Corporate Finance Careers: Skills, Pathways, and Boardroom Readiness

Explore corporate finance career paths, core skills, and leadership capabilities needed for strategic and board-level roles, with practical insight from CLFI faculty.

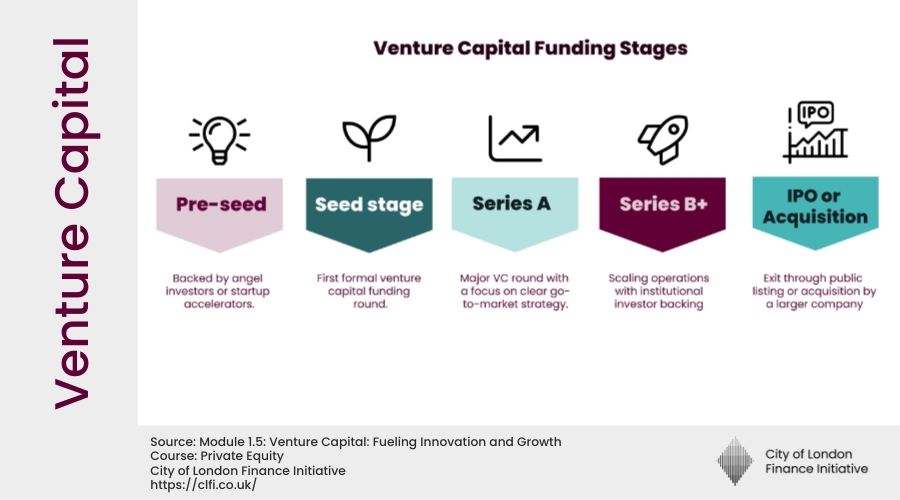

What Is Venture Capital? Definition, Stages, and Valuation

Learn what venture capital is, how it works, and how startups are valued. Covers funding stages, benefits, risks, and governance caveats.

Mergers and Acquisitions Rebound: Why Strategic Deals Are Shaping 2025

M&A momentum returns with record valuations, cash-rich corporates, and boardroom focus on AI.

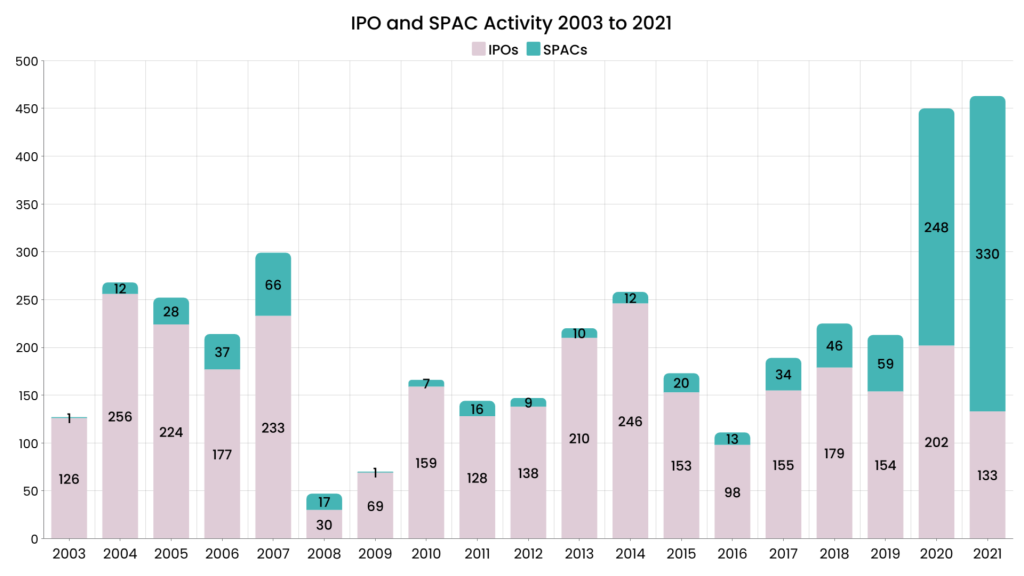

What Are Special Purpose Acquisition Companies (SPACs)?

Learn what Special Purpose Acquisition Companies (SPACs) are, how they work, sponsor incentives, key risks, and why many pandemic-era SPACs disappointed investors.

Qué es Capital Privado o Private Equity?

Table of Contents ¿Qué es Private Equity o Capital Inversión Privado? El capital de inversión privado o private equity desempeña un papel transformador en los mercados de capitales globales, permitiendo a los inversores adquirir participaciones en empresas fuera de lo que conocemos como empresas cotizadas. A través de una variedad de estrategias que van desde […]

Private Equity’s Power Shift: From Public Markets to Private Giants

Private equity now holds +$2.5 trillion in dry powder as public listings decline.

What is Private Equity: The Role of GPs and LPs

Learn what a GP in private equity does — their role, responsibilities, and how they align with LPs to manage funds and deliver investor returns.

What Is Private Equity?

Table of Contents What Is Private Equity? Private equity plays a transformative role in global capital markets, allowing investors to take ownership stakes in companies away from public markets. Through a range of strategies — from venture capital to leveraged buyouts — private equity firms unlock value, reshape governance, and drive strategic change. This article […]