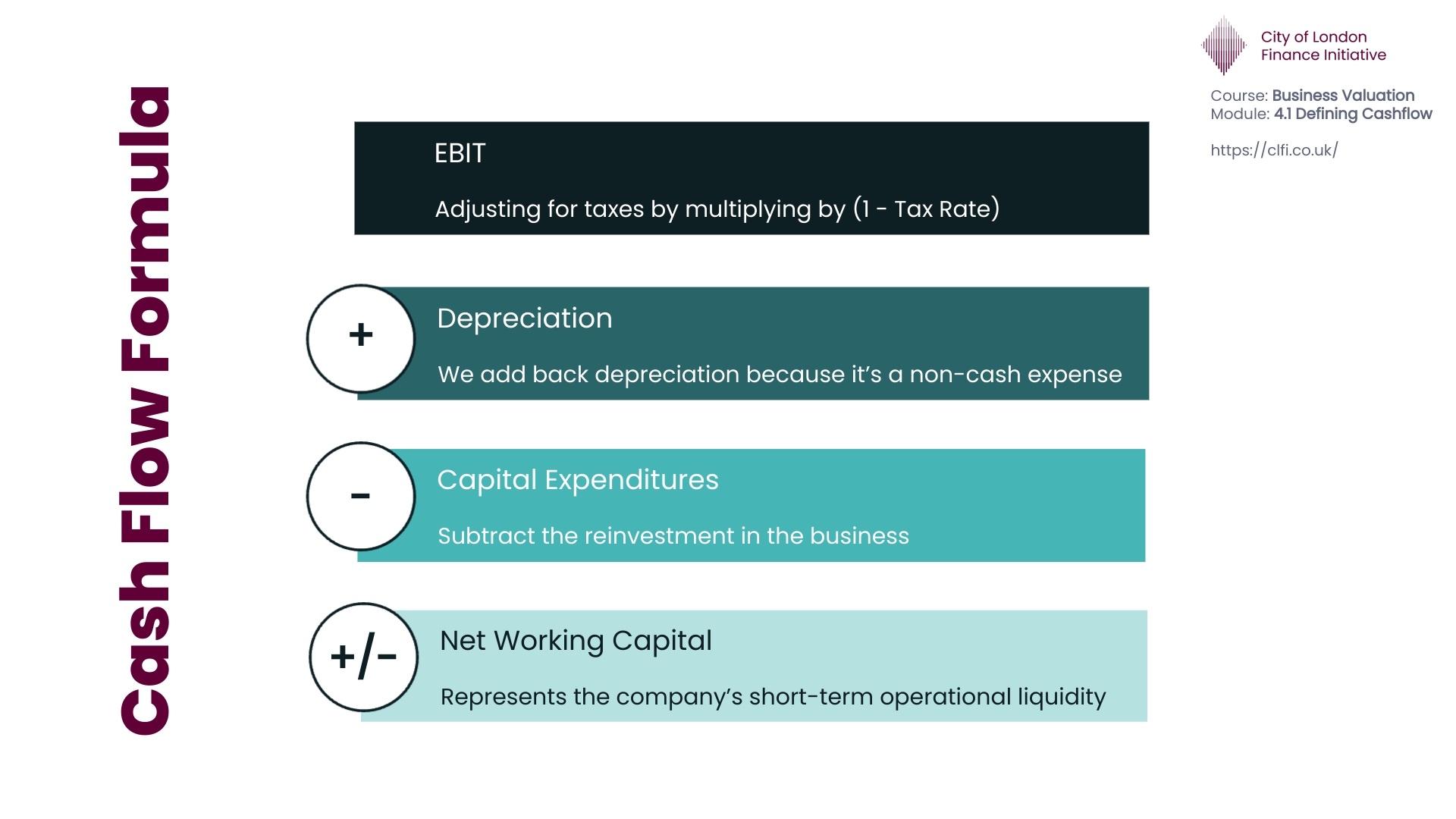

- Business Valuation: Discounted Cash Flow (DCF), Net Present Value (NPV), Internal Rate of Return (IRR), and market multiples. These tools form the analytical foundation of investment evaluation and M&A decision-making.

- Corporate Governance: Board structures, accountability, and ethical oversight. Understanding governance principles ensures financial decisions are aligned with transparency, performance, and long-term stakeholder value.

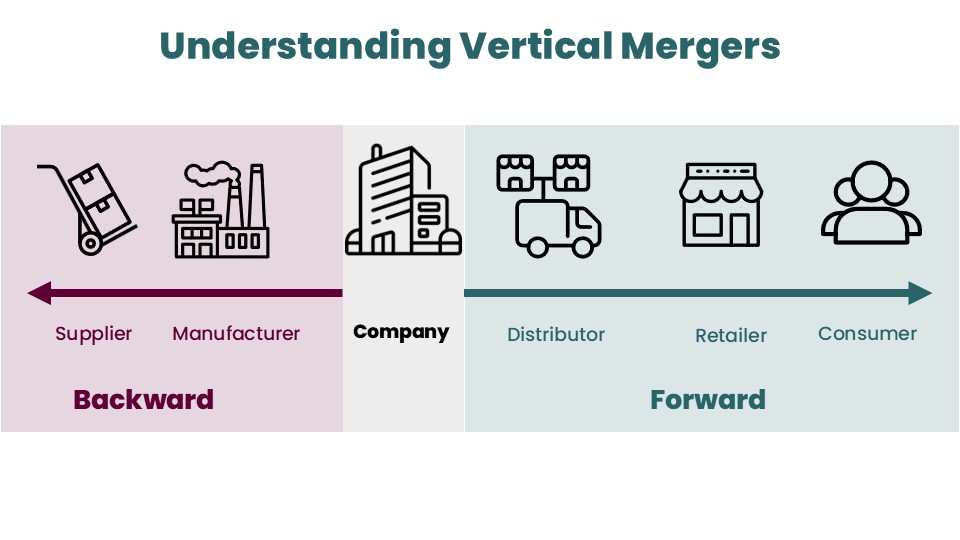

- Private Equity & M&A: Deal structuring, exit strategies, and synergy creation. This module explains how investors assess opportunities and how corporate leaders negotiate and integrate acquisitions effectively.

The programme’s case studies — from the Hilton buyout by Blackstone, and its later IPO to the Essilor–Luxottica merger, forming the world’s largest eyewear company — illustrate how corporate finance decisions translate directly into market-defining business outcomes. Participants don’t just learn concepts; they analyse real transactions, valuation models, and governance frameworks drawn from the City of London’s dealmaking environment.

Capital Is a Resource. Allocation Is a Strategy.

Learn more through the Executive Certificate in Corporate Finance, Valuation & Governance – a structured programme integrating governance, finance, valuation, and strategy.

Career Pathways in Corporate Finance

Corporate finance offers multiple entry points and progression routes, both vertical and lateral. Typical paths begin with analyst or associate roles focused on modelling and financial planning. From there, professionals often progress to positions such as Finance Manager or FP&A Lead, where they manage budgets, forecasts, and business performance metrics. The next stages include strategic roles such as Corporate Development, M&A Lead, or Head of Finance — positions that blend financial analysis with executive-level decision-making.

At the top of this trajectory sits the Chief Financial Officer or Board Advisor — roles where financial insight informs enterprise-wide strategy. But beyond vertical progression, corporate finance also opens lateral opportunities. Many entrepreneurs, consultants, and even product leaders find that mastering financial frameworks enables them to better evaluate investment opportunities and articulate value to investors.

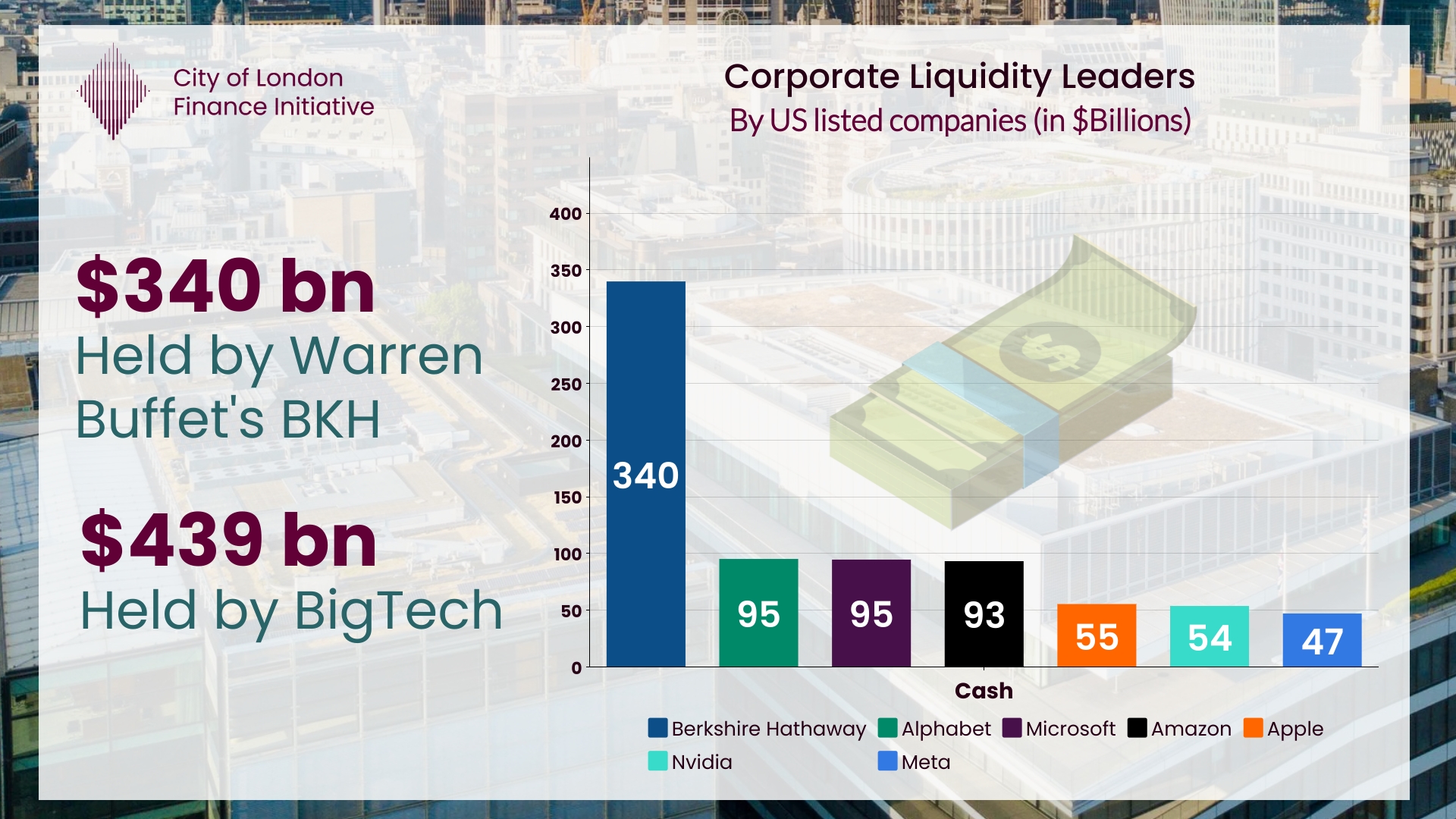

Professionals working in or alongside private equity-backed companies also benefit significantly. As private capital increasingly replaces public markets as the dominant source of funding, corporate finance skills are vital. Whether advising on valuation, structuring, or governance, professionals equipped with financial fluency are positioned to lead in this new environment.

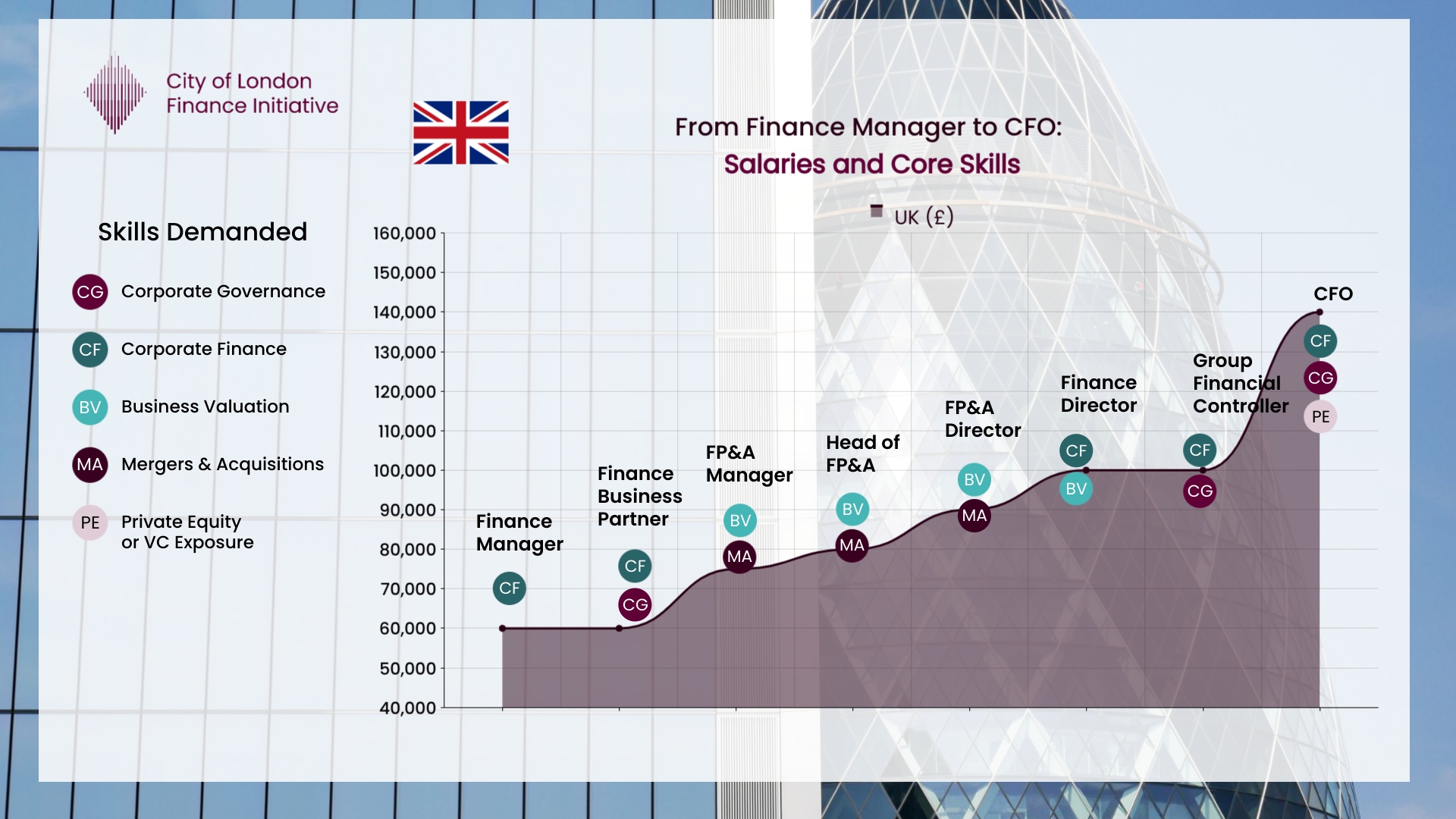

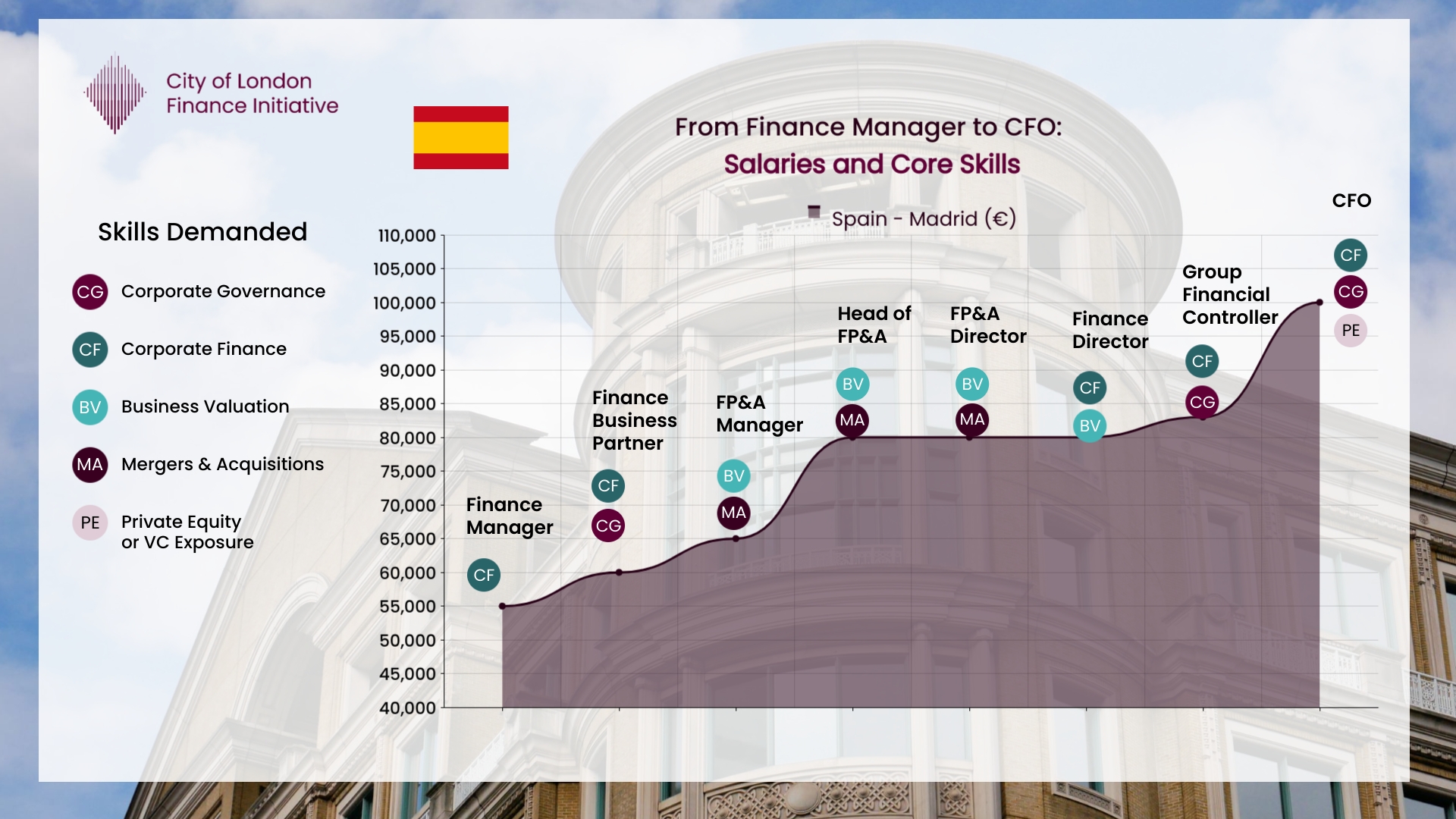

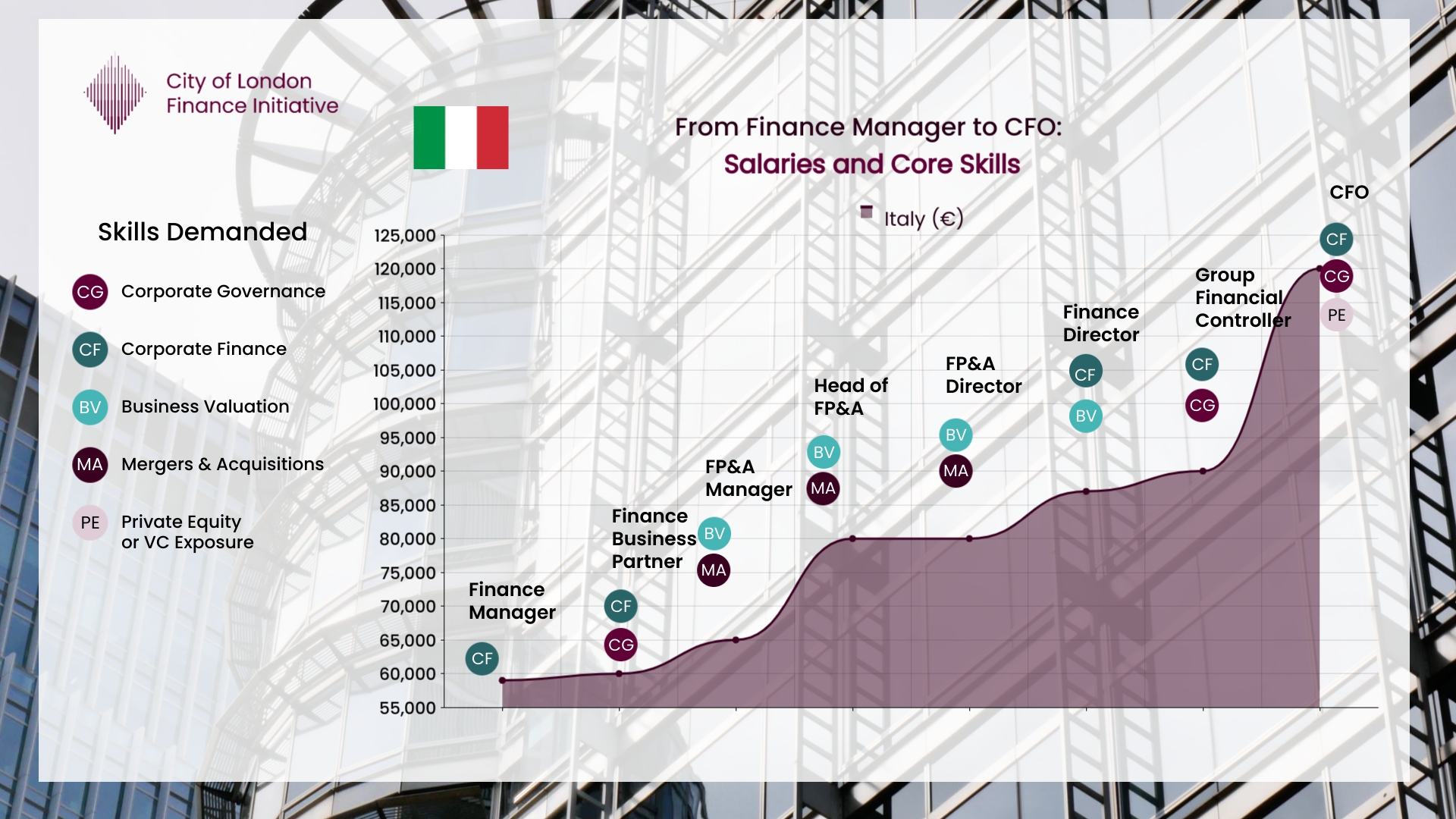

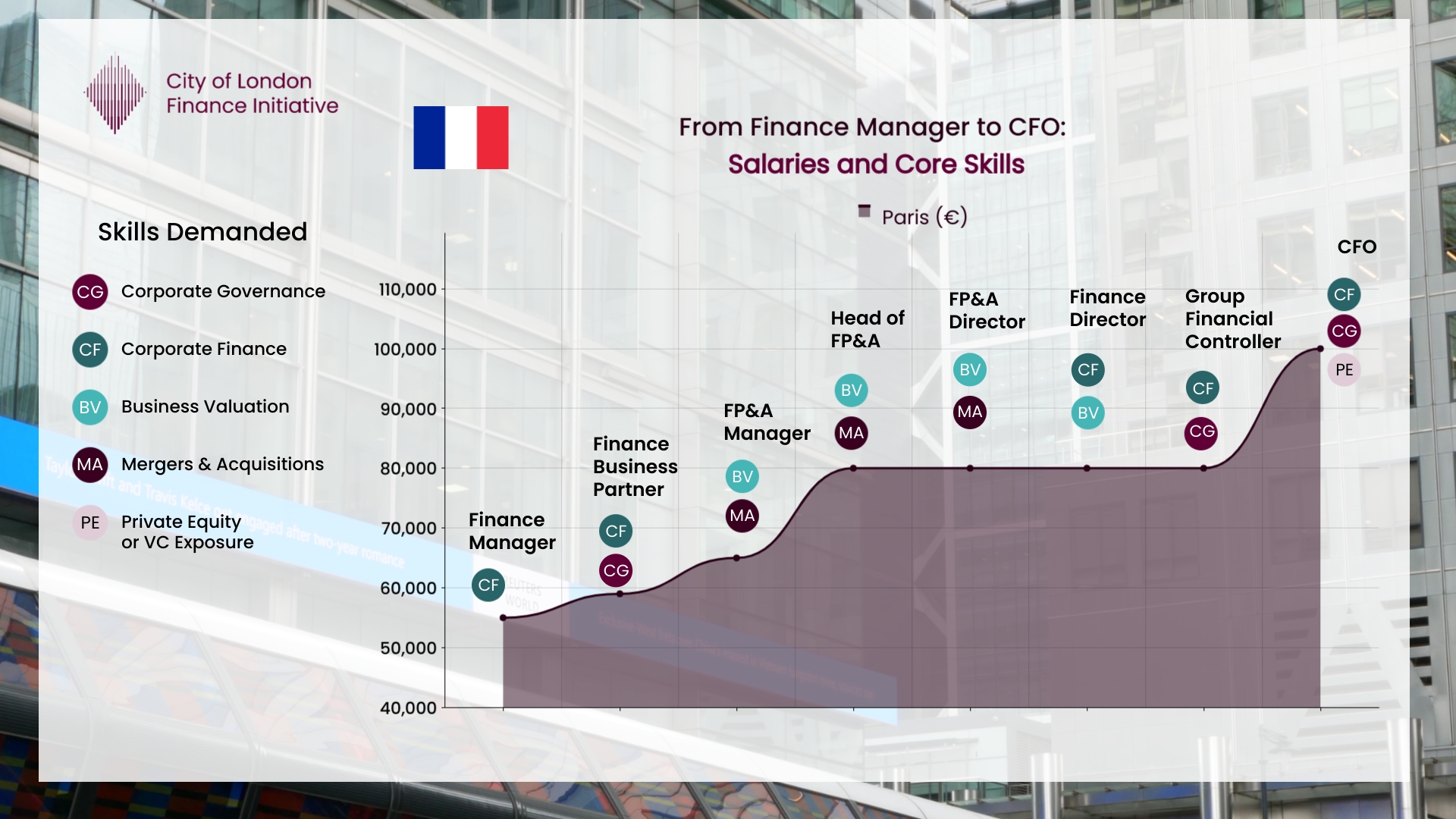

Our research across London, Paris, Milan, and Madrid shows a clear correlation between compensation levels and the depth of corporate finance expertise professionals bring to their roles. Skills in valuation, investment analysis, and private markets exposure are consistently in high demand across the most active areas of the finance job market — from FP&A and strategy to M&A and private equity — making corporate finance one of the strongest drivers of career and salary progression.

What to Look for in a Corporate Finance Course

Selecting the right corporate finance course is as strategic as the subject itself. The best programmes combine academic depth with real-world application. Practitioner-led instruction ensures that concepts like valuation and capital structure are grounded in current market realities, not just textbook examples.

Professionals should prioritise courses that include hands-on case studies and flexibility in delivery — whether online, hybrid, or in-person. Equally valuable is the learning environment: peer interaction, access to experienced faculty, and exposure to London’s financial ecosystem all add context and depth to the learning experience.

The City of London Finance Initiative (CLFI) offers a uniquely flexible model. Participants can study entirely online, in hybrid format with in-person masterclasses, or through intensive three-day sessions in London’s financial district. This adaptability ensures that senior professionals can integrate high-quality executive education into their schedule without compromising professional commitments.

How CLFI Bridges Learning with Real-World Application

The Executive Certificate in Corporate Finance, Valuation & Governance is designed to equip professionals with the analytical and strategic tools to lead confidently in complex financial environments. Led by faculty member Edward Bace, Senior Lecturer in Corporate Finance and former S&P Director, the course connects advanced academic content with real-world application.

Participants work through practical valuation exercises, governance theory and practice, and M&A case studies that mirror the challenges faced in senior finance and board roles. The combination of practitioner insight, real-world application, and flexible delivery positions the programme as a leading choice for professionals seeking executive development grounded in boardroom realities.

Capital Is a Resource. Allocation Is a Strategy.

Learn more through the Executive Certificate in Corporate Finance, Valuation & Governance – a structured programme integrating governance, finance, valuation, and strategy.