Table of Contents

Mergers and Acquisitions Rebound: Why Strategic Deals Are Shaping 2025

- 10 min read

- Contributors: Nicolas Moura (PitchBook Senior Analyst), Garrett Hinds (PitchBook Senior Analyst), Michael Field (Morningstar, Chief Market Strategist), Jeremy Grantham (GMO Chief Investment Strategist), PwC UK

- Authored & Reviewed by: Farhan Qamar

Context and Shift

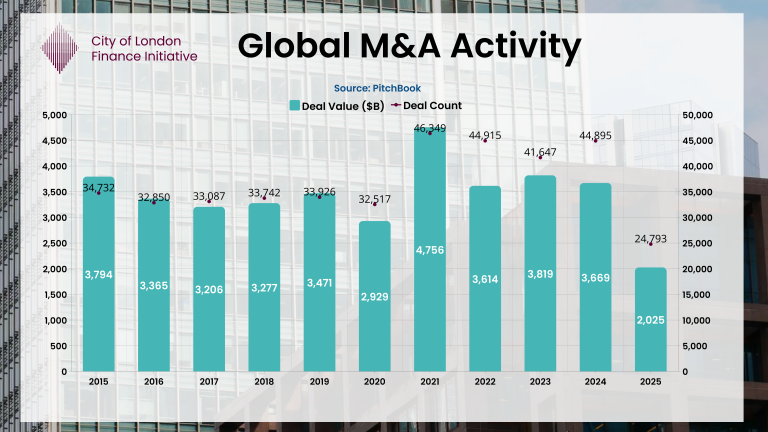

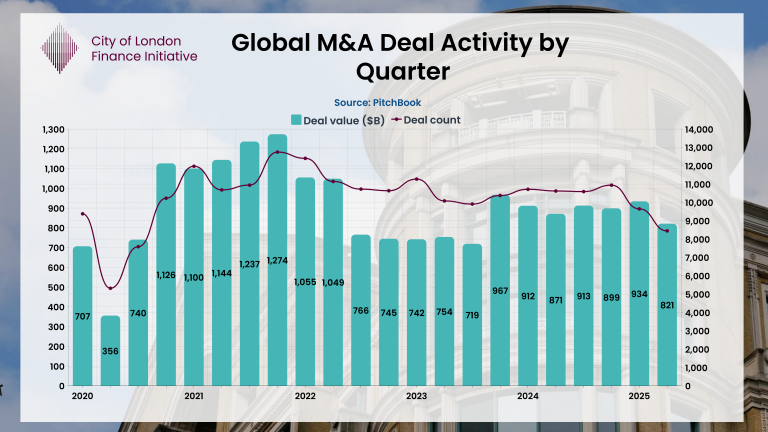

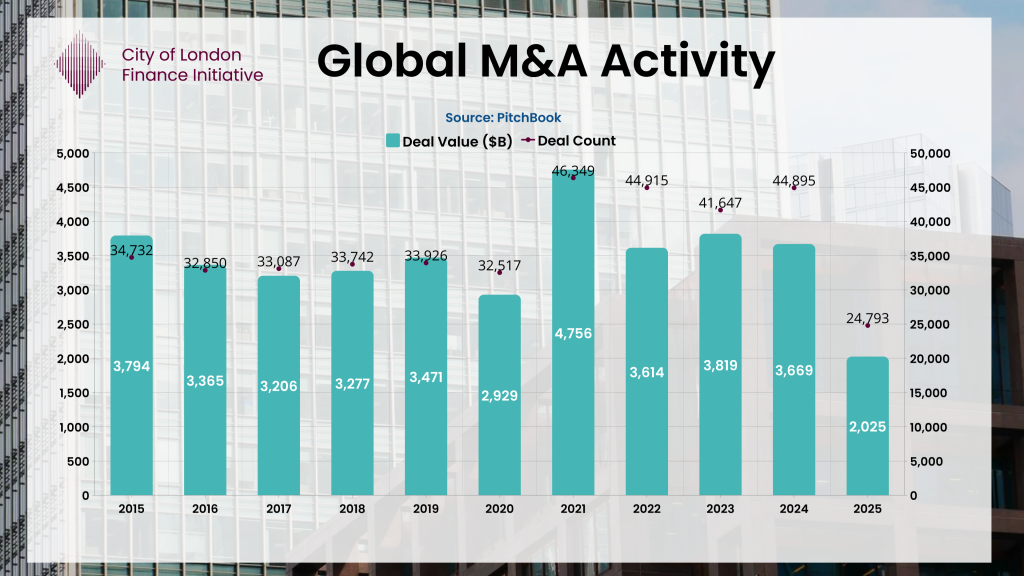

As of the end of July 2025, global mergers and acquisitions had reached an announced value of approximately $2.6 trillion, the strongest first-seven-month total since 2021. This figure stands out not only for its scale, but also for its timing. At the start of the year, many market participants anticipated that a new U.S. administration would loosen regulatory constraints and unlock a surge in corporate deal-making and IPO activity. The expectation was that a friendlier stance toward transactions would accelerate the pace of large-cap combinations, unblock pending deals, and reopen public listing windows.

M&A side

While the average deal size has been lifted by a surge in megadeals, the overall number of transactions has also grown, signalling that both, the breadth and scale of activity, have increased compared with last year.

Source: PitchBook, Q2 2025 Global M&A Report

Several factors underpin this change. High equity markets have encouraged stock-for-stock mergers, particularly in sectors where share prices are trading near record highs. In parallel, the urgency for boards to define and secure their long-term strategies has driven a wave of targeted acquisitions, especially in technology and infrastructure.

This momentum has persisted despite elevated recession risk, geopolitical instability, and renewed trade frictions. According to Garrett Hinds, Senior Research Analyst at PitchBook, «global M&A reached $2.0 trillion across 24,793 transactions in the first half of 2025, marking year-on-year increases of 13.6 percent in value and 16.2 percent in deal count. The second quarter alone delivered $988 billion in aggregate value — down modestly from the first quarter but up 13.4 percent year-on-year — across 12,605 transactions.»

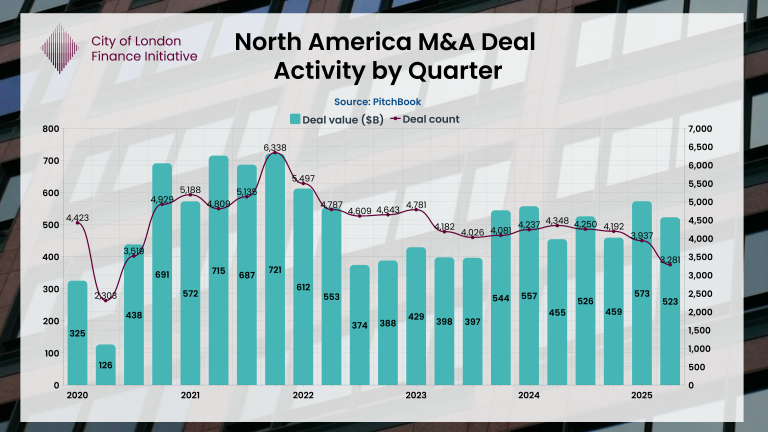

The increase in aggregate deal value this year has been driven by megadeals, especially in North America region. Transactions exceeding $10 billion are up compared with the same period in 2024. Some of the biggest transactions were structured as stock-for-stock mergers, signalling that management teams and shareholders view their own equity as attractively priced in a market trading at all-time highs.

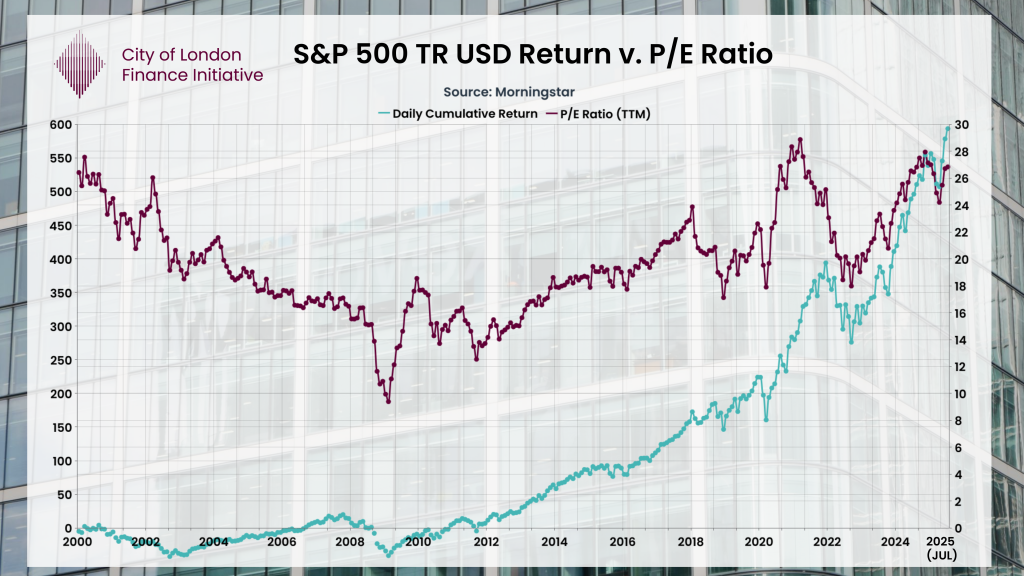

To put these valuations into context, it is worth pausing briefly to assess where US equity markets currently stand.

Michael Field, CFA, Chief European Market Strategist, Morningstar, noted that «on a Price to Earnings basis, the S&P 500 certainly doesn’t look cheap. But, on a bottom-up Price to Fair Value Estimate metric, the market is about where it should be, fairly valued. Does that mean investors shouldn’t invest right now? While the market as a whole might be fairly valued, we still see a lot of opportunity in specific sectors, namely Energy, Telecoms and Healthcare.»

Source: Morningstar, S&P 500 TR USD Return v. P/E Ratio, 2025

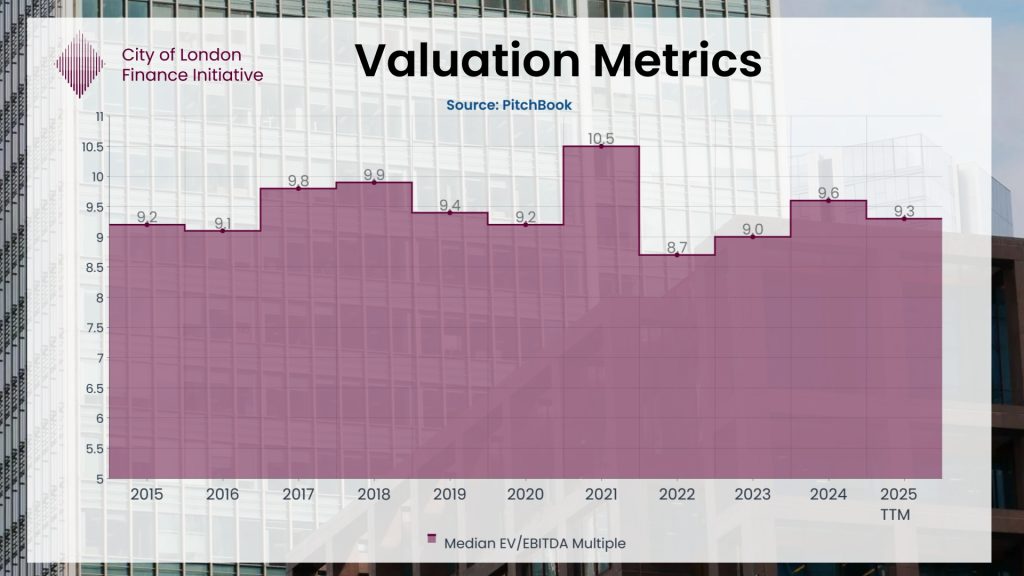

The recent share exchange mechanism used in recent acquisitions also reduces immediate cash outlay, allowing acquirers to preserve liquidity for integration costs or further investments. Recent transactions illustrate this trend. Union Pacific’s proposed $85 billion acquisition of Norfolk Southern aims to reshape U.S. freight rail, while Palo Alto Networks’ $25 billion move for CyberArk illustrates consolidation in the identity security segment. Both acquirers have paid premiums of around 25 percent, signalling confidence in strategic value creation. On valuations more broadly, median EV/EBITDA multiples have retreated from the exceptional highs seen during the pandemic-era frenzy of SPACs, meme stocks, and inflated deal terms. Current levels are broadly consistent with pre-COVID norms, suggesting a reversion to more sustainable pricing benchmarks.

Source: Pitchbook, Valuation Metrics, 2025

Garrett noted that North American M&A cooled slightly from the first quarter, but still climbed strongly year-on-year. Deal value reached $596.8 billion in Q2 2025, up more than 30 percent compared with the same period last year, while deal count rose by just over 10 percent. «M&A activity was relatively slow in April, but momentum built back up in May. The top 10 North American deals in Q2 collectively amounted to an impressive $155.5 billion. While this was below the sizable $168.8 billion total last quarter, it was up 53.2% YoY compared with Q2 2024.»

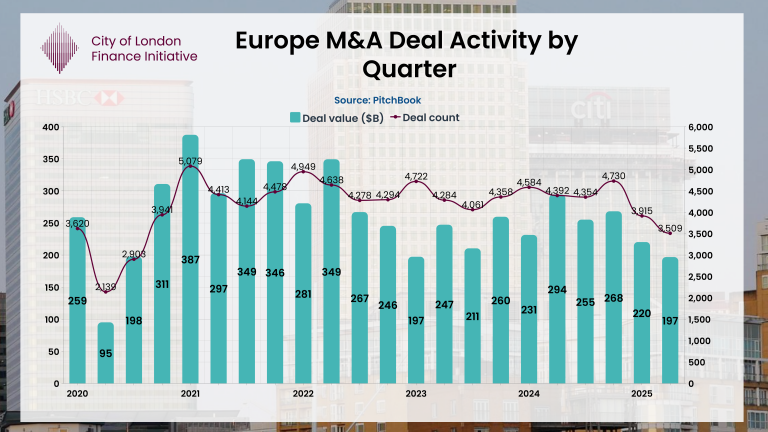

On the European side, Nicolas Moura, CFA, CAIA, Senior Research Analyst, EMEA Private Capital, said, «Q2 M&A remained very resilient despite the volatile market conditions imposed by the US tariff announcements in early April. M&A value is down a percentage point quarter-on-quarter but up two percentage points in terms of count. In fact, M&A count in Europe is pacing for its best year in over a decade if it can repeat the number of deals completed in H1. Since 2023, Europe has enjoyed more M&A deals than North America. There are several reasons for this. First, European companies continue to trade at a discount to their North American peers, which has attracted the attention of many US buyers looking to expand their footprint in Europe. One such example has been the acquisition of Hornetsecurity by Proofpoint for $1.6 billion in Q2. Another would be the acquisition of Deliveroo by DoorDash for $3.8 billion.»

IPO Side

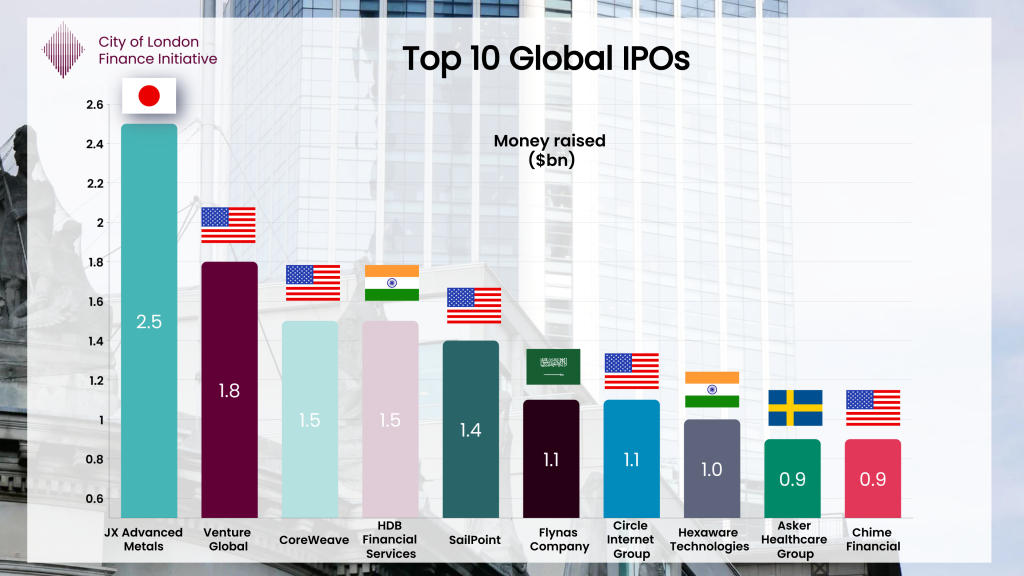

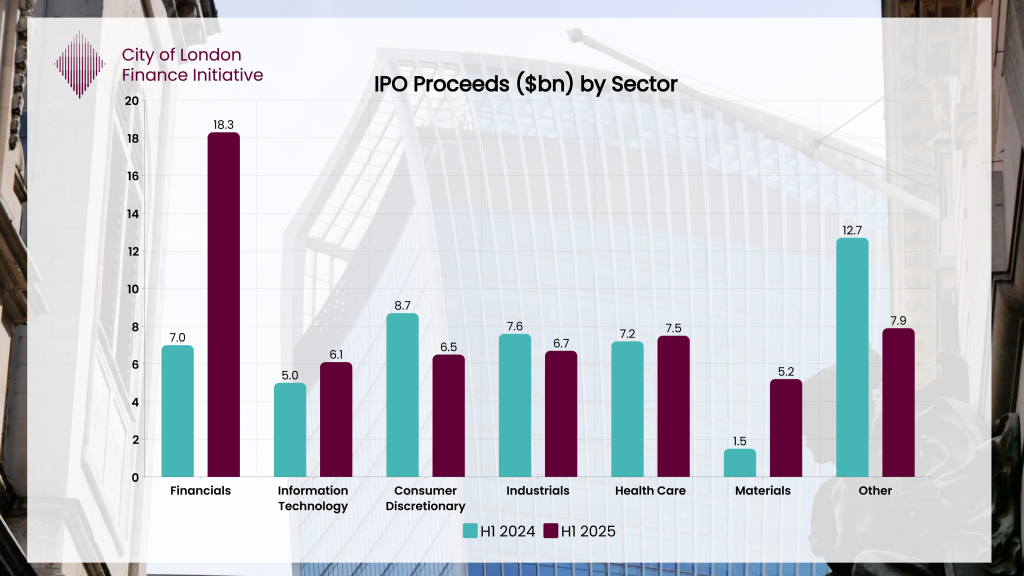

On the IPO side, after a subdued start to the year, the second quarter of 2025 brought signs that IPO markets are beginning to reopen. According to PwC’s H1 2025 Global IPO Watch, global proceeds reached $58.2 billion in the first half, up from $49.6 billion a year earlier, supported by growth in the US and Asia-Pacific. The US saw its busiest start since 2021, buoyed in part by a resurgence of SPAC issuance, while India and Japan delivered several of the year’s largest traditional listings.

Source: PwC, Global IPO Watch H1 2025

The gradual reopening of IPO markets is important for both corporates and private equity sellers. For private equity, companies that held back from going public during recent volatility now have an alternative to selling assets or relying on continuation funds. For corporates sitting on large cash balances, stronger IPO activity can reshape the competitive landscape: successful new listings often push valuations higher, making acquisitions more expensive, but they can also create new targets for partnerships or strategic takeovers once these firms enter the public market.

London tells a different story. As reported by the Financial Times, in the first half of 2025, only £8.8 billion was raised through IPOs and follow-on issuance — the lowest level in three decades when adjusted for inflation. Just three IPOs reached the main market and seven listed on AIM, compared with more than 120 combined at the peak in 2021. This collapse has forced City bankers to pivot toward advisory and secondary market work, underscoring how far London has slipped as a venue for new listings. Rather than competing with New York or Asia, the City’s more immediate challenge is simply to halt the erosion of its public market relevance.

Liquidity

Many of the largest corporates hold cash positions that rival the GDP of mid-sized nations. That capital has only a few realistic outlets:

- Returning capital to shareholders through buybacks or special dividends

- Pursuing acquisitions to strengthen market position

- Investing in new capacity and infrastructure

In recent years, periods of record cash holdings have often preceded aggressive buyback programmes, reducing share counts and lifting earnings per share.

Deploying cash into growth, by contrast, can deliver longer-term strategic returns. In the AI sector, this has already translated into multi-billion-dollar commitments for data centre construction, chip acquisitions, and securing critical supply chains. With valuations high and balance sheets strong, the choice between returning capital and deploying it for competitive advantage is likely to define the next phase of corporate strategy.

The concentration of liquidity among a handful of corporate giants positions them as potential catalysts for the next wave of large-scale transactions, particularly if the new U.S. administration delivers on expectations of a looser antitrust stance.

Berkshire Hathaway’s $339.8 billion in cash and short-term holdings remains unmatched, but technology leaders are not far behind: Alphabet holds $95.1 billion, Microsoft $94.6 billion, Amazon $93.2 billion, Apple $55.4 billion, Nvidia $53.7 billion, and Meta $47.1 billion.

Some of these companies have previously held even higher cash reserves, which they chose to deploy into substantial share buyback programmes — also known as share repurchase where a company repurchases its own shares from the market to reduce the number of shares outstanding, often boosting earnings per share and shareholder value, as you are reducing the denominator. With equity valuations at all-time high and strong balance sheets, these firms either continue returning capital via buybacks and dividends, or channel it into acquisitions that secure long-term competitive advantages.

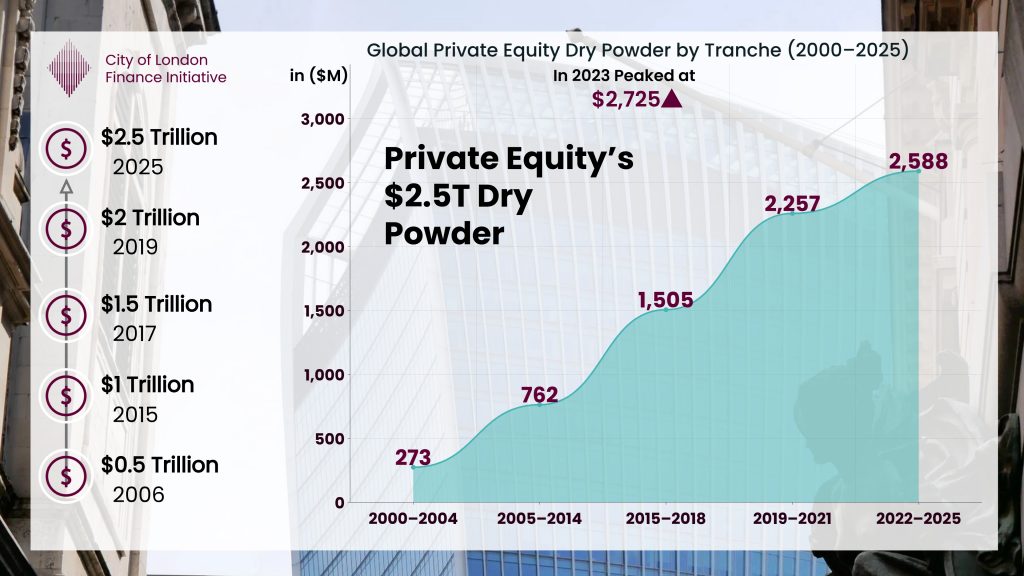

By contrast, private equity firms are finding it harder to sell the companies they have been holding in recent years, with exit activity remaining subdued. Many have turned to continuation funds — vehicles that allow them to hold assets for longer — as a way to return some capital to investors. Any meaningful rebound in exits is likely to be gradual, and will depend on a healthier IPO market and lower interest rates. But they continue to hold near record-breaking levels of deployable capital, with an estimated $2.5 trillion in dry powder as of H1 2025.

In December 2023, Adobe and Figma jointly terminated their $20 billion merger intent after more than fifteen months of review, stating “they no longer saw a viable path to regulatory approval”. Both companies emphasized that, despite extensive engagement with authorities, the deal could not move forward, and Figma confirmed it would remain independent and continue building out its product suite. Since then, its IPO was in the making, and finally launched on on 31 July 2025, with shares priced at $33 before closing their first trading day at $115.50, a 250 percent gain that valued the company at roughly $56.3 billion — more than triple the Adobe acquisition price. That outcome reiterates that IPO remains a viable exit when public markets reward growth and governance clarity.

History offers perspective. The 2021 pandemic-era surge in dealmaking often sidelined fundamentals, with valuations driven more by narratives than by cash flow or earnings. By contrast, today’s M&A cycle rests on a different footing: record levels of available capital combined with more deliberate, strategically motivated transactions. This foundation appears more sustainable, though the outlook remains tempered by regulatory scrutiny, fragile mid-market activity, and unresolved geopolitical risks.

According to Jeremy Grantham, co-founder and chief investment strategist at GMO, «the Covid stimulus bubble began to burst conventionally in 2022 — until the sudden rise of AI in late 2022 interrupted the pattern. The 2021 market had already shown classic signs of a peak: extreme euphoria, IPO and SPAC surges, and speculative leaders falling even as blue chips rose. But the launch of ChatGPT and the public awakening to AI’s potential reignited optimism, much like past technological revolutions. And many such revolutions are in the end often as transformative as those early investors could see and sometimes even more so – but only after a substantial period of disappointment during which the initial bubble bursts.» That cycle’s echoes are evident today, with Chamath Palihapitiya — one of the most visible figures of the SPAC boom — returning to the market with a new blank-cheque vehicle. American Exceptionalism Acquisition A, his blank-cheque company targeting energy, AI, DeFi, and defense, has just filed with the SEC to raise up to $250 million in an initial public offering. Yet his earlier “SPAC King” legacy is mixed, as most of the companies he took public have since lost the majority of their market value, leaving SoFi as the only notable outlier.These shifts, from renewed speculation in capital markets to consolidation in core industries, highlight a common challenge for leadership teams in positioning for the next wave of growth. For boards, the strategic imperative is to secure a place in the emerging AI value chain while also protecting their existing lines of business, a priority that has become non-negotiable. Only last year, nearly half of S&P 500 companies cited “AI” on their earnings calls, underscoring the pressure on leadership to articulate a strategy. Yet many early implementations have struggled to deliver returns, revealing a gap between boardroom mandates and operational outcomes. The industry is still in the early stages of disruption, but first consolidation among emerging actors will be needed across foundation models, AI infrastructure (chips and cloud), specialised applications, and agentic AI.

Whether through acquisitions, targeted investments, or reallocation of cash on hand, M&A has shifted from being opportunistic to being central to long-term corporate positioning in the current market environment.

This cycle spanning deal rationales, transaction structures, and the strategic drivers behind acquisition, is examined in the Mergers & Acquisitions Executive Course.

Capital Is a Resource. Allocation Is a Strategy.

Learn more through the Executive Certificate in Corporate Finance, Valuation & Governance – a structured programme integrating governance, finance, valuation, and strategy.

Explore Further from CLFI Insight

References:

- PitchBook Q2 2025 Global MA Report

- Reuters, “Global dealmaking has reached $2.6 trillion … first seven months of the year since 2021”, Reuters, August 4 2025. Read more

- PwC Global IPO Watch H1 2025. Read the full report.

- Financial Times: The new Square Mile: how London’s IPO drought forced City bankers to pivot

- Jeremy Grantham: “The Great Paradox of the U.S. Market!” Viewpoints by Jeremy Grantham GMO, 11 March 2024.

- SPACs: How Special‑Purpose Acquisition Companies Work