Restaurant Profit Margins

This CLFI guide explains how margins are calculated, what drives them, and how restaurant owners and investors can benchmark performance, improve efficiency, and build sustainable profitability.

Inside the AI Economy: How Circular Investment and Energy Demand Are Reshaping Business

Explore how AI’s trillion-dollar cycle is being driven by energy demand, hyperscaler spending, and circular financing between major players like OpenAI, Nvidia, and Oracle. Understand what business leaders should watch as AI reshapes productivity, capital, and competition.

Online Corporate Finance Course with Private Equity, Venture Capital & M&A | CLFI

Explore CLFI’s online corporate finance course with modules in private equity, venture capital, and M&A — designed for executives shaping strategic decisions.

Corporate Finance Careers: Skills, Pathways, and Boardroom Readiness

Explore corporate finance career paths, core skills, and leadership capabilities needed for strategic and board-level roles, with practical insight from CLFI faculty.

How to Get a Job in Private Equity: Skills, Courses & Salaries

Explore our Private Equity course and learn how PE firms operate, what roles exist, and why PE-backed company jobs offer higher salaries.

From Finance Manager to CFO: The Skills that Redefine the Modern Finance Career Path

How do finance professionals make the leap to CFO? Explore the skills, strategic literacy, and executive education shaping modern finance careers.

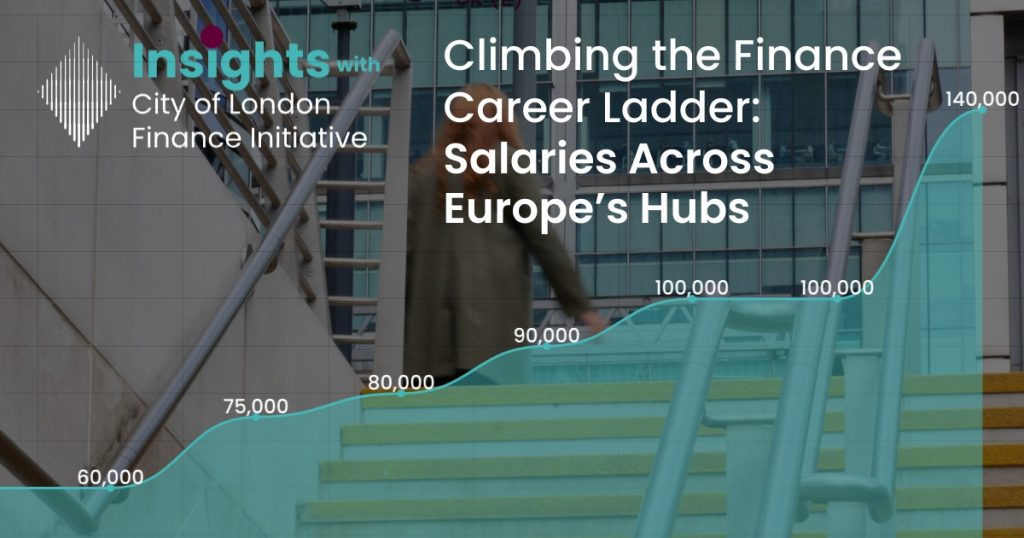

Climbing the Finance Career Ladder: Salaries Across Europe’s Hubs

Explore 2025 salary ranges for CFOs, Finance Directors, and FP&A leaders across London, Paris, Milan, and Madrid, and the skills driving demand.

Selling to Private Equity: How Valuation Really Works

Learn how private equity firms value companies, from EBITDA multiples to DCF, including key adjustments, sector benchmarks, and real-world examples.

Corporate Finance Course Receives CPD Certification for Strategic Decision-Making

Strategic Corporate Finance Course Receives CPD Certification London, 09 September 2025 — City of London Finance Initiative (CLFI) announces that its Strategic Corporate Finance – Executive Course has been CPD Certified by The UK CPD Certification Service. Following independent assessment, the course was described as “an excellent course that more than meets the required level […]

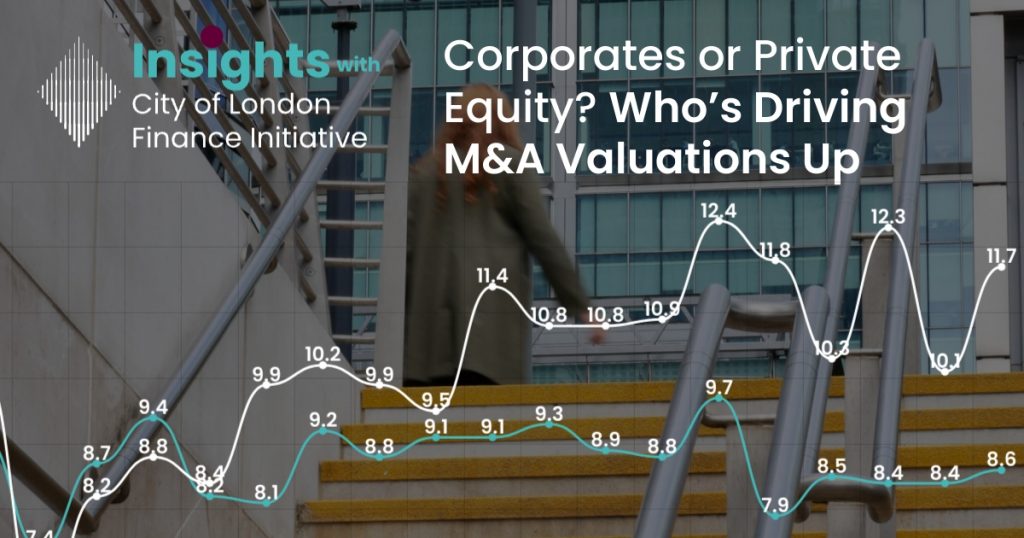

EBITDA Multiples by Industry (2025): Who’s Paying What

Discover 2025 M&A EV/EBITDA multiples by industry and region. Compare PE vs corporate buyers, deal valuations, and trends across US and Europe.