Table of Contents

The UK Corporate Governance Code: Principles and Practice

- CLFI Team

- 7 min read

The UK Corporate Governance Code serves as a cornerstone for governance in the UK, offering a structured yet flexible framework for companies listed on the London Stock Exchange. It provides a benchmark for best practices in board leadership, accountability, and stakeholder engagement. While the Code is not legally binding, it operates on the principle of “comply or explain”, which gives companies the option to either follow its provisions or publicly justify any alternative arrangements. This approach encourages meaningful dialogue and allows for thoughtful adaptation, while still upholding high standards of accountability.

These principles form part of the broader discipline of Corporate Governance as applied at board level, which is examined in depth in the Corporate Governance Executive Course.

Table of Contents

- What Is the UK Corporate Governance Code?

- The Core Principles Explained

- Comply or Explain: What It Means

- Board Responsibilities Under the Code

- How the Code Has Evolved

- Comparison with Other Global Frameworks

- Application in Practice

- Further Reading

What Is the UK Corporate Governance Code?

Let’s start by defining Corporate Governance:

It is the framework that defines how a company is directed, controlled, and held accountable. It clarifies where decisions are made, how authority is exercised, and the standards of conduct expected from those in leadership. At its core, governance helps ensure that boards act in the long-term interests of the organisation, balancing oversight, strategic direction, and responsibility in a way that builds confidence among shareholders, employees, and wider stakeholders.The UK Corporate Governance Code: Developed by the Financial Reporting Council (FRC), the Code is a foundational reference for boardroom leadership and accountability, specifically designed for companies listed on the premium segment of the London Stock Exchange. It promotes investor confidence, financial transparency, and effective risk oversight. Unlike prescriptive legislation, the Code adopts a principles-based approach, inviting companies to apply its provisions with the flexibility to account for their individual business context. The emphasis is not just on compliance but on thoughtful, well-articulated governance strategies that reflect the nature and risk profile of each organisation.

The Core Principles Explained

The Code is structured around a set of core principles that collectively form the foundation of effective corporate governance. These principles are not isolated rules but interconnected themes that influence how boards lead, control, and report on their organisations.

- Leadership. Boards are expected to define the company’s purpose, values, and strategy. They must ensure that resources are aligned to support long-term success and that a culture of integrity permeates the organisation.

- Board Effectiveness. Effective boards demonstrate diversity in thought, experience, and background. A strong emphasis is placed on appropriate composition, regular performance reviews, and continuous board development.

- Accountability. Directors are expected to present a clear and balanced assessment of the company’s financial position and prospects. Internal control and risk management must be robust and proportionate to the business.

- Remuneration. Executive pay should support long-term strategy and be aligned with performance. Remuneration policies must be transparent, fair, and subject to shareholder scrutiny.

- Shareholder Engagement. The board should maintain regular and constructive communication with shareholders. This ensures that shareholder perspectives are understood and considered in strategic and operational decisions.

Comply or Explain: What It Means

The Code’s most distinctive feature is its “comply or explain” mechanism. This approach offers companies the flexibility to depart from specific provisions when appropriate, provided that they explain the reasons clearly and convincingly. The quality of these explanations is critical. Investors, regulators, and the public rely on them to evaluate the legitimacy of alternative governance approaches. A boilerplate or vague explanation undermines credibility, where a thoughtful, company-specific rationale strengthens it. This model has influenced governance frameworks globally and reflects the UK’s pragmatic approach to regulation.

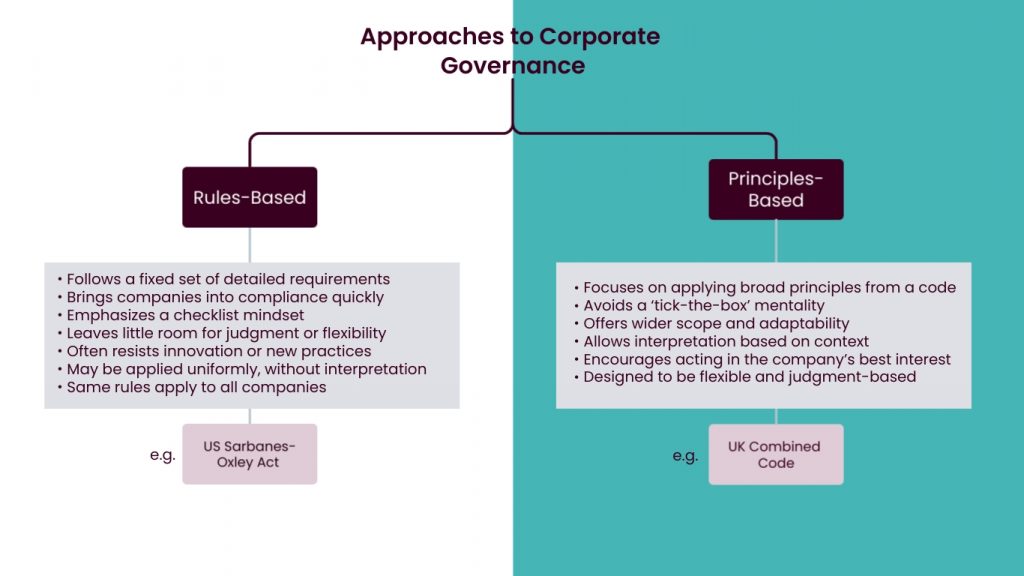

It’s important to recognise that different countries take distinct approaches to corporate governance compliance. For example, the U.S. Sarbanes–Oxley Act, which applies to companies listed on U.S. exchanges, follows a strict rule-based model.

Course: Corporate Governance

City of London Finance Initiative

https://clfi.co.uk/

Board Responsibilities Under the Code

One of the most practical aspects of the Code lies in its guidance on board composition and committee structures. Boards must not only lead strategically but also create substructures to monitor risk, ensure transparency, and uphold accountability. Key responsibilities include:

- Nomination Committee. Oversees board succession planning and ensures that board appointments are merit-based, diverse, and strategically aligned with the company’s future needs.

- Audit Committee. Monitors financial reporting, internal controls, and risk management frameworks. It also maintains the relationship with external auditors and ensures audit independence.

- Remuneration Committee. Designs and reviews executive pay structures. It ensures alignment with shareholder interests and avoids incentives that might encourage excessive risk-taking.

Corporate Governance Is More Than Compliance

Learn more through the Executive Certificate in Corporate Finance, Valuation & Governance — a structured programme integrating governance, finance, valuation, and strategy.

How the Code Has Evolved

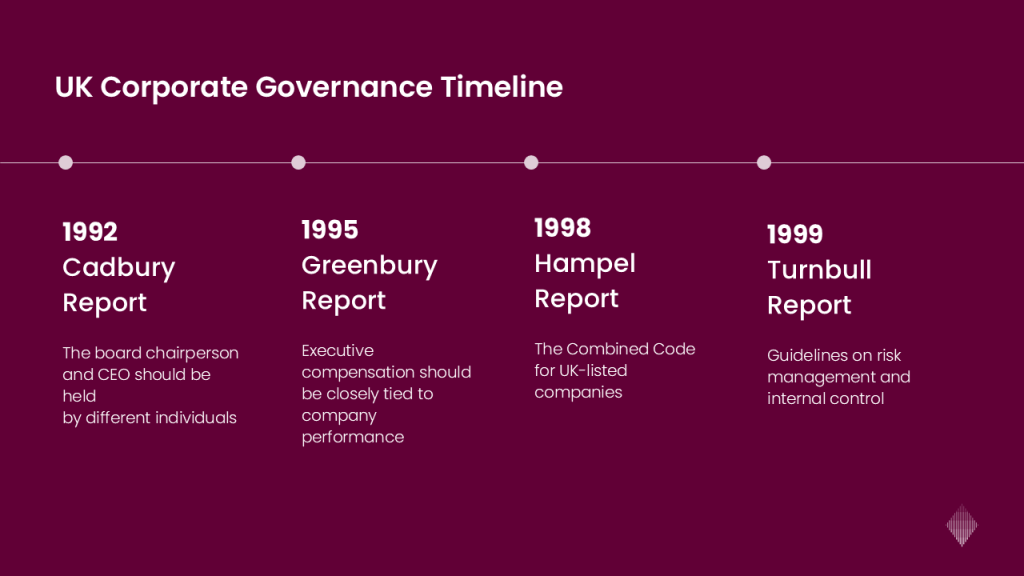

Since its introduction in 1992 following the Cadbury Report, the UK Corporate Governance Code has undergone a steady process of refinement to reflect shifting expectations in business leadership and boardroom accountability. Over the years, major revisions have expanded its scope: from strengthening director independence and tightening audit oversight, to introducing formal board evaluations and improving engagement with stakeholders. The 2018 update marked a notable shift, placing greater emphasis on corporate culture, purpose, and the board’s relationship with the workforce. Most recently, the 2024 revision responded to growing scrutiny around sustainability, ESG reporting, and risk management. Taken together, these developments highlight the Code’s ability to adapt to the evolving landscape while reinforcing the core principles of effective governance.

Comparison with Other Global Frameworks

While the UK Corporate Governance Code is a prominent example of the “comply or explain” approach, it is not the only framework to adopt this model. Countries such as Germany, the Netherlands, and others across the European Union also encourage companies to either follow established governance practices or provide a clear explanation when they do not. This contrasts with more prescriptive, rule-based systems found elsewhere. For example, the U.S. Sarbanes–Oxley Act imposes strict requirements on audit committees and executive accountability, with legal consequences for non-compliance. The UK approach places greater emphasis on board judgement and constructive dialogue with shareholders. At the global level, the OECD Principles of Corporate Governance serve as a widely accepted benchmark for governance quality. Although governance frameworks differ in how they are enforced, they increasingly reflect shared values such as trust, accountability, and responsible leadership.

Application in Practice

UK-listed companies apply the Code through annual reports, governance statements, and investor briefings. The effectiveness of governance is often judged not by strict compliance, but by how transparently a board explains its governance choices and demonstrates that it upholds the spirit of the Code. High-profile governance failures in the last decades have reinforced the importance of board accountability and culture. Shareholders and regulators increasingly expect companies to link governance outcomes with corporate performance and risk oversight. Boards that embrace the Code thoughtfully, rather than mechanically, are more likely to win stakeholder confidence.