How to Calculate Return on Equity (ROE) and Its Use Case

Learn how to calculate Return on Equity (ROE), interpret its meaning, and apply it in executive finance and board-level decision-making.

Online Corporate Finance Course with Private Equity, Venture Capital & M&A | CLFI

Explore CLFI’s online corporate finance course with modules in private equity, venture capital, and M&A — designed for executives shaping strategic decisions.

Corporate Finance Careers: Skills, Pathways, and Boardroom Readiness

Explore corporate finance career paths, core skills, and leadership capabilities needed for strategic and board-level roles, with practical insight from CLFI faculty.

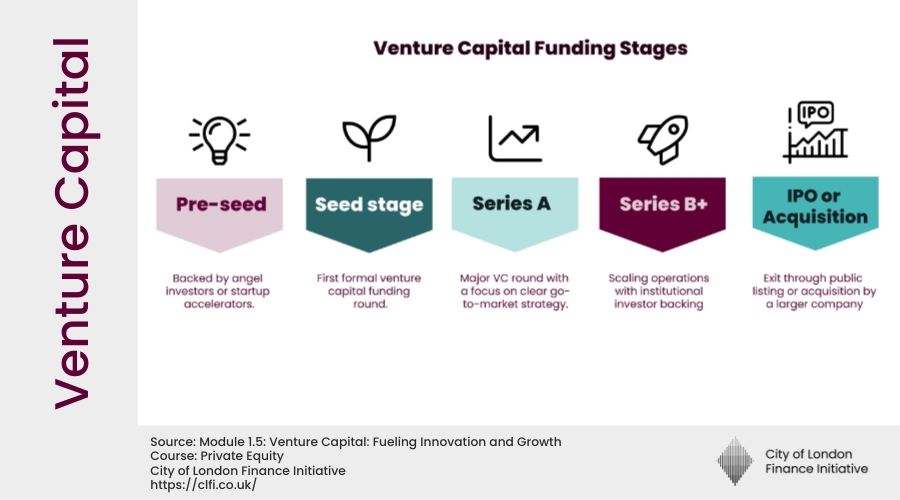

What Is Venture Capital? Definition, Stages, and Valuation

Learn what venture capital is, how it works, and how startups are valued. Covers funding stages, benefits, risks, and governance caveats.

Mergers and Acquisitions (M&A): Types, Valuation Methods, and Strategy | CLFI

Learn what mergers and acquisitions (M&A) are, the main types, and how they are valued.

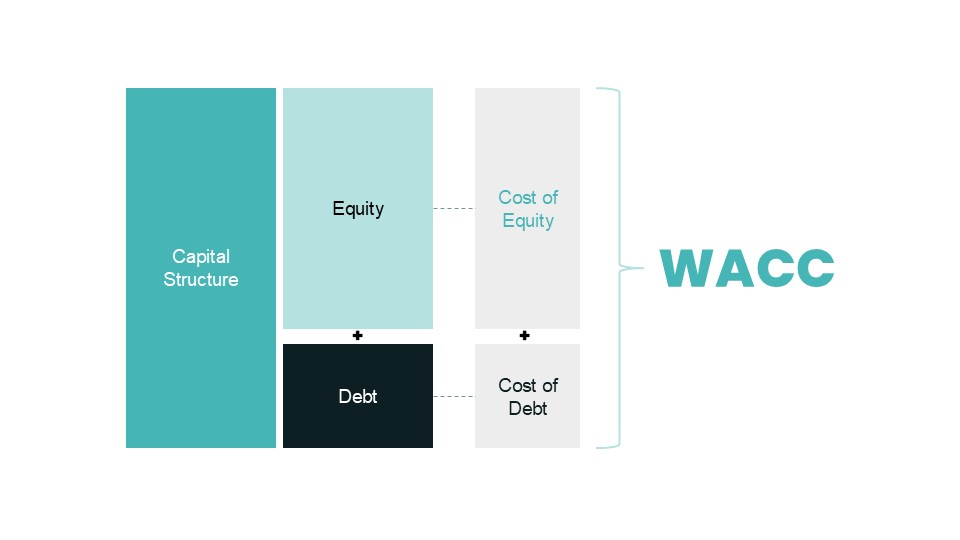

Weighted Average Cost of Capital (WACC)

Learn what WACC means, how to calculate it, and why it matters for valuation and corporate finance. Includes formula and worked example.

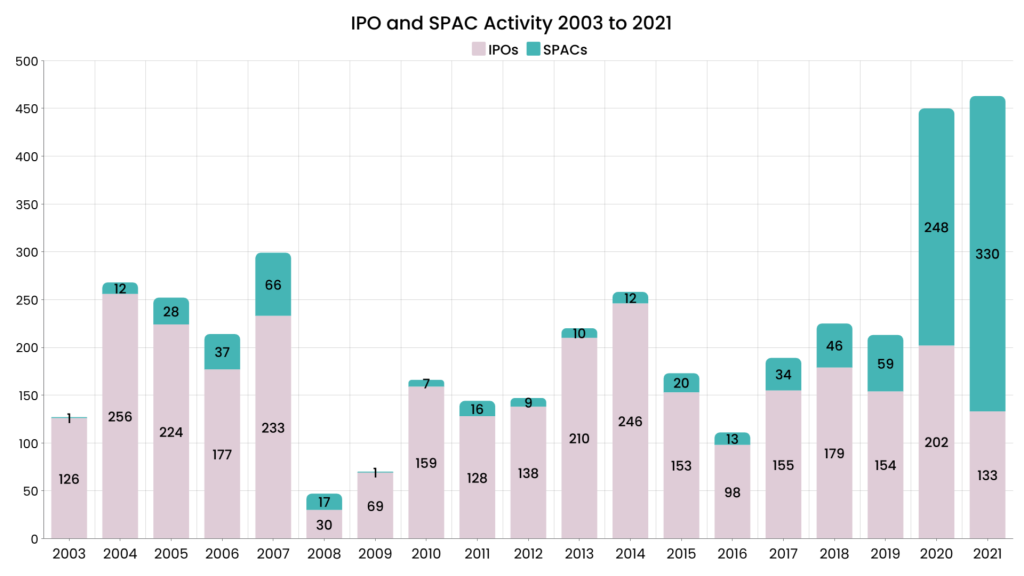

What Are Special Purpose Acquisition Companies (SPACs)?

Learn what Special Purpose Acquisition Companies (SPACs) are, how they work, sponsor incentives, key risks, and why many pandemic-era SPACs disappointed investors.

Corporate Finance, Capital Structure, Investment Decisions, Cost of Capital, Valuation, WACC

Table of Contents What Is Corporate Finance? Corporate finance governs the way organisations allocate capital, evaluate risk, and pursue long-term value creation. From deciding which investments to pursue to determining how to fund them, corporate finance is the strategic engine that powers decision-making at every level of an enterprise. This article introduces the key principles […]