Table of Contents

Corporate Governance Courses and Career Pathways: Building Boardroom Expertise for Modern Leadership

- 8 min read

Why Corporate Governance Matters in the Modern Boardroom

Corporate governance defines how companies are directed, controlled, and held accountable. It determines where authority lies, how decisions are made, and the ethical and strategic standards expected of leadership. Far from being a purely regulatory concern, governance is now viewed as a strategic function — the architecture through which trust, transparency, and long-term value are built.

Corporate governance is, at its heart, about responsible leadership. Boards that govern well don’t just comply — they inspire trust, manage risk, and create conditions for sustainable growth. For executives aspiring to influence strategy at the highest levels, mastering governance is not a formality; it’s a strategic investment in their credibility and career longevity.

Key Learning Areas in a Corporate Governance Course

The Corporate Governance module within CLFI’s Executive Certificate in Corporate Finance, Valuation & Governance is structured around four integrated areas of learning:

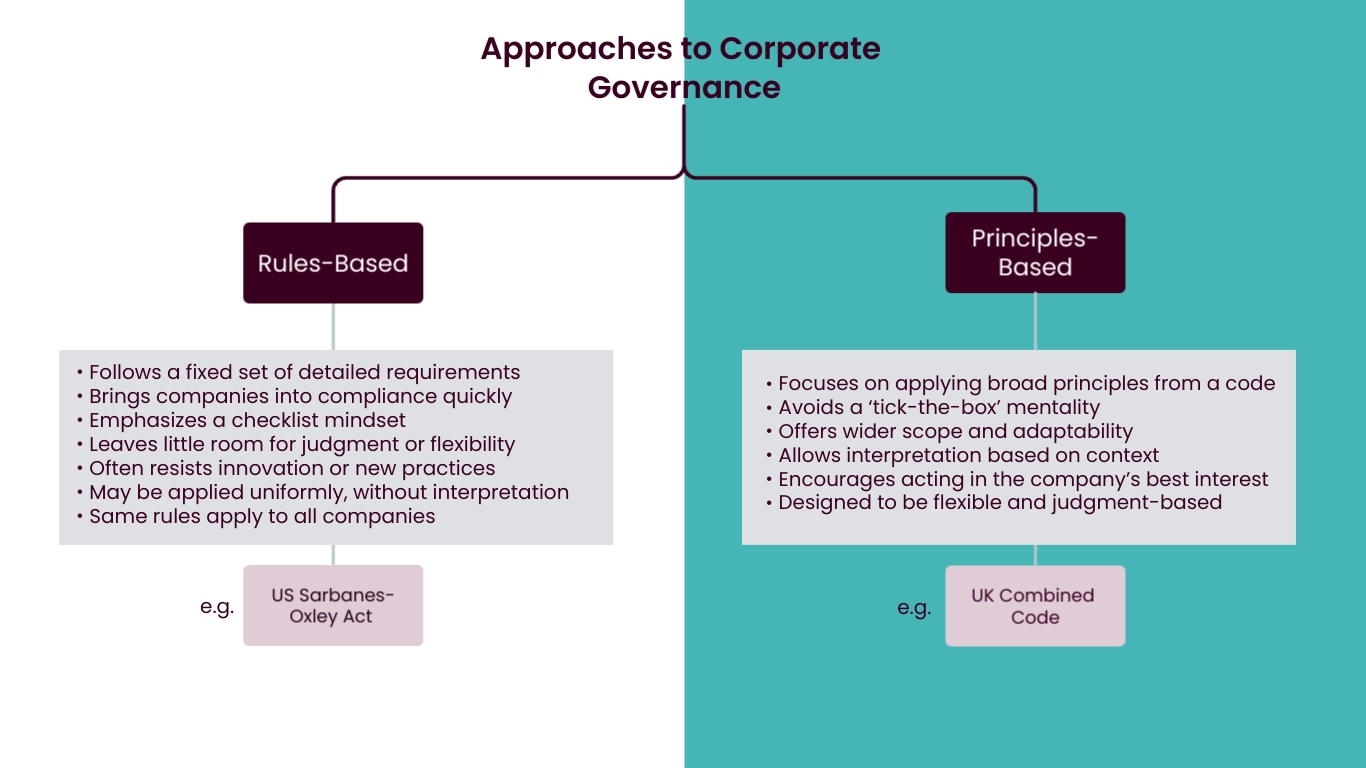

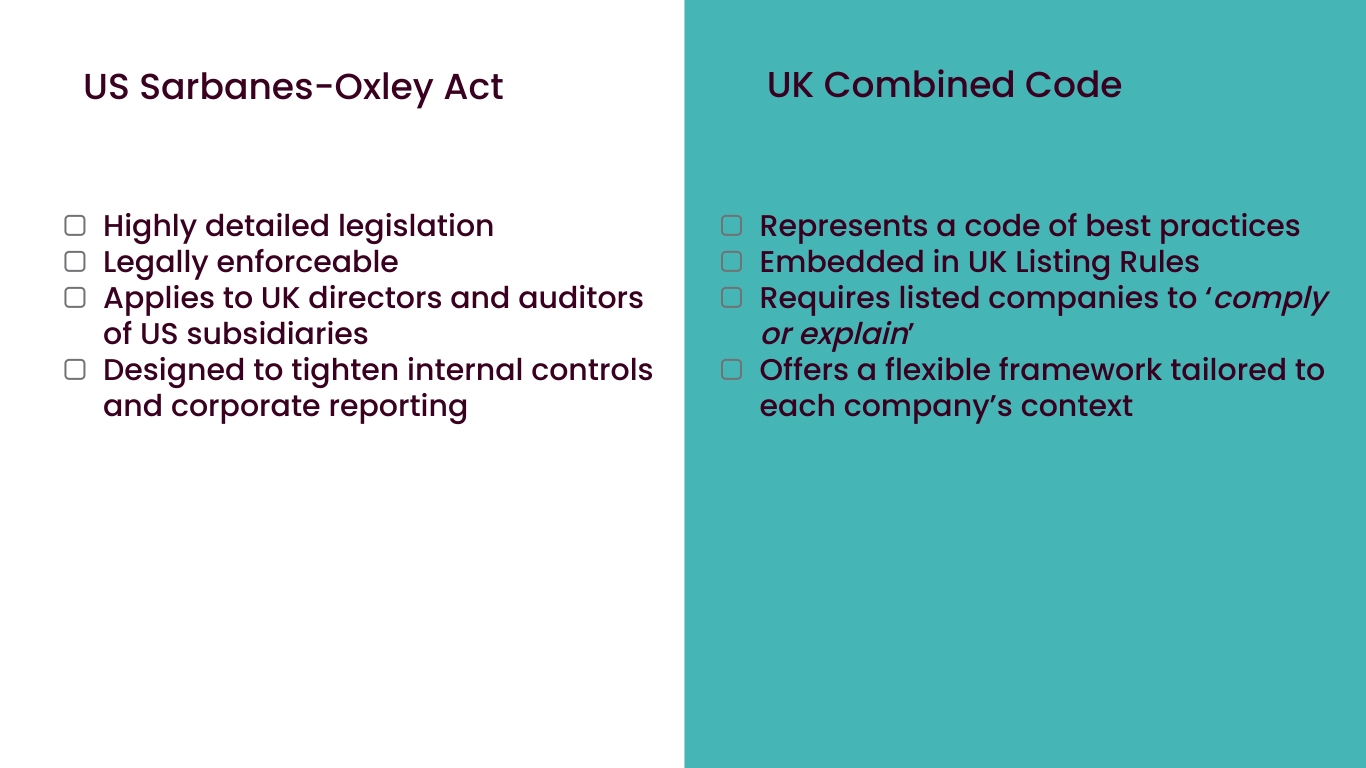

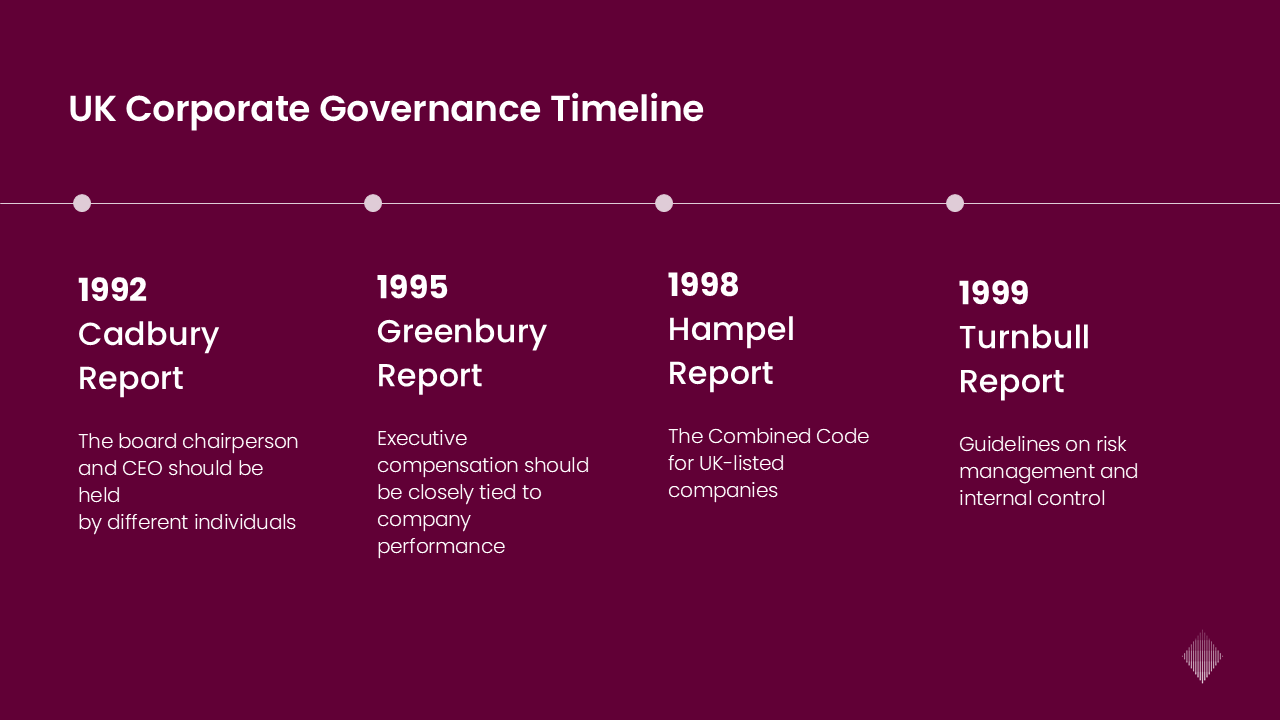

- Governance Frameworks: Understanding global models including the UK Corporate Governance Code and international equivalents, and how they translate into practical responsibilities for boards and committees.

- Board Structure and Composition: The dynamics of executive and non-executive directors, diversity and independence requirements, and how effective boards maintain balance between oversight and management.

- Committees and Oversight Functions: In-depth study of audit, remuneration, nomination, risk, and sustainability committees, with focus on their mandates, composition, and reporting lines.

- Ethics, Accountability, and ESG Integration: How corporate culture, sustainability, and stakeholder engagement influence board decision-making and long-term resilience.

Through case studies — including the Tesla Board Oversight and Essilor-Luxottica merger — participants examine how governance frameworks operate under real pressure, and how board decisions influence corporate direction and investor trust.

Grow expertise. Lead strategy.

Build a better future with the Executive Certificate in Corporate Finance, Valuation & Governance.

From Compliance to Strategy: The Expanding Scope of Governance

The UK Corporate Governance Code, developed by the Financial Reporting Council (FRC), is one of the most respected frameworks worldwide, setting expectations for board leadership, accountability, and engagement with shareholders. Its principle-based “comply or explain” model encourages thoughtful application rather than box-ticking — making governance a living practice rather than a static rulebook.

Modern boards operate through specialised committees that reflect this broader view. Audit, remuneration, nomination, risk, and sustainability committees all serve distinct but interconnected roles. Together, they ensure that financial oversight, talent succession, ethical conduct, and long-term strategy remain aligned. A well-structured committee system signals to investors that the organisation values transparency and performance in equal measure.

Why Study Corporate Governance?

For professionals aspiring to senior management or board positions, governance education builds the knowledge base and judgement required for effective oversight. Training in corporate governance offers insight into how boards operate, how responsibilities are divided, and how decisions are made under fiduciary duty. It equips participants with the tools to evaluate board performance, manage stakeholder expectations, and navigate complex ethical or regulatory challenges.

Understanding governance improves communication with non-executive directors, auditors, and investors. It also enhances credibility when discussing topics such as remuneration alignment, audit independence, or enterprise risk management.

Over the past two decades, the number of publicly listed companies has steadily declined, while private equity and venture capital have become dominant sources of business funding. This shift has fundamentally altered the expectations placed on company leaders. Investors in private markets now play a central role in shaping governance standards, strategic direction, and performance oversight.

For entrepreneurs and directors of privately held or investor-backed companies, governance training provides the discipline and structure that these backers increasingly require. Private equity and venture capital firms expect robust reporting, defined accountability, and transparent decision-making from the companies they support. Understanding governance frameworks is therefore not just a matter of good practice — it is a prerequisite for attracting and retaining investor confidence.

How CLFI Bridges Governance Learning with Boardroom Application

The Executive Certificate in Corporate Finance, Valuation & Governance by the City of London Finance Initiative (CLFI) combines governance principles with real-world financial insight. Taught by seasoned academics and City practitioners, the programme bridges theory and boardroom practice through case-based learning and interactive sessions.

Participants gain a holistic understanding of how governance, finance, and strategy intersect — from evaluating risk frameworks to designing effective board structures and committee oversight. The course empowers executives to contribute confidently to board discussions, ensuring their decisions uphold accountability, ethics, and long-term value creation.

Programme Content Overview

The Executive Certificate in Corporate Finance, Valuation & Governance delivers a full business-school-standard curriculum through flexible, self-paced modules. It covers five integrated courses — Corporate Finance, Business Valuation, Corporate Governance, Private Equity, and Mergers & Acquisitions — each contributing a defined share of the overall learning experience, combining academic depth with practical application.

Chart: Percentage weighting of each core course within the CLFI Executive Certificate curriculum.

Grow expertise. Lead strategy.

Build a better future with the Executive Certificate in Corporate Finance, Valuation & Governance.

Participants work through practical valuation exercises, governance theory and practice, and M&A case studies that mirror the challenges faced in senior finance and board roles. The combination of practitioner insight, real-world application, and flexible delivery positions the programme as a leading choice for professionals seeking executive development grounded in boardroom realities.

Grow expertise. Lead strategy.

Build a better future with the Executive Certificate in Corporate Finance, Valuation & Governance.