Table of Contents

Private Equity’s Power Shift: From Public Markets to Private Giants

- CLFI Team

- 10 min read

- Contributors: Edward Bace, Nicolas Moura (PitchBook Analyst) and SP Global Market Intelligence team

- Reviewed by: Farhan Qamar

- Last updated: January 3, 2026

The Decline of Public Listings and the Rise of Private Capital

Although 2024 brought high-profile IPOs like Reddit, and 2025 saw CoreWeave file to go public amid the latest wave of AI-driven investment enthusiasm, both on U.S. exchanges, the broader trend remains unchanged: the number of listed public companies continues to decline.

As 2025 began, many anticipated a rebound in M&A and IPO activity, driven by expectations that the new U.S. administration would pursue a deregulatory agenda. However, global dealmaking has so far fallen short of those hopes. The size and scale of private equity have remained dominant, a reflection of decades-long expansion.

Public markets, long associated with transparency, price discovery, and liquidity, have steadily ceded ground to private capital — now more concentrated, strategically deployed, and increasingly embedded in the financial system. Harvey Schwartz, CEO of Carlyle, stated in a recent Bloomberg interview that over the past 25 years, private capital has emerged as a more efficient alternative to public markets for companies seeking funding.

Private equity funds, originally niche vehicles for institutional capital and corporate carveouts, have become foundational to the capital ecosystem. Companies with stable cash flows or long-term growth potential increasingly favour private ownership, not only to avoid regulatory burdens and market volatility, but to escape the short-term pressures of quarterly reporting and retain greater strategic control.

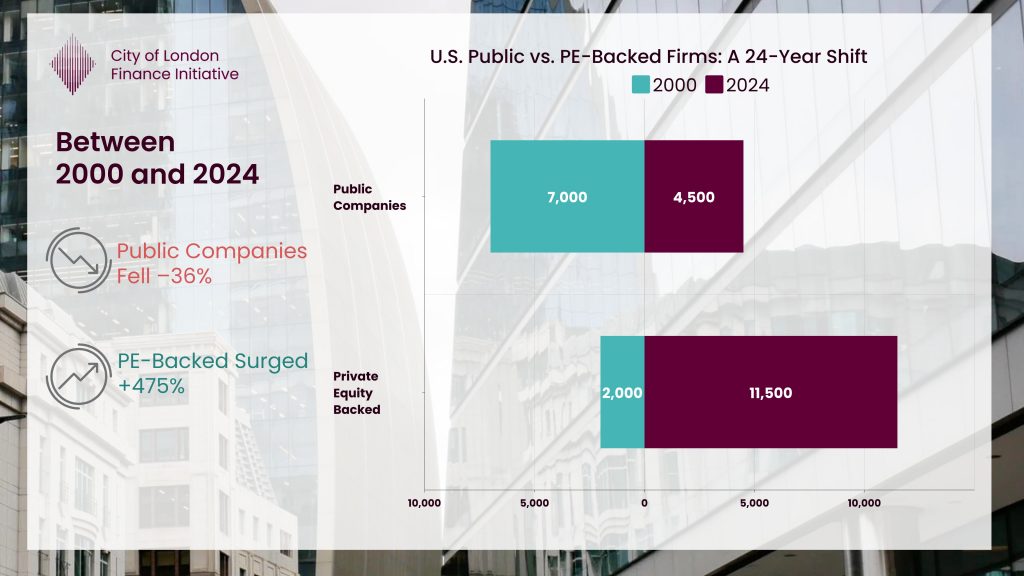

Between 1996 and 2022, the number of U.S. public companies fell from over 7,000 to fewer than 4,000. Fewer private firms chose to go public, while many listed firms exited through mergers, buyouts, or business failure.

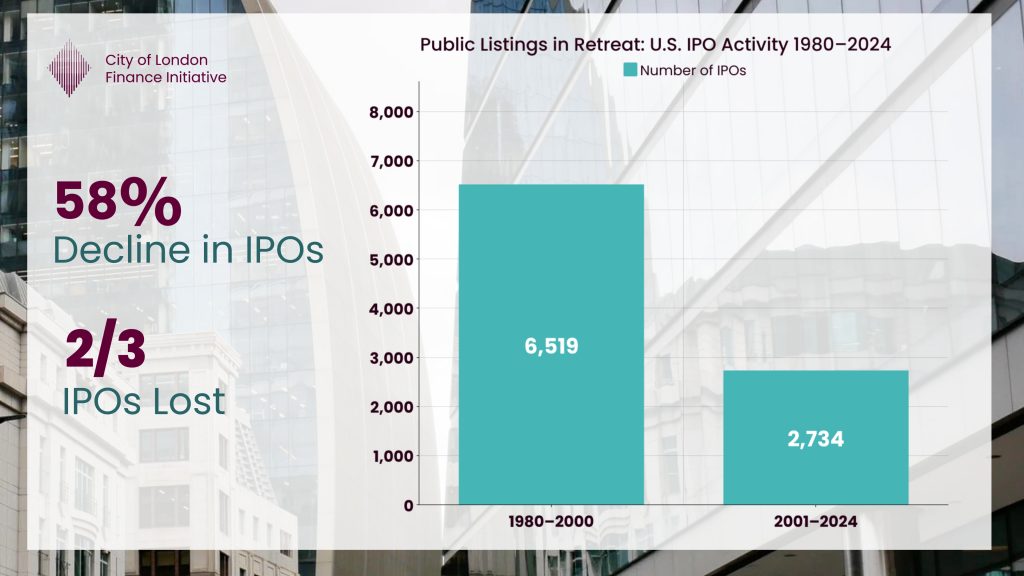

IPO volume in the U.S. has also declined sharply over the past two decades. While more than 6,500 public offerings occurred between 1980 and 2000, the two decades leading up to the dot-com era, fewer than 2,800 took place between 2001 and 2024, a comparable post-dot-com period. A drop that reflects the structural shift toward private ownership.

Source: Jay R. Ritter, Initial Public Offerings: Updated Statistics, University of Florida, July 2025.

Venture-backed and buyout-backed IPOs now represent a significant portion of public listings, accounting for approximately 40% and 14% of recent IPOs respectively. This trend underscores the growing influence of private capital in shaping companies well before they reach public markets. Over the past 25 years, the number of U.S. companies backed by private equity has increased more than fivefold, rising from around 2,000 to over 11,500.

Source: Jay R. Ritter, Initial Public Offerings: Updated Statistics, University of Florida, July 2025.

This reversal has reshaped financing options, enabling firms to raise vast sums without ever going public. For instance, OpenAI, the firm behind ChatGPT, has raised $57.9 billion across 11 private rounds, most recently securing $40 billion in a single Series F led by SoftBank, reaching a $300 billion valuation without listing. Databricks has followed a similar path, raising $8.6 billion of a planned $10 billion Series J round, valuing the company at $62 billion. Both have scaled through private capital, sidestepping the scrutiny and structural demands of public markets. IPOs have become rarer, while buyouts, growth equity, and private debt deals flourish.

Yet despite this sharp numerical decline, the economic significance of public firms has not diminished. Public firms today are more profitable than ever, significantly larger on average — with the striking example of Microsoft briefly surpassing a $4 trillion valuation, second only to Nvidia — and active across a broader range of industries, underscoring their continued dominance despite shrinking in number.

The structural shift toward private ownership, the role of private equity within the capital ecosystem, and the implications for investors and companies are examined in the Private Equity Executive Course.

The Dominance and Diversification of PE Giants

The structural shift is perhaps best seen in the scale and scope of today’s leading private equity firms. As of Q2 2025, Blackstone leads with $1.21 trillion in AUM. Ares Management and KKR follow at $545.9 billion and $541 billion respectively. Carlyle, under Schwartz, reports $453 billion, and TPG manages $250.6 billion.

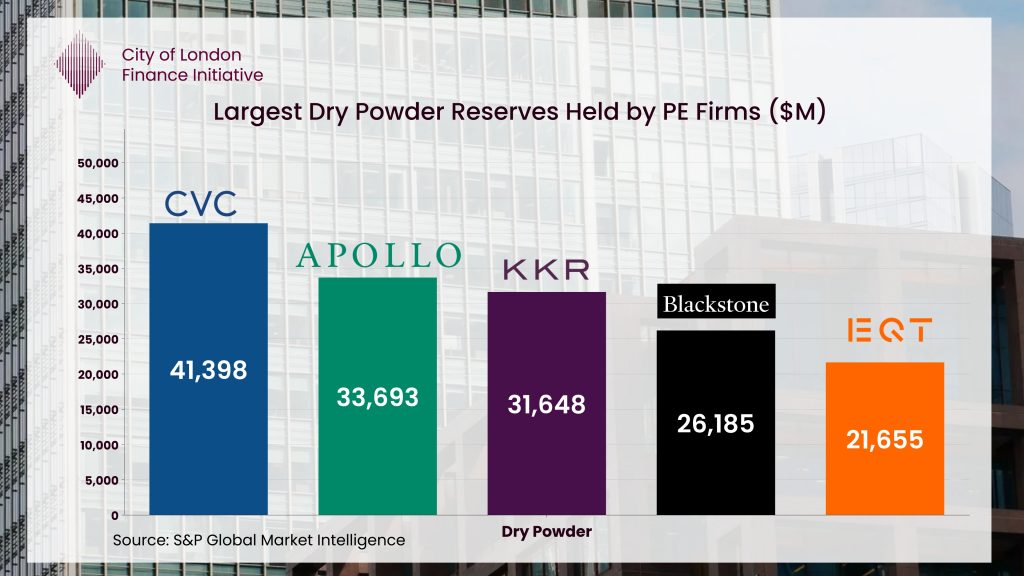

Some of these firms also rank among the top holders of dry powder globally, highlighting their capacity to move quickly when deals become available. The chart below shows the five private equity firms with the largest uncommitted capital reserves as of mid-2024.

Source: S&P Global Market Intelligence (2024). Based on latest dry powder figures by firm.

The term “private equity” may no longer capture their reach. These firms have evolved into multi-asset managers with global portfolios spanning sectors such as infrastructure, logistics, insurance, credit, real estate, and technology. Their reach now extends well beyond traditional buyouts, reflecting a shift toward diversified, sector-driven investment platforms.

But private equity is not just about buying. Firms operate with clearly outlined exit strategies, agreed upon with their capital providers —whether general partners or direct shareholders. However, the industry is now meeting resistance. Inflation, rising interest rates aimed at curbing it, and the threat of new U.S. trade tariffs have added further uncertainty to an already cautious dealmaking environment.

According to PitchBook’s Senior Analyst, EMEA Private Capital Research, Nicolas Moura: «There could be four spillover effects from imposed tariffs on European PE:

- Take-private opportunity: Lower share prices equal lower valuations and thus present a buying opportunity for firms with substantive dry powder.

- Denominator effect: LPs are likely to reduce PE allocations due to the denominator effect arising from a fall in public markets.

- Secondaries activity is poised to rise: Given the increase in market volatility and pricing, as well as the potential rise of the denominator effect, we expect to see more GPs and LPs forced to sell assets and portfolios. This would see secondaries PE deal activity accelerate from already-record levels.

- US investors could withdraw from Europe: In the medium term, lower global growth and potential recessions could cause lower PE deal activity and a retraction of US investor participation in European deals. Currently, 1 in 5 PE deals in Europe has a US investor on the ticket, but we expect this to drop if investor sentiment does not improve.»

While dry powder remains abundant, it has declined modestly from recent highs, and a significant portion is now aging, with capital sitting undeployed for extended periods. The pressure on fund managers is mounting. Valuation mismatches, macro volatility, and tighter deployment conditions have slowed transaction flow and made capital allocation more selective.

In response, general partners are relying more heavily on continuation funds, a controversial tactic that allows them to transfer portfolio assets into new vehicles they also manage. The Financial Times reported that continuation funds accounted for 19% of all private equity exits in the first half of 2025, marking a 60% year-on-year increase. Once viewed as a tactical workaround, these structures have become institutionalised, offering a way to crystallise performance, extend asset holding periods, and preserve fee income in a constrained exit environment.

Looking Forward: Risk, Optimism, and Strategic Relevance

Despite these concerns, the outlook remains largely optimistic. Demand for infrastructure, energy transition, and technology investment is rising.

Edward Bace, Corporate Finance Senior Lecturer at City of London Finance Initiative said, «the preference of private companies to avoid public scrutiny, regulatory oversight, and market volatility, alongside the availability of large, flexible capital pools, has allowed private equity to establish itself as an alternative to public markets. Private equity firms are not regulated in the same way as public companies, nor subject to equivalent disclosure requirements. If done properly, private equity can make a valuable contribution to economic and social development. Where it goes wrong, it can have devastating consequences for society and wealth creation, so it is important to conduct it in an exacting and responsible fashion.»

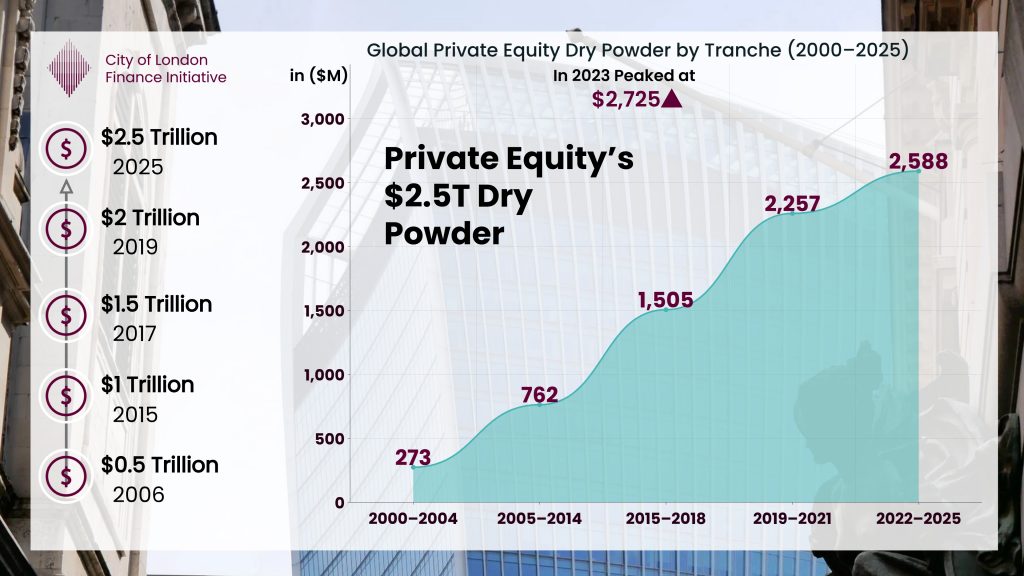

Global private equity dry powder continues to decline from its recent all-time high, even as private equity fund managers remain under pressure to put investors’ capital commitments to work. Global private equity funds collectively held nearly $2.515 trillion in dry powder as of June 30, down 7.7% from a record $2.725 trillion in 2023, according to data from S&P Global Market Intelligence.

Source: S&P Global Market Intelligence, July 2025

Carlyle CEO highlights this direction. He envisions private markets not just as a complement to public ones, but as a new financial centre of gravity, anticipating that “the demand for private capital will only increase”. For executives, this shift is not theoretical. Understanding how private capital operates, and how its incentives differ from those of public shareholders or traditional capital providers, is now essential for leaders navigating strategic finance.

As private markets assume a more prominent role in the financial system, their influence increasingly extends beyond corporate finance into areas with direct societal relevance. From housing and healthcare, to infrastructure and cultural assets. This expansion raises important questions around governance, transparency, and long-term accountability. Whether the growing concentration of capital leads to more resilient outcomes or introduces new systemic risks will depend not only on how private equity evolves, but also on how it is interpreted, regulated, and challenged by the broader financial and policy ecosystem.

References:

- Quotation from Nicolas Moura, Senior Analyst, EMEA Private Capital Research at PitchBook. Source: PitchBook Data, Inc.

- Global private equity dry powder figures sourced from S&P Global Market Intelligence, July 2025.

- Edward Bace is a senior finance professional with over 30 years’ experience in investment banking, financial regulation, and higher education. He leads the Corporate Finance and Business Valuation courses at City of London Finance Initiative and is also a Senior Lecturer in Finance & Investment at Middlesex University.

- Going Private With Carlyle CEO Harvey Schwartz, Bloomberg Originals, 2024. https://www.bloomberg.com/news/videos/2024-05-08/going-private-with-carlyle-ceo-harvey-schwartz-bullish-video

- Jay R. Ritter, Initial Public Offerings: Updated Statistics, University of Florida, Warrington College of Business, July 2, 2025. https://site.warrington.ufl.edu/ritter/files/IPO-Statistics.pdf

- Scott Reeds, The Public to Private Equity Pivot Continues, Citizens Bank, December 2024. https://www.citizensbank.com/corporate-finance/insights/private-equity-trends.aspx