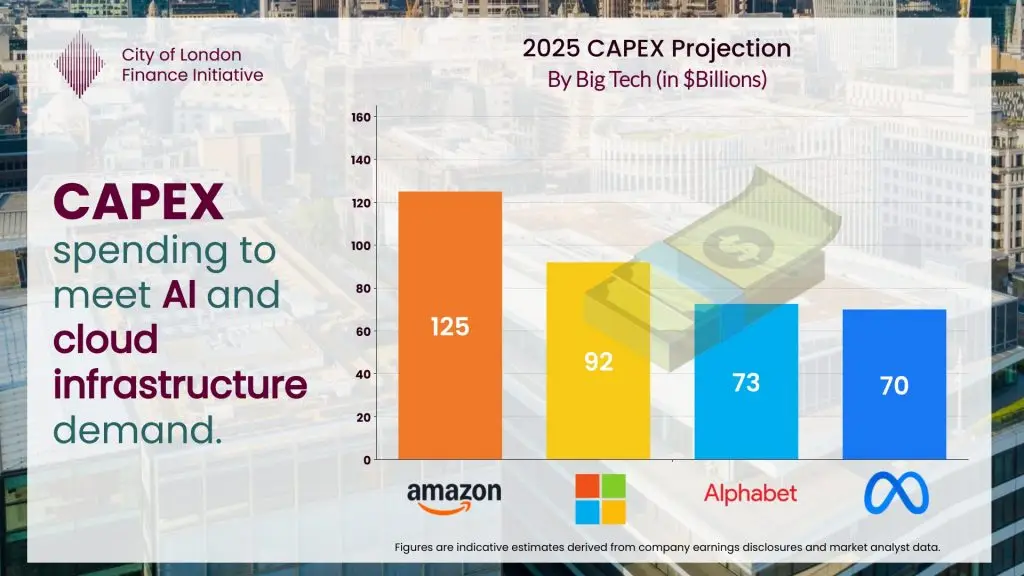

What Is CAPEX? Meaning, Examples, and AI Era Use

Learn what CAPEX means in finance, how it differs from OPEX, and how capital expenditure is used today in software, cloud, and AI infrastructure.

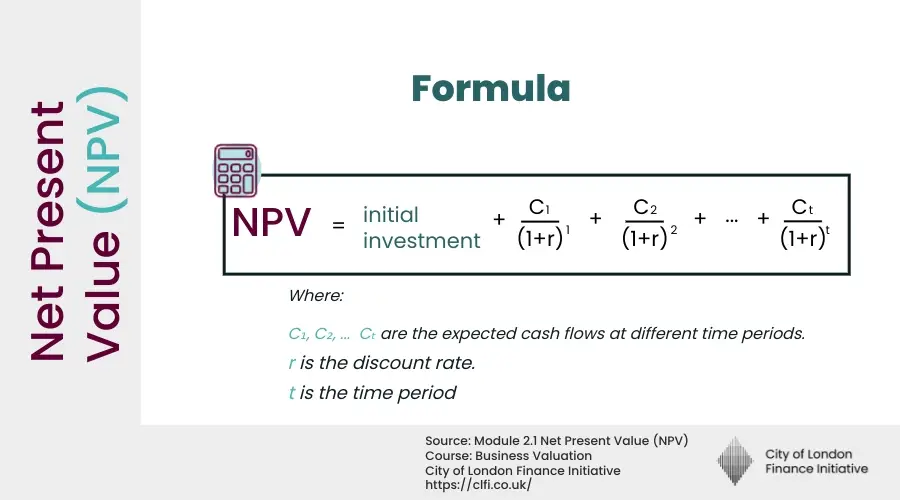

Net Present Value (NPV): Definition, Formula, and Calculation

Learn how Net Present Value (NPV) evaluates investments by discounting future cash flows, and why it remains the preferred decision rule in corporate finance.

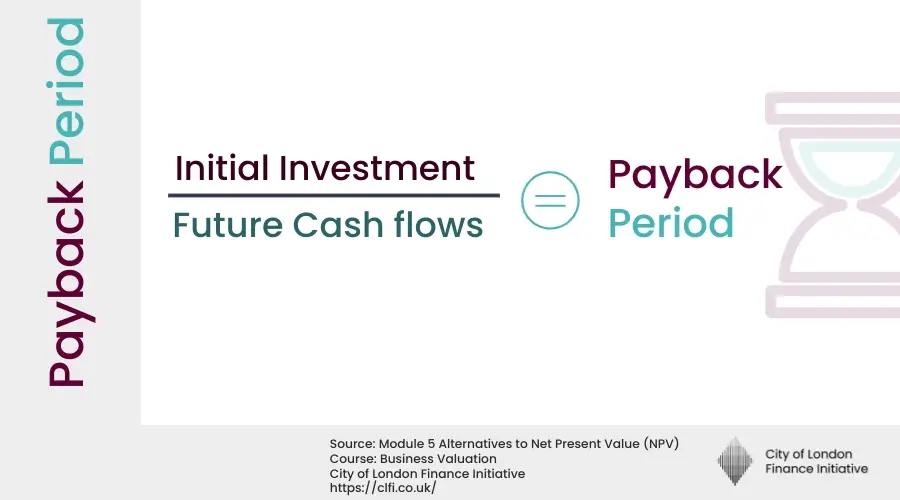

Payback Period Explained: Definition, Formula, and Calculation

Learn how the payback period works, where it helps, and why it must be used alongside NPV in capital investment decisions.

How Private Equity Values Target Companies | Private Equity Series | CLFI

Learn how private equity investors value target companies, from venture-style projections to EBITDA multiples and exit scenarios.

Private Equity Deal Types Explained | Private Equity Series | CLFI

A clear, stage-by-stage definition to private equity deal types, from seed to turnaround financing. Ideal for executives, founders, and finance learners.

What Is Growth Equity? A Practical Guide for Executives | Private Equity Series | CLFI

Learn what growth equity is, how it differs from venture capital and buyouts, and how minority growth investors partner with founders to fund expansion and create value.

Private Equity: How Deals Are Structured | Private Equity Series | CLFI

Understand the fundamentals of private equity, including deal structuring, investment approaches, and value creation.

Break-Even Analysis: What It Is and How the Break-Even Point Is Calculated| Accounting Series | CLFI

Learn what break-even analysis is and how the break-even point is calculated in sales, units, and price with clear formulas and examples.

What Is Goodwill in Accounting and M&A? Definition and Example | Accounting Series | CLFI

Learn what goodwill is in accounting and M&A, how it is calculated, and why buyers pay more than net assets during acquisitions.

Tangible vs Intangible Assets: Definition and Difference | Accounting Series | CLFI

Learn the difference between tangible and intangible assets, with definitions, examples, and how depreciation and amortisation affect the balance sheet.