Table of Contents

Climbing the Finance Career Ladder: Salaries Across Europe’s Hubs

- 8 min read

Context & Shift

Careers in senior finance are increasingly defined by a combination of compensation potential and strategic influence. The traditional perception of finance roles as limited to technical and backward-looking activities such as accounting or financial reporting has shifted. Today, finance executives are expected to contribute directly to strategic planning, investment appraisal, and board-level decision-making. These responsibilities demand strong capability in business valuation, attention to customer dynamics, and a focus on cash generation metrics—skills particularly visible in industries such as SaaS. The shift is evident both in the evolving structure of senior finance roles and in the salary benchmarks shaping Europe’s major business hubs.

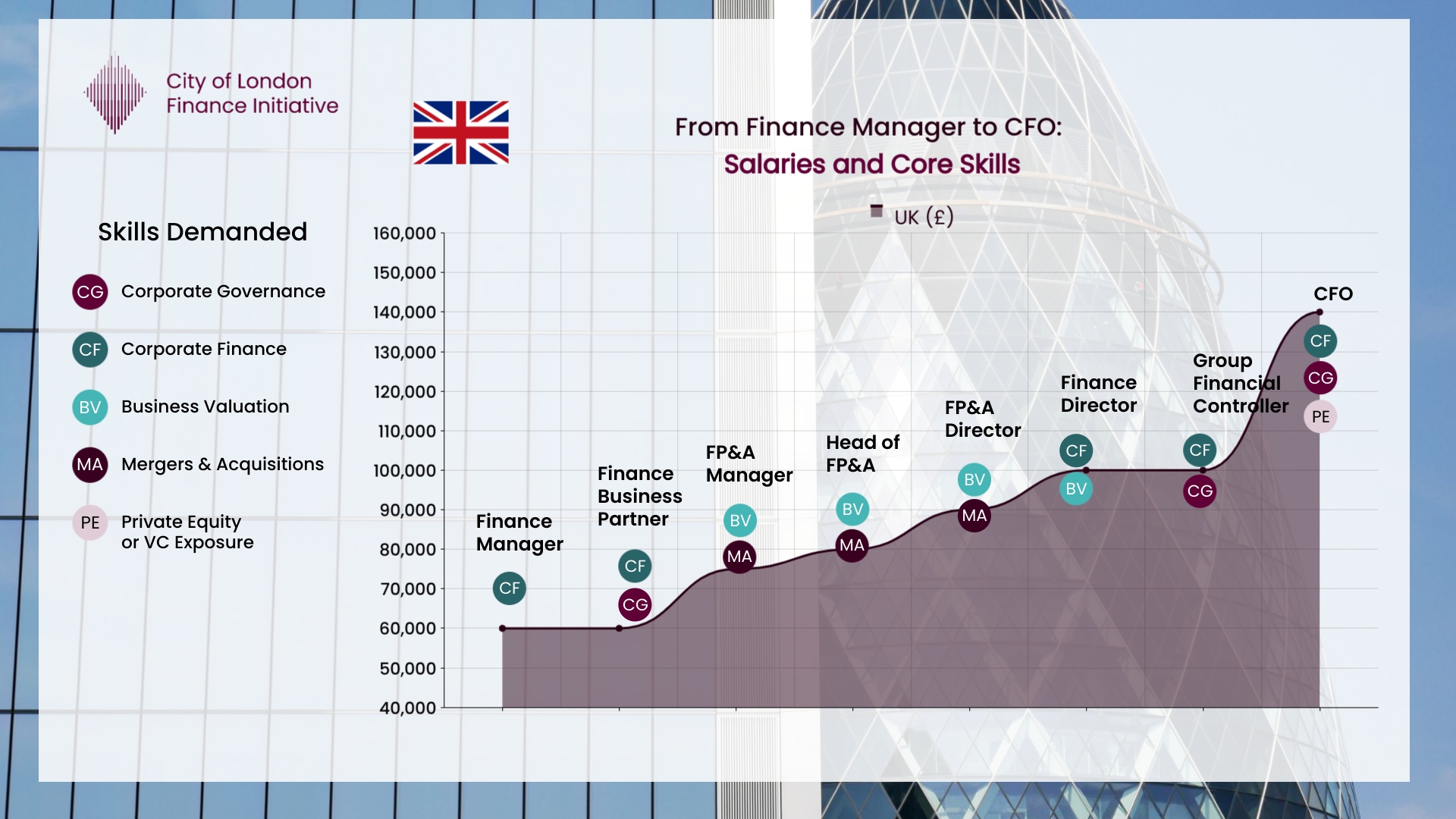

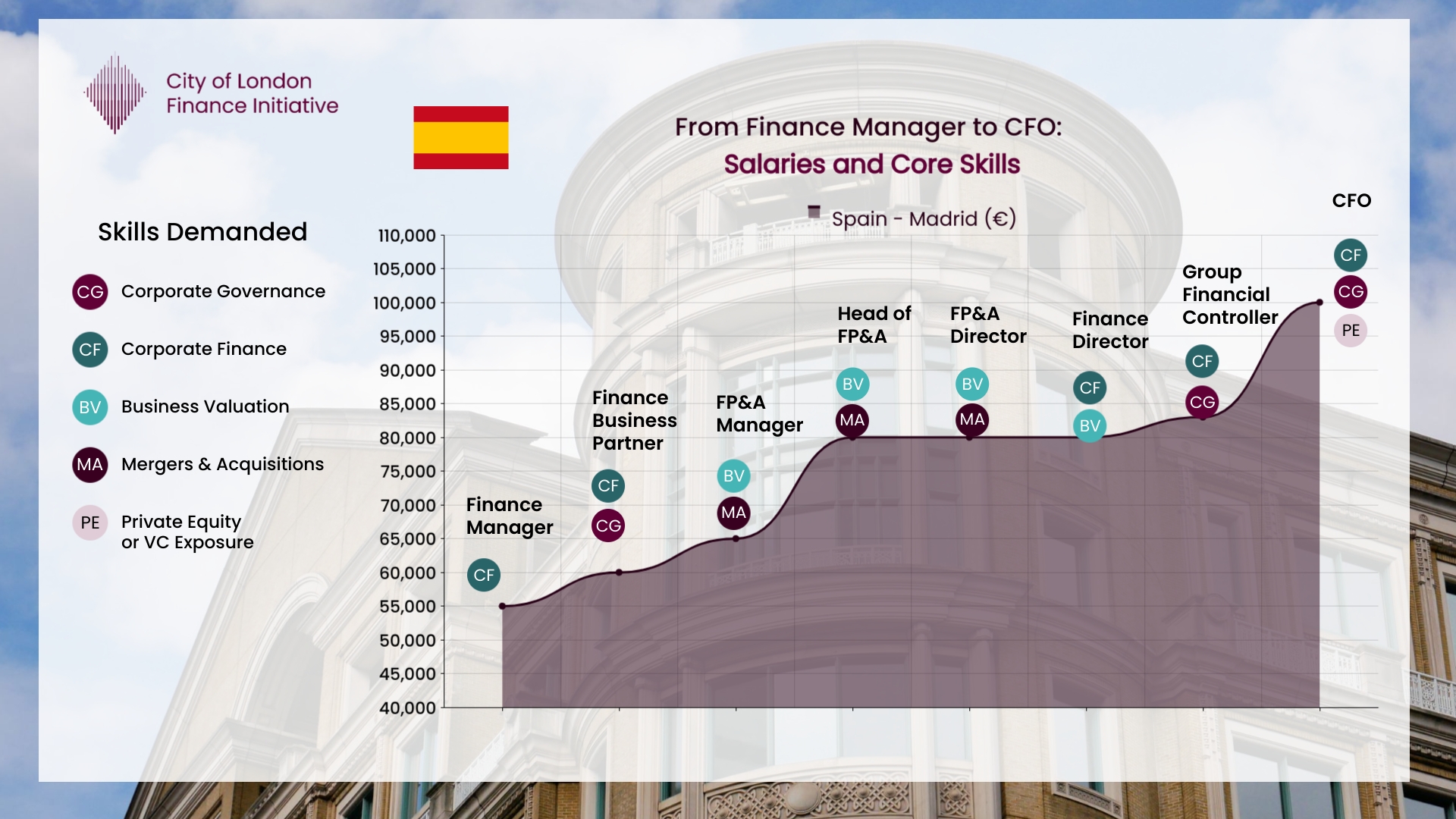

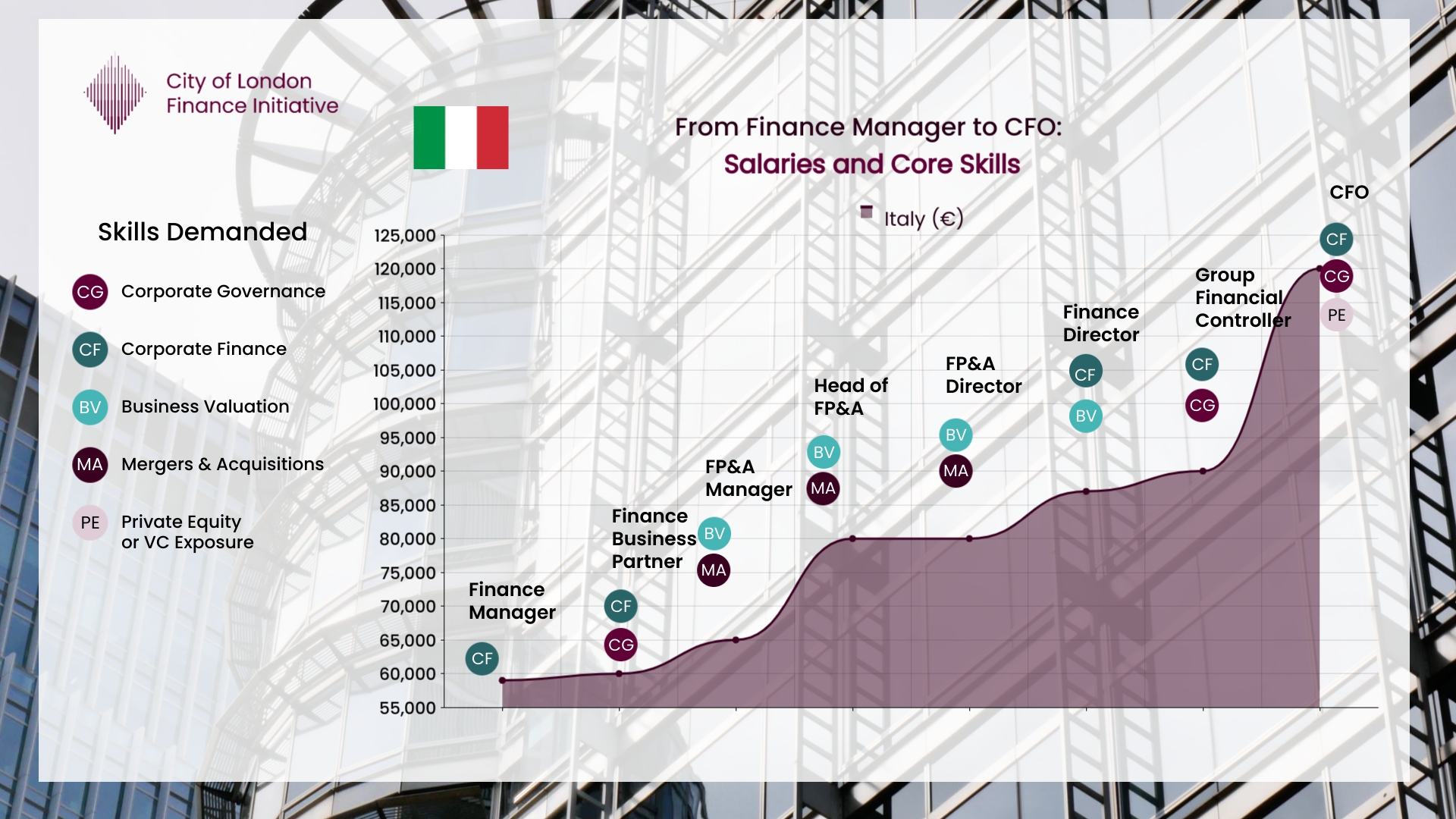

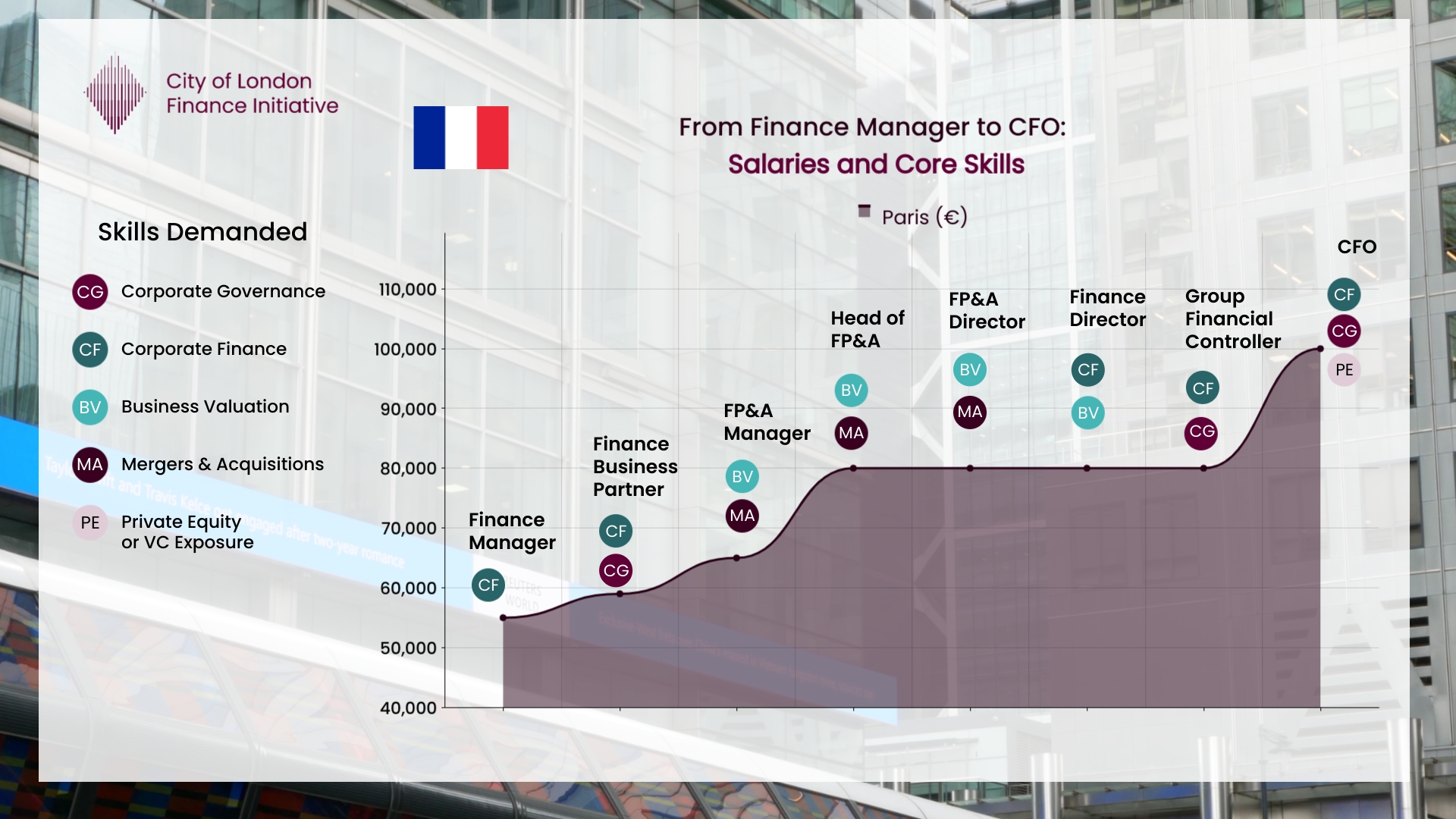

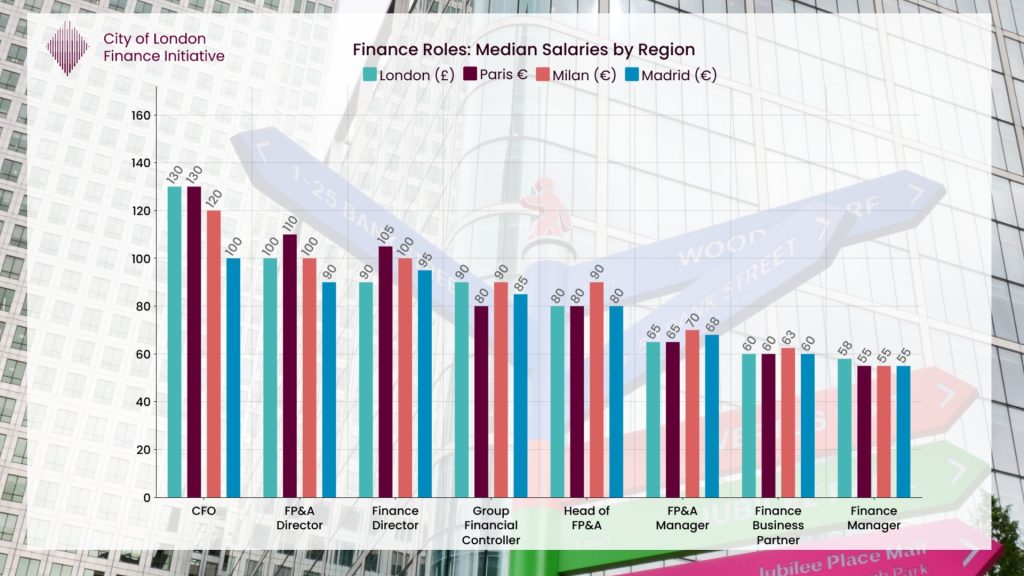

Across London, Paris, Milan, and Madrid, salaries for roles such as Finance Director, FP&A lead, or Chief Financial Officer reflect not only accountability for compliance and reporting, but also an expectation of broader strategic engagement. Median pay ranges, often supplemented by substantial bonus structures, indicate how employers are pricing a mix of technical mastery and strategic competence. For ambitious professionals, the critical question becomes: which skills should be prioritised to climb the salary ladder?

A review of senior finance job listings across the UK and continental Europe highlights five recurring areas of expertise associated with the most competitive compensation packages:

Corporate Governance

Corporate Finance

Business Valuation

Experience in Private Equity or Venture Capital-backed companies

Mergers and Acquisitions

Each step on the salary ladder is associated with a distinct skill profile. Finance Business Partners are typically expected to demonstrate strong knowledge in corporate finance and governance. FP&A positions require fluency in financial modelling and business valuation. At director and CFO levels, employer expectations expand to include corporate governance, mergers and acquisitions, and in some cases, private equity exposure. These clusters of expertise closely mirror the course content taught in advanced executive programmes, including corporate finance, valuation, governance, and deal-making.

Dominance & Diversification

The consolidated salary data highlights a clear hierarchy across Europe’s financial hubs. At the entry point to senior finance, Finance Managers and Finance Business Partners tend to earn in the mid-50k range in continental markets and around £60k in London. At the upper levels, CFO packages extend to around £130k in London, while top positions in Paris and Milan reach the €120k to €130k range, and Madrid follows at approximately €100k. Intermediate roles such as FP&A Directors and Finance Directors typically fall between €90k and €110k in continental Europe and approach the £90k to £100k range in London. Bonuses, often accounting for 10 to 20 percent of total compensation, can be particularly significant in larger firms and financial services.

Regional variation remains pronounced. London stands out as the most lucrative hub, with salary benchmarks consistently above those in continental Europe. Paris offers compensation at the higher end of the continental range, while Milan maintains competitive pay for senior roles given its position as Italy’s financial centre. Madrid offers slightly lower headline salaries but delivers robust overall packages when adjusted for cost of living. A common theme across all hubs is the rising premium placed on finance professionals who can combine traditional financial control with advanced capabilities in valuation, governance, and corporate finance.

Programme Content Overview

The Executive Certificate in Corporate Finance, Valuation & Governance delivers a full business-school-standard curriculum through flexible, self-paced modules. It covers five integrated courses — Corporate Finance, Business Valuation, Corporate Governance, Private Equity, and Mergers & Acquisitions — each contributing a defined share of the overall learning experience, combining academic depth with practical application.

Chart: Percentage weighting of each core course within the CLFI Executive Certificate curriculum.

Grow expertise. Lead strategy.

Build a better future with the Executive Certificate in Corporate Finance, Valuation & Governance.

Looking Forward: Risk, Optimism, Relevance

As private capital plays a larger role in European economies and public listings decline, professionals with expertise in private equity and M&A are well positioned to capture the salary premium. The trend towards financial fluency in the boardroom suggests that careers in finance will continue to expand in influence and compensation, provided individuals actively update their skillset.

Valuefinex, provider of fractional CFO services in the UK and Europe said, «our fractional CFOs operate for Private Equity-backed and Series A+ companies, where the role typically requires senior finance leaders to streamline processes, improve information flow, and take an active role in the commercial side of finance.»

«Employers consistently demand strong financial literacy, a minimum of five years post-qualification experience (ACCA or ACA), and the ability to work effectively across departments.»

Programmes that integrate corporate finance, valuation, governance, and private equity equip professionals with the precise tools that employers associate with career progression in the salary benchmarks.

The European salary ladder for finance professionals highlights both the promise and the constraints of career progression. The direction of travel is clear: roles are becoming more strategic, skills more diversified, and compensation more closely linked to impact at the board level.

Explore Further from CLFI Insight

References:

- 2025 Accounting & Finance Salary Guide (UK).

- Michael Page, Studi di Retribuzione 2025, Italy.

- Michael Page, Estudio de Remuneración 2025, Spain.

- Finance Salaries in London: A Competitive Landscape